Crypto funds post record $4.4B inflows as Ether ETPs break 2024 gains

Cryptocurrency investment products posted record-breaking inflows last week as they recorded gains for a 14th consecutive week.

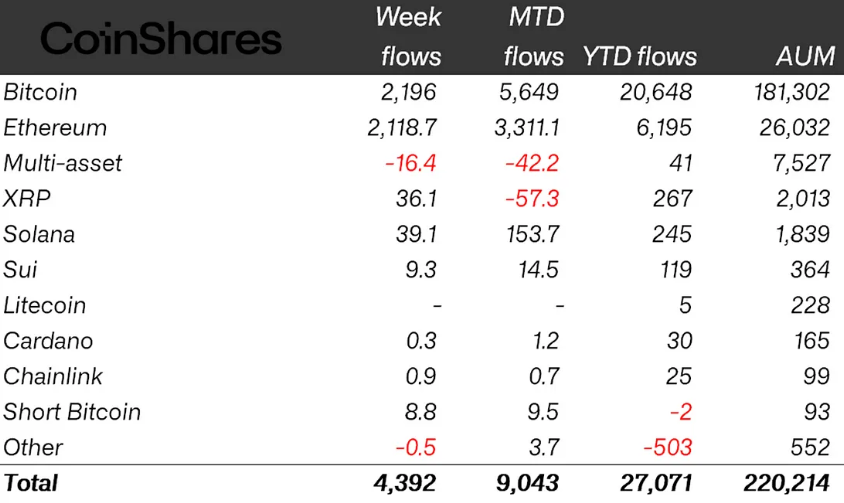

Global crypto exchange-traded products (ETPs) recorded $4.4 billion of inflows for the trading week that ended Friday, CoinShares reported on Monday.

The inflows came amid Bitcoin surging past $122,000 for the first time on July 14, then dropping to an intraweek low of about $116,000 before finishing the trading week at around $120,000, according to CoinGecko data.

With the fresh gains, the year-to-date (YTD) inflows in crypto ETPs climbed to a new high of $27 billion, while total assets under management (AUM) for the first time broke $220 billion.

Ether ETP inflows surpass 2024 totals

Ether ETPs set multiple records last week, with 2025 inflows surpassing 2024 totals at $6.2 billion, while weekly inflows hit double the previous record at $2.12 billion, CoinShares’ head of research James Butterfill wrote in the report.

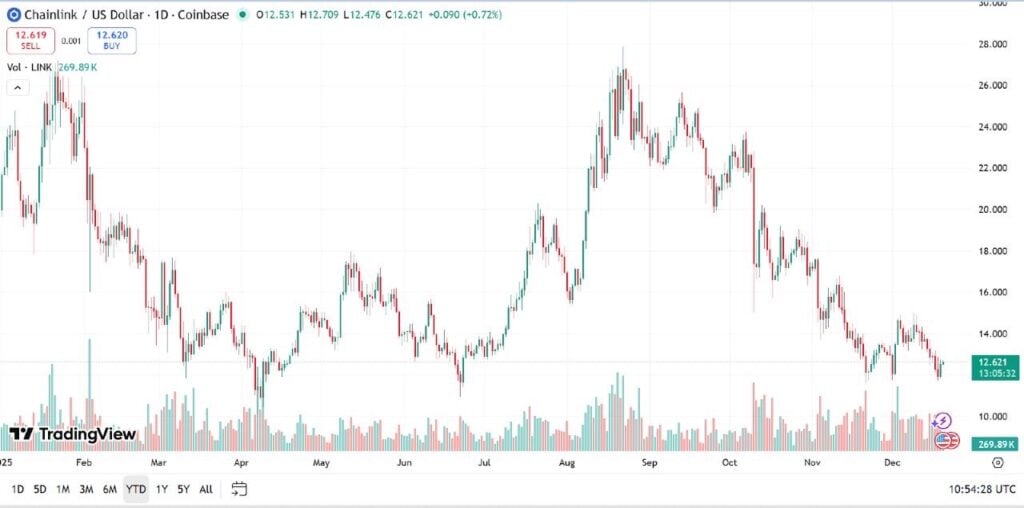

The latest inflows came as ETH surged past $3,500 for the first time since early January. The highs followed several months of downward pressure that pushed ETH below $1,500 in April, according to CoinGecko.

Ether price chart in the past year. Source: CoinGecko

Ether price chart in the past year. Source: CoinGecko

“The past 13 weeks of inflows now represent 23% of Ethereum AUM,” Butterfill noted.

New Bitcoin highs don’t disrupt ETP inflows

Bitcoin ETP inflows remained resilient as BTC reached new all-time highs, contrasting with the slowdown seen in early July, a dip Butterfill attributed to growing caution as Bitcoin neared record levels.

According to the latest update, Bitcoin funds posted $2.2 billion of inflows last week, accounting for 50% of total crypto ETP inflows.

Crypto ETP flows by asset as of Friday (in millions of US dollars). Source: CoinShares

Solana , XRP and Suiwere notable for their inflows totaling $39 million, $36 million and $9.3 million, respectively.

US issuers see $200 million of outflows combined

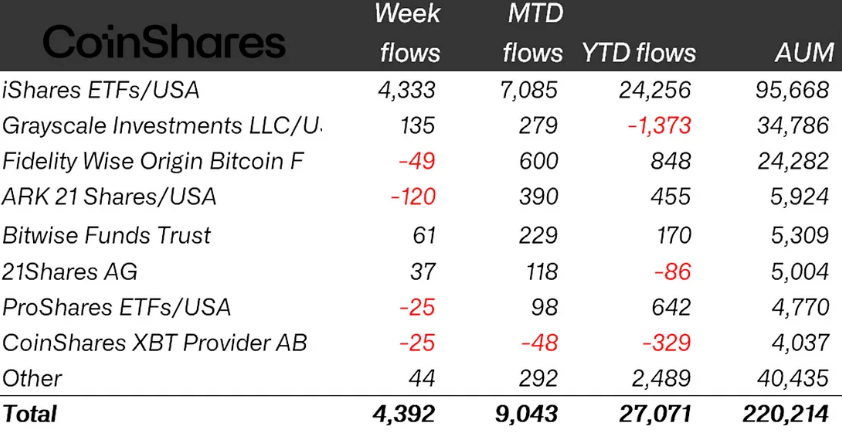

Despite crypto ETPs seeing record-breaking inflows last week, some issuers recorded some minor outflows.

Cathie Wood’s ARK Invest recorded the largest losses among issuers, with total outflows reaching $120 million, CoinShares reported.

The ARK Next Generation Internet ETF contributed to the sell-off, offloading $8.7 million worth of its ARK 21Shares Bitcoin ETF (ARKB) last Tuesday.

Crypto ETP flows by issuer as of last Friday (in millions of US dollars). Source: CoinShares

Crypto ETP flows by issuer as of last Friday (in millions of US dollars). Source: CoinShares

Other US issuers, including Fidelity Investments and ProShares, experienced modest outflows of $49 million and $25 million, respectively.

European issuer CoinShares also saw minor outflows of $25 million, adding to last week’s $18 million in outflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Seek Protocol Joins Forces with ICB Network to Enhance Network Scalability, Advance Cross-Chain Benefits to Users

The Rise and Fall of Aster and Hyperliquid Coins: A Dynamic Crypto Journey

Best Cryptos to Invest In for 2026 – Top 7 List