The Bitcoin Ecosystem is Heating Up Again, What are the 4 Fronts to Watch?

BRC2.0, Classic Bitcoin NFT, Runes, and Alkanes: What Is the Market Playing At?

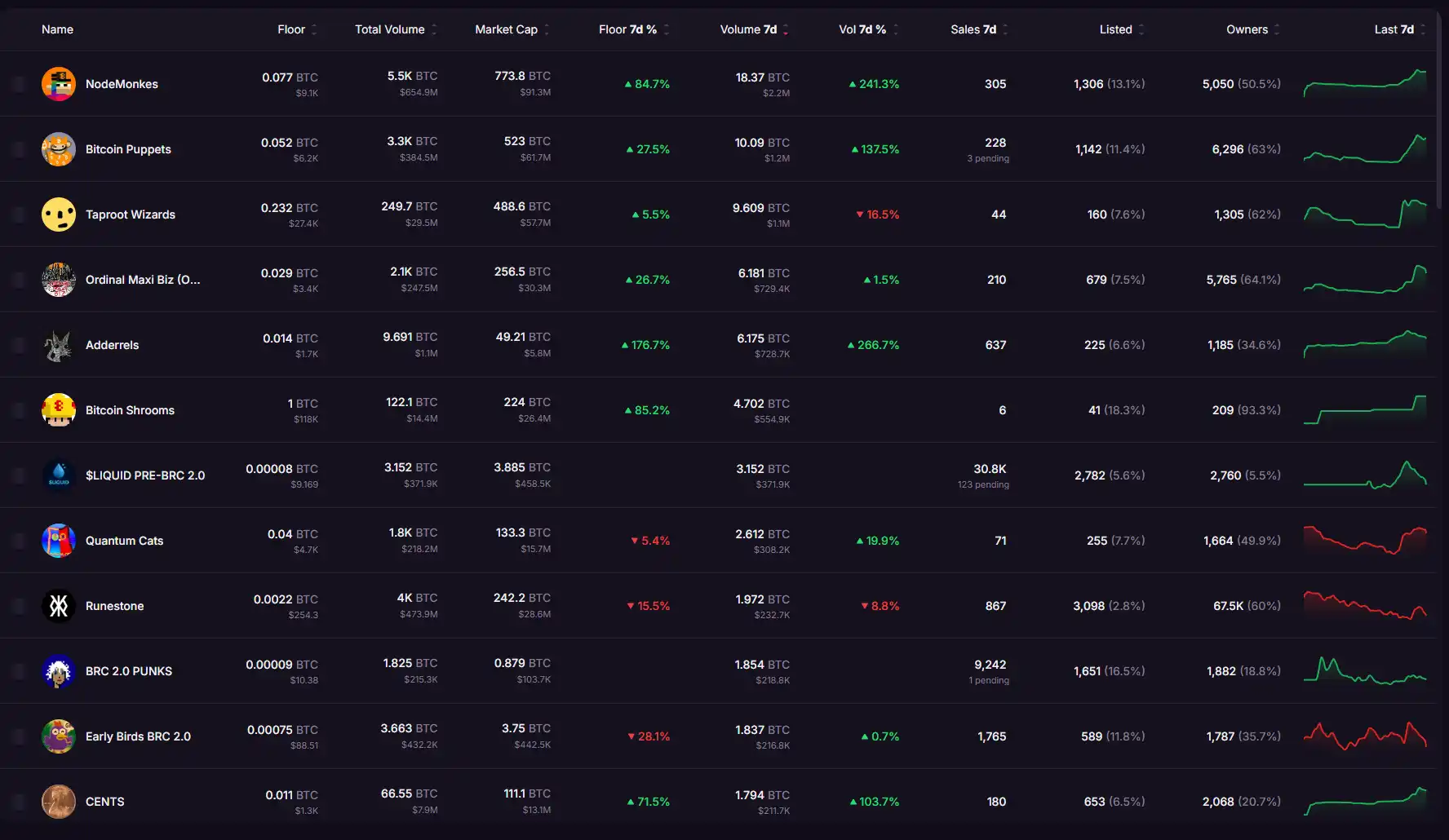

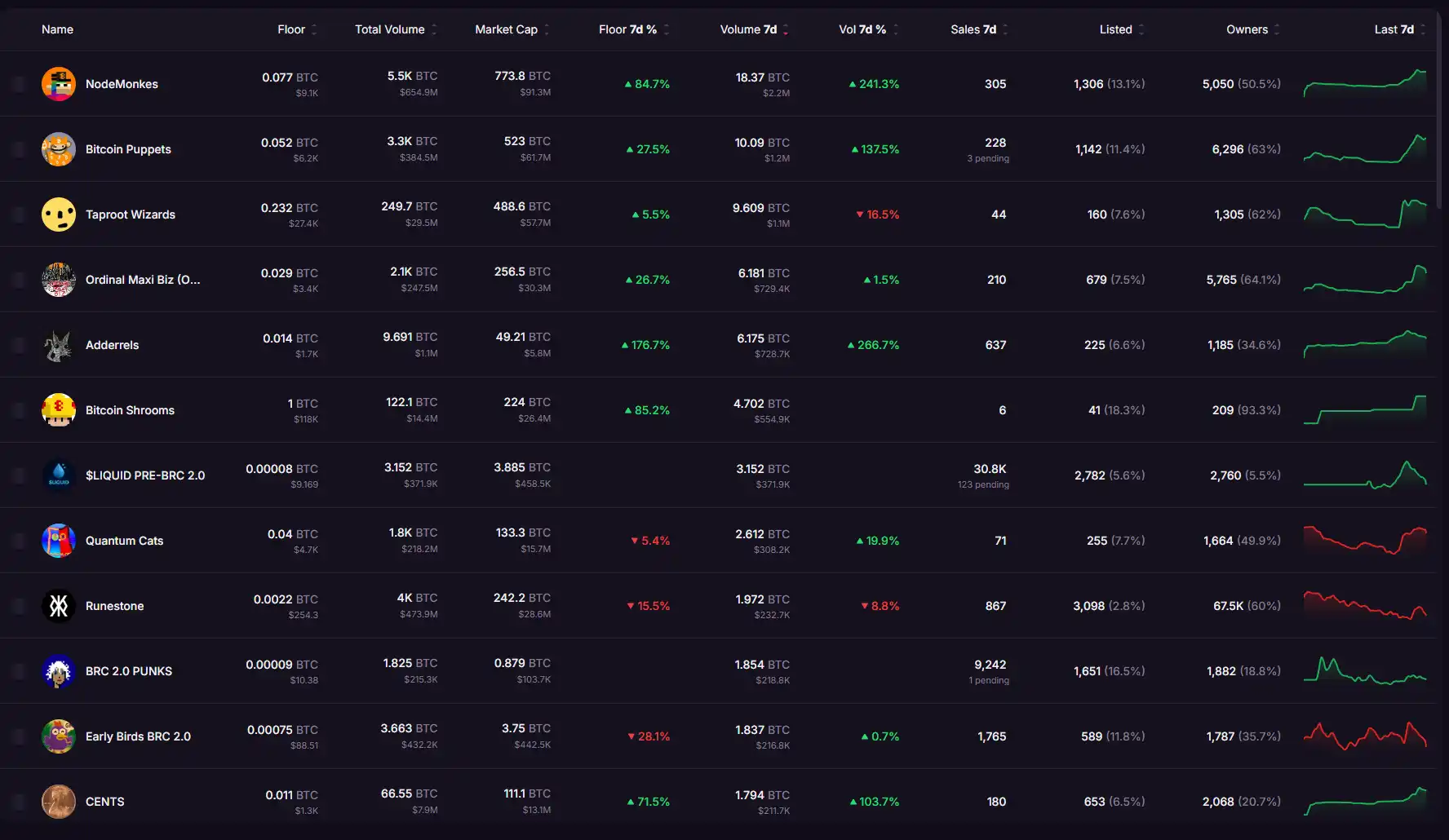

When we open the Ordinals market on Magic Eden, we find that the Bitcoin ecosystem has performed quite well in terms of price over the past week:

Although the chart above shows only 12 projects, it includes 3 of the main directions currently focused on by players in the Bitcoin ecosystem... Next, we will combine the specific performance of each project to introduce what exactly the Bitcoin ecosystem is up to now.

BRC 2.0

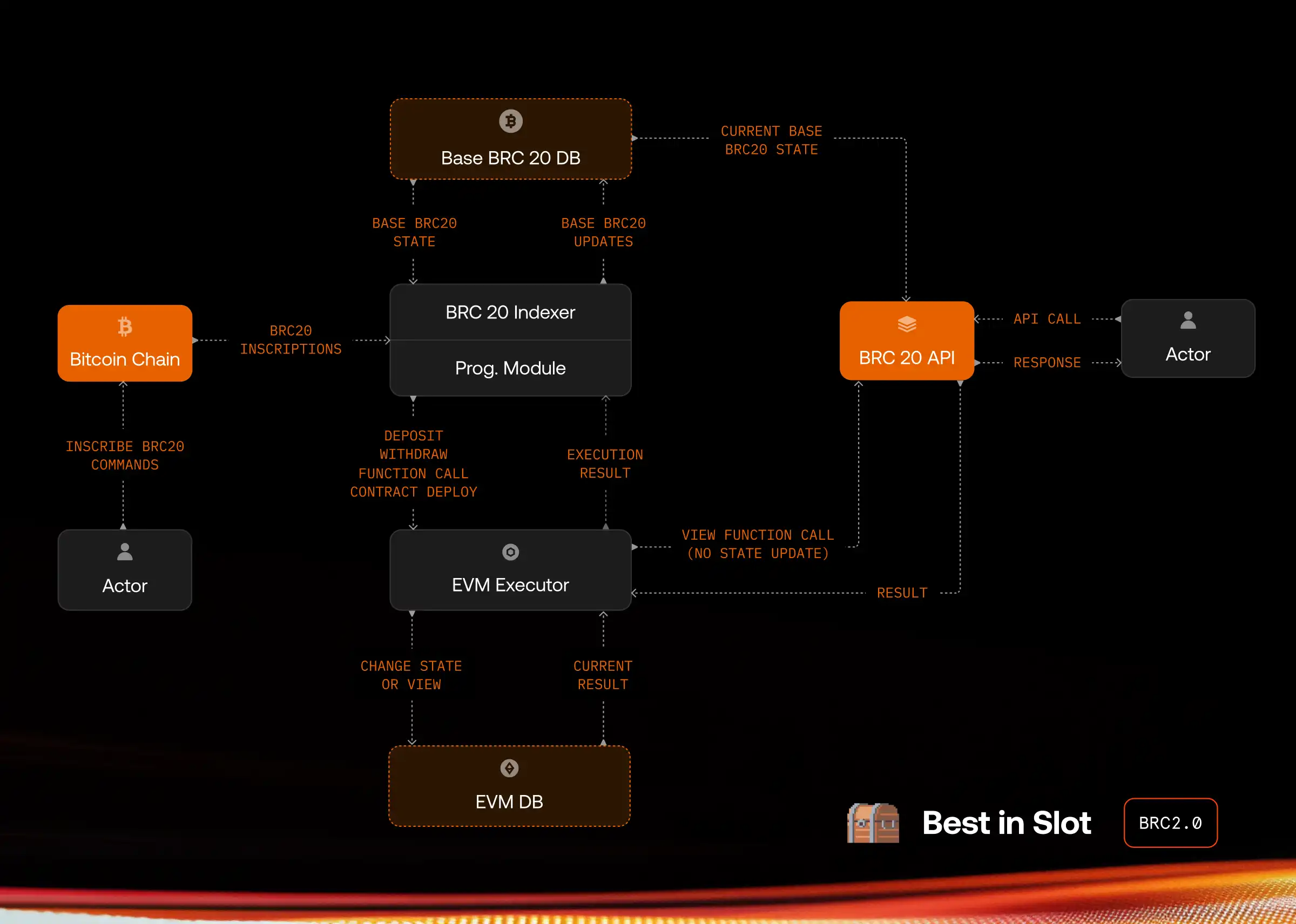

BRC 2.0 is the most highly anticipated concept in the Chinese-language Bitcoin ecosystem recently. This is the BRC20 "Programmable Module" released by the BRC20 Chief Maintenance Team Best in Slot, simply put, enabling BRC20 to support smart contracts.

This update will be formally activated on the Bitcoin mainnet at block height 909969 (estimated to be August 14).

This major update has been supported by the Layer 1 Foundation (L1F) led by the BRC20 creator domo. From the technical architecture diagram below, we can see that BRC 2.0's method of supporting smart contracts uses an off-chain "EVM Executor." According to the workflow shown in this diagram, not only are smart contracts executed off-chain, but only the "initiate contract interaction behavior" and "contract interaction results" are recorded on-chain, making the contract state and execution a "black box."

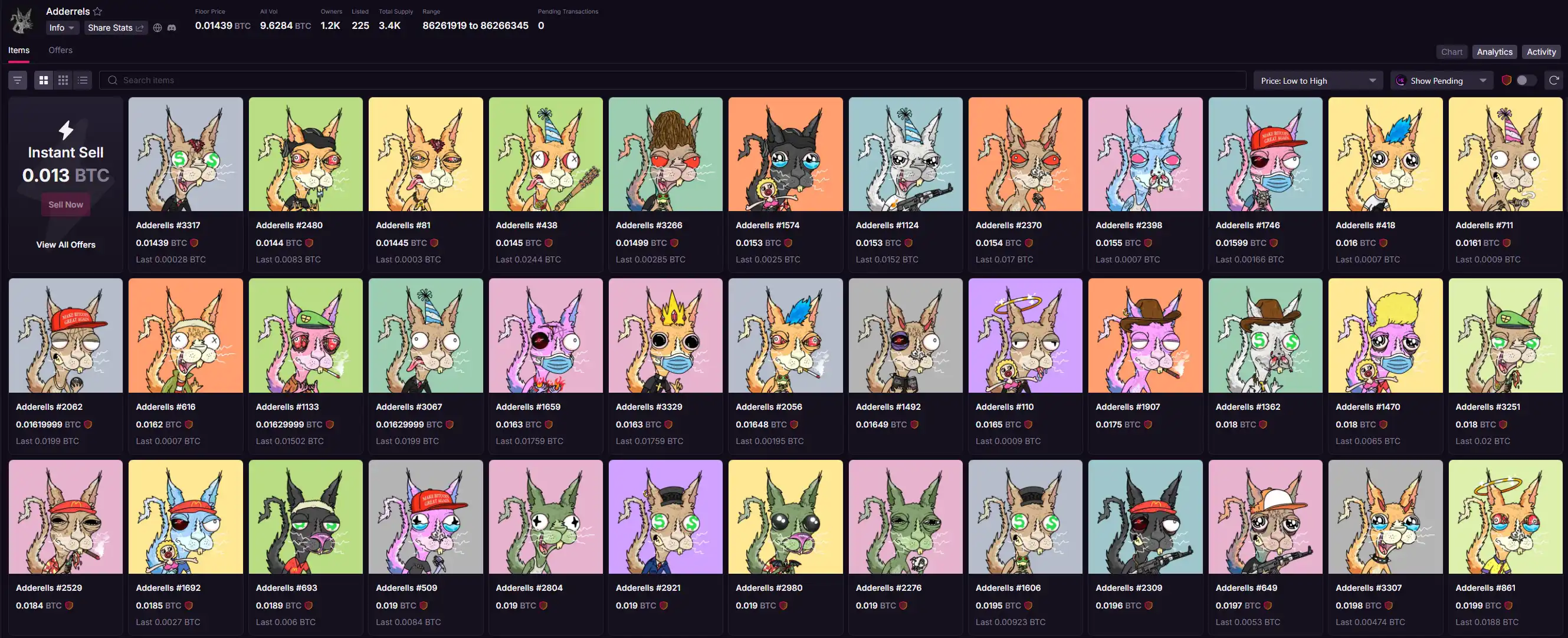

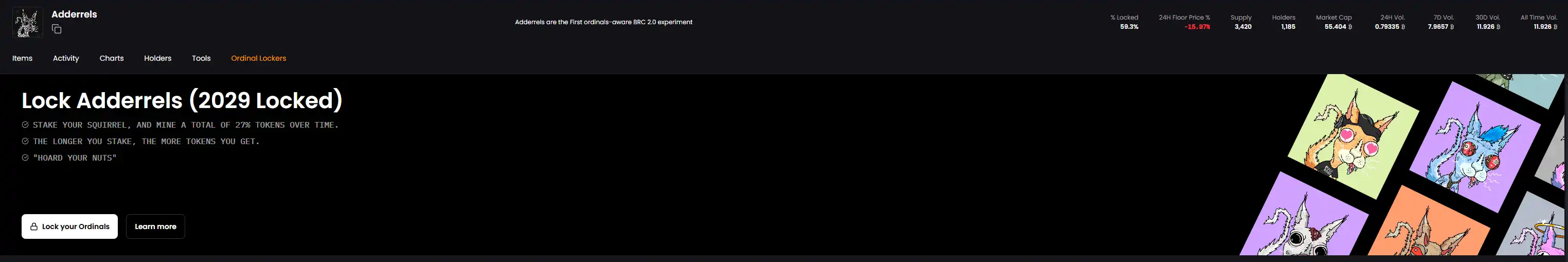

Despite its imperfections, BRC20 is undoubtedly the most robust asset protocol in the Chinese-language Bitcoin ecosystem, which has always been the biggest advantage of the BRC20 protocol. As the first BRC 2.0 NFT project, Adderrels is currently truly the leader in BRC 2.0 based on its floor price and trading volume, with a current floor price of 0.0143 BTC (approximately $1,687) and a trading volume exceeding 6 BTC (approximately $730,000) in the past 7 days.

The highlights of this project are mainly strong support from the Chinese community, being the first BRC 2.0 NFT project, and having a subsequent token distribution plan (a total of 55% allocated to holding and staking shares). It has a total supply of only 3,420, but currently, 2,029 have been staked, with a staking rate of nearly 60%. In addition, the order volume on Magic Eden is only 225.

Due to its absolute dominance in price and volume at present, holders and stakers also believe that apart from the airdrop, they will receive more whitelist allocations for new projects, hoping that this project will become the "golden shovel" of BRC 2.0.

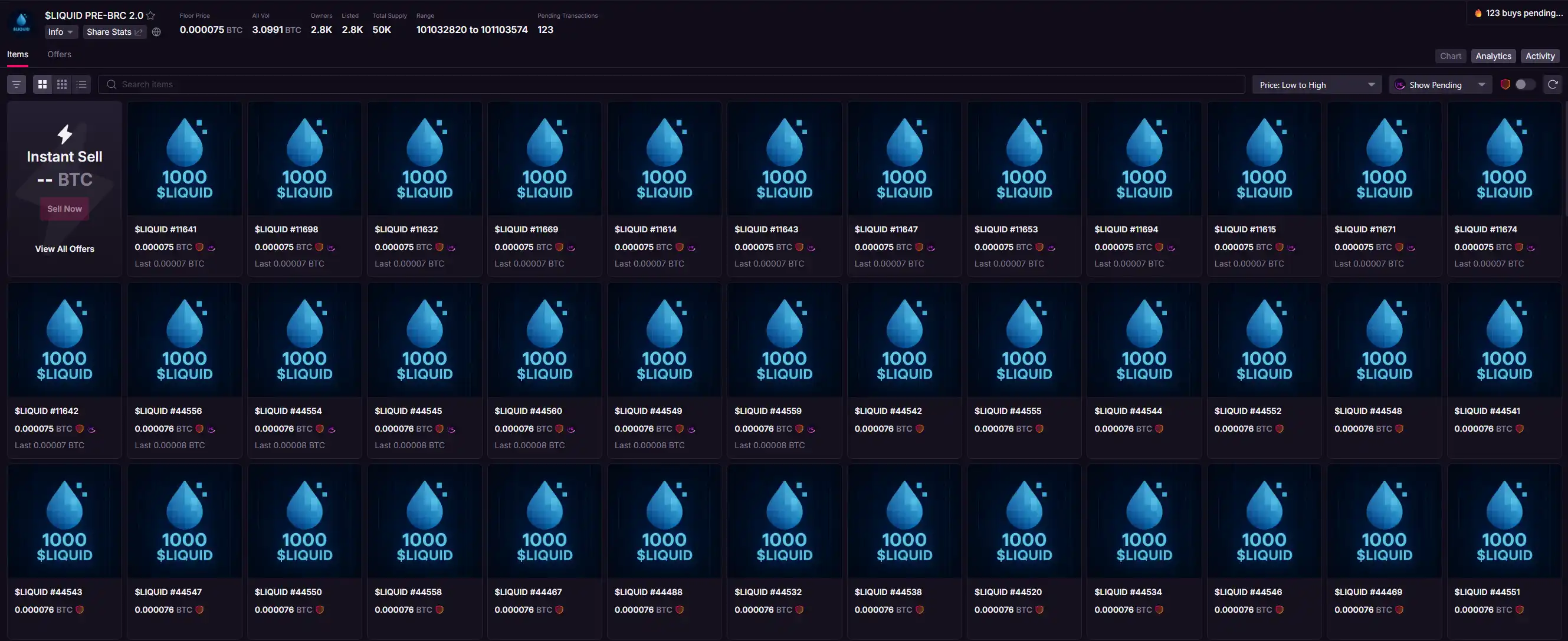

As for the BRC 2.0 "pre-mint" tokens, the largest in terms of volume is $LIQUID, with a volume of approximately 3.13 bitcoins (about $370,000) in the past week, and the current floor price corresponds to a market capitalization of about $450,000.

During the $LIQUID minting period, the fee rate jumped from ~3 sat/vB to over 30 sat/vB, with about $130,000 directly coming from these minting transactions.

For the long-silent Bitcoin ecosystem, the vitality brought to the market by BRC 2.0 is already commendable.

Established Bitcoin NFT Series

Let's revisit the image at the beginning of the article:

In this round of rise, the established Bitcoin NFT series is most prominently represented by the "NodeMonkes" series, which has surged by nearly 80% in the past week, with a trading volume close to 18.5 bitcoins (about $2.2 million). However, NodeMonkes actually did not have a very clear positive catalyst, only announcing on July 25 that it would launch a fee-free trading market.

However, looking at the trading volume, we can see that the established Bitcoin NFT series still has appeal, with no significant changes in the leading ranks, still consisting of NodeMonkes, Bitcoin Puppets, Taproot Wizards, and OMB, the "Big Four." These projects are still far from their peaks, and this wave of revival may benefit from Bitcoin's strength and the recent excellent performance of Ethereum NFT leaders such as CryptoPunks.

In the more niche category of art projects, CENTS has increased by 70% in the past week, with a trading volume of about 1.8 bitcoins (approximately $220,000), and the current floor price is 0.0112 bitcoins (approximately $1,320). As a conceptual art project, this is CENTS' third time above 0.01 bitcoins, gradually solidifying its position as a leader in Bitcoin art NFT projects over more than a year. Sadly, the artist of this project, Rutherford Chang, passed away in February of this year, a day that also happened to be the day Trump directed the U.S. Treasury to stop minting new 1-cent coins.

RIP Rutherford, your legacy will forever live on in Bitcoin.

Runes

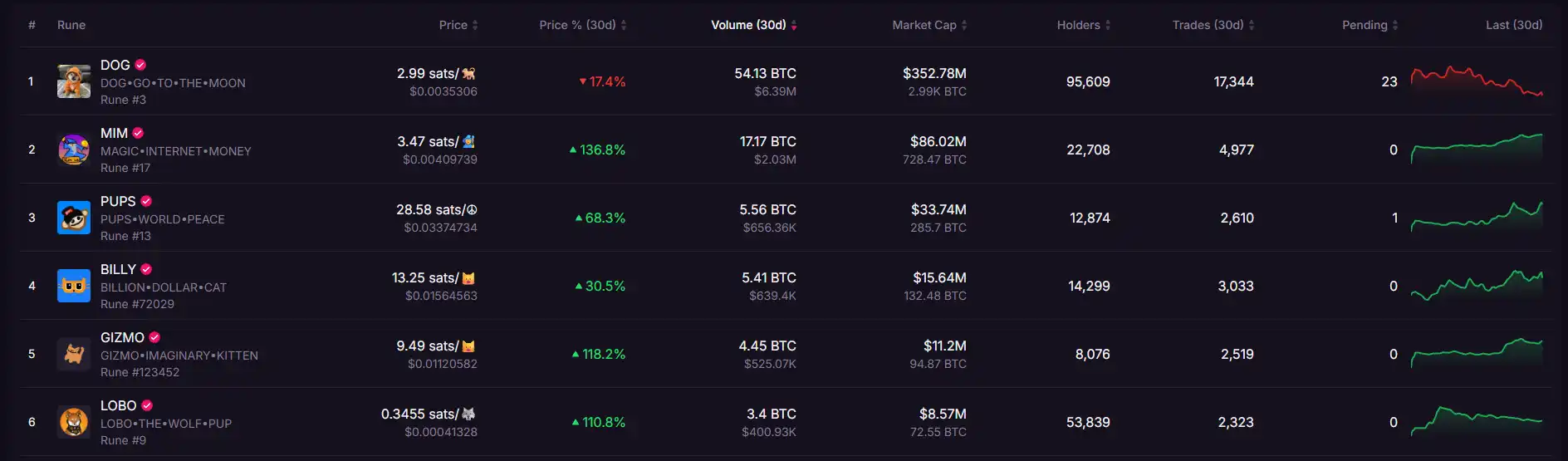

Despite the most famous rune of the past week, $DOG, and its NFT Runestone experiencing a downturn, looking at a 30-day timeline, several other runes have performed quite well. These include $MIM from Bitcoin Wizard, $PUPS from Bitcoin Puppets, the "Billion Dollar Cats" $BDC, and $GIZMO derived from Bitcoin Puppets.

Nevertheless, the biggest recent bullish news in the rune space has been around $DOG. On June 27, Kraken listed $DOG. Yesterday, C2 Blockchain announced that they had increased their holdings by 11.45 million $DOG (approximately $39,000), bringing their total holdings to around 145 million tokens (about $490,000) with a target of 200 million tokens.

Alkanes

The Alkanes ecosystem has recently received relatively little attention. However, yesterday, Oyl announced the completion of a snapshot for Oyl Wallet XP. The community is eagerly anticipating a $DIESEL airdrop or a potential $OYL distribution in the near future.

Conclusion

Although the Bitcoin ecosystem still has a long way to go to return to its peak, and price performance has been lackluster for a while, the community continues to silently develop and gradually strengthen. At the same time, the Chinese-speaking community remains a steadfast force in the Bitcoin ecosystem, perhaps one of the most influential markets in the crypto world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.

From panic to reversal: BTC rises above $93,000 again, has a structural turning point arrived?

BTC has strongly returned to $93,000. Although there appears to be no direct positive catalyst, in reality, four macro factors are resonating simultaneously to trigger a potential structural turning point: expectations of interest rate cuts, improving liquidity, political transitions, and the loosening stance of traditional institutions.