Pudgy Penguins (PENGU) is trading near $0.04280 in today’s session after rebounding from a critical mid-range demand zone. While recent netflows suggest cautious sentiment, price structure and momentum indicators point to the potential for a short-term continuation if $0.04350 is cleared convincingly.

What’s Happening With Pudgy Penguins Price?

PENGU price dynamics (Source: TradingView)

PENGU price dynamics (Source: TradingView)

PENGU price remains well inside an ascending parallel channel on the 1-hour chart. Recent lows were defended near $0.03720, just above the lower channel boundary. The recovery was initiated after a failed breakdown from a descending wedge. Bulls swiftly absorbed supply near $0.038, and the ongoing push is now testing mid-channel resistance around $0.04350.

PENGU price dynamics (Source: TradingView)

PENGU price dynamics (Source: TradingView)

On higher timeframes, the daily chart confirms that Pudgy Penguins price action has broken free from its long-term accumulation box between $0.006 and $0.021. The breakout was supported by volume and Smart Money BOS markers. PENGU price is now forming higher highs and higher lows, showing a textbook uptrend structure with bullish continuation potential.

The directional movement index (DMI) on the daily chart remains bullish. The +DI is leading at 61.5 while -DI continues to weaken. This is reinforced by a sharp uptick in the Money Flow Index (MFI), currently at $78.59. The reading signals aggressive capital inflow, though it is nearing overbought conditions.

Why Is The Pudgy Penguins Price Going Up Today?

PENGU price dynamics (Source: TradingView)

PENGU price dynamics (Source: TradingView)

The latest rebound is being driven by strong structural defense and signs of momentum returning. The 30-minute RSI has moved back above 66.30 and continues to flirt with the 70 zone. This suggests a possible breakout setup. Meanwhile, VWAP has now flipped into support near $0.04196, with price comfortably trading above it and pressing toward the upper session band.

PENGU price dynamics (Source: TradingView)

PENGU price dynamics (Source: TradingView)

From a Smart Money Concepts perspective, multiple BOS (Break of Structure) levels were reclaimed this week. PENGU is now attempting to break above the most recent weak high near $0.04500, which capped earlier upside. A clean close above this level could confirm another leg higher toward $0.050.

Price Indicators, Signals, Graphs and Charts (24h)

PENGU price dynamics (Source: TradingView)

PENGU price dynamics (Source: TradingView)

The 4-hour chart reveals a powerful bounce from the lower Bollinger Band near $0.036. Price is now testing the upper band resistance at $0.04501. The Bollinger Bands have started to expand again, which indicates a potential volatility breakout.

In addition, the EMA cluster is now fully bullish. The 20, 50, 100, and 200 EMAs are aligned beneath current price. The 20 EMA is acting as intraday support at $0.03966. The short-term trend remains intact as long as this level holds.

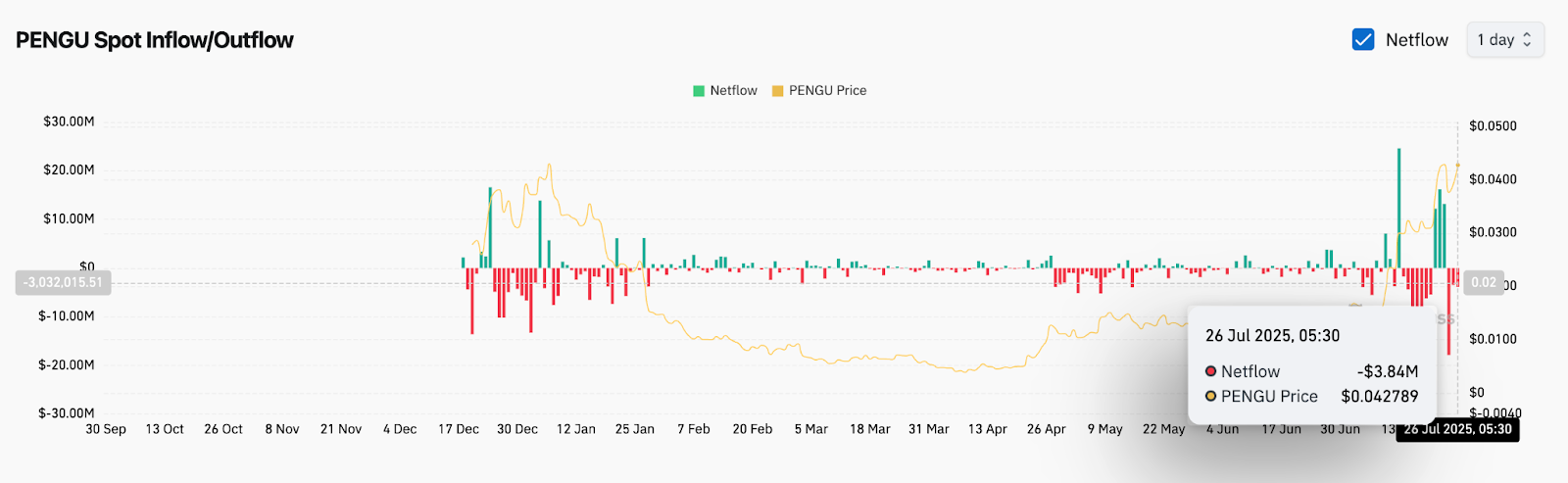

PENGU Spot Inflow/Outflow Data (Source: Coinglass)

PENGU Spot Inflow/Outflow Data (Source: Coinglass)

That said, exchange data shows caution. The latest netflow chart (as of July 26) reflects a negative daily flow of -$3.84M. This outflow suggests some profit-taking or risk-off behavior and may limit breakout strength if buyer follow-through falters.

PENGU Price Prediction: Short-Term Outlook (24h)

As long as PENGU holds above $0.04150, momentum remains with the bulls. The breakout attempt above $0.04350 could extend toward the $0.045 to $0.047 zone. This region represents the upper channel edge and prior liquidity rejection level.

If the breakout fails and price drops below $0.04080, short-term structure could turn sideways. This may prompt a retest of $0.03850. A break below that level would reopen the lower channel test near $0.035.

Given the strong EMA support, compression buildup, and Smart Money BOS structure, traders should monitor the $0.04350 to $0.04500 region closely for signs of a continuation or rejection. Volatility is likely to pick up if PENGU decisively clears or fails this key area.

Pudgy Penguins Price Forecast Table: July 27, 2025

| Indicator/Zone | Level / Signal |

| Pudgy Penguins price today | $0.04289 |

| Resistance 1 | $0.04500 (upper BB, weak high) |

| Resistance 2 | $0.04750 (top channel test) |

| Support 1 | $0.04080 (VWAP, consolidation) |

| Support 2 | $0.03850 (prior BOS, wedge base) |

| RSI (30-min) | 68.36 (bullish, near overbought) |

| MFI (1D) | 78.59 (elevated inflow) |

| DMI (1D) | +DI 61.5, -DI weak (bullish) |

| Bollinger Bands (4H) | Expanding, volatility setup |

| EMA Cluster (4H) | Fully bullish below price |

| VWAP (30-min) | Acting as short-term support |

| Smart Money BOS | Active, weak high at $0.04500 |

| Netflow (July 26) | -$3.84M (mild outflow) |