Ripple Co-Founder Moves $26 Million XRP Amid Price Surge

- Ripple co-founder Chris Larsen transferred $26M worth of XRP to Coinbase amid a price surge.

- Larsen’s wallet has moved over 106M XRP, raising speculation about continued token sales.

- Larsen’s wallet holds 4.39% of XRP supply, sparking concerns over possible sell pressure.

Chris Larsen, Ripple’s co-founder and executive chairman, has transferred $26 million worth of XRP to Coinbase this week. The move comes as XRP hits a seven-month high, breaking above the price of $3.40. The transfer sparked renewed market speculation, especially as it aligns with XRP’s growing institutional demand and legal clarity.

Founder’s Wallet Sends $26M XRP Amid Rally

On Tuesday, a wallet linked to Larsen sent nearly 8.5 million XRP to Coinbase, valued at around $26 million. This is the latest in a series of large transfers from Larsen’s known addresses. Since January, the Ripple co-founder has moved over 106 million XRP, worth about $344 million, to various exchanges and wallets.

While it is unclear if Larsen sold the funds, transfers to centralized exchanges typically imply a sell-off. Investors keenly observe such actions because massive sales by early founders may have an impact on the market sentiment. Despite these ongoing transfers, Larsen’s known wallet still holds 332.5 million XRP, worth more than $1 billion.

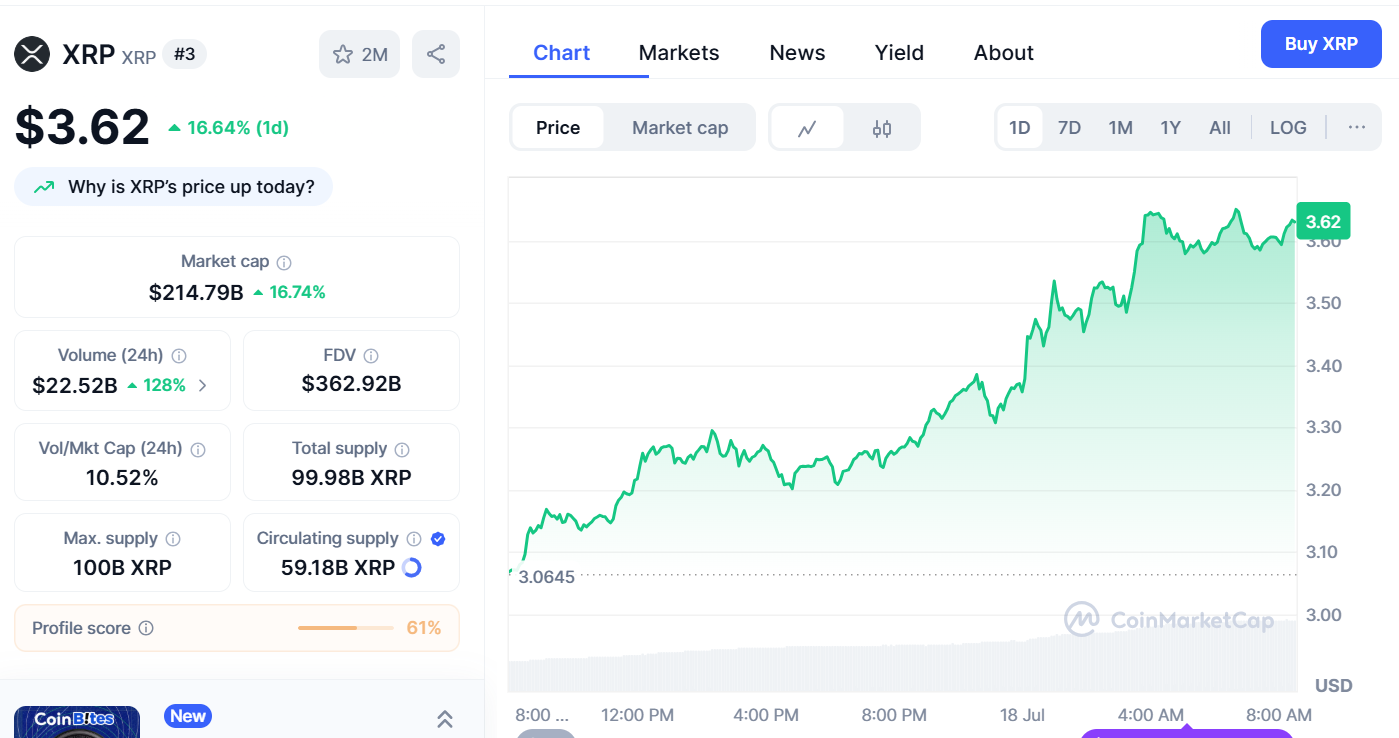

The wallet controls about 4.39% of XRP’s circulating supply. That concentration has triggered concern within the XRP community. Many fear that more sales could place downward pressure on prices. Yet, the market has remained resilient. XRP has climbed more than 35% in the past week. At press time, the coin is trading around $3.62, representing a 16.64% increase in the past day.

Source:

CoinMarketCap

Source:

CoinMarketCap

Ripple’s Momentum Boosts XRP Demand

XRP’s rally comes during a broader market surge. Bitcoin recently broke past $123,000 for the first time, pulling the altcoin market higher. But XRP’s rise also reflects Ripple’s growing business influence and regulatory progress in the U.S.

Earlier this month, XRP overtook Tether (USDT) to become the third-largest crypto by market capitalization. Institutional demand has also increased. In June, Nasdaq-listed Webus International filed to build a $300 million XRP treasury.

Ripple, along with Circle, also applied for a U.S. National Trust Bank charter in early July. This would allow Ripple to operate under federal oversight. The move is rare and demonstrates Ripple’s intention to integrate more deeply into the U.S. financial system.

According to XRPscan, wallets linked to Larsen still hold about 2.6 billion XRP. That stash is valued at $8.3 billion. Forbes currently estimates Larsen’s net worth at $9.7 billion, up from $3.2 billion last year. In October 2024, he donated $1 million in XRP to a political group backing Vice President Kamala Harris. He has also supported other Democratic politicians with crypto-based contributions.

Related: Ripple and Ctrl Alt Tokenize Real Estate in Dubai Using XRPL

Market Eyes More Sales as XRP Nears ATH

Larsen’s XRP movements are not new. Back in January, he transferred a large batch of tokens from his wallet to exchanges. Since then, he has made several similar transactions, often timed around price surges.

Market watchers remain cautious as XRP trades at above $3.6. Further sell-offs from large holders could lead to increased volatility. Still, the token’s strong momentum has helped ease fears. The institutional interest, listing on exchanges, and the legal clarity of Ripple have helped maintain investor confidence. The market continues to monitor wallets linked to Ripple insiders. Any significant transactions could impact sentiment, especially as XRP sets a new record.

The post Ripple Co-Founder Moves $26 Million XRP Amid Price Surge appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Telegram, the world's largest social platform, launches major update: Your graphics card can now mine TON

Telegram’s ambition for privacy-focused AI

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

An overview of two new projects in the Polkadot ecosystem and what they will bring to Polkadot Hub

HIC: Continue to bring truly valuable new projects to Polkadot in a sluggish market!