SPX6900 Hits New Highs — Here’s Why Smart Money Could Push It Higher

SPX price just touched a new all-time high of $1.85. With momentum building and $2.09 as the next major resistance, traders are eyeing a potential 17% breakout. But what if bulls lose steam?

SPX6900, riding the momentum of the “Meme coin SuperCycle” thesis, briefly touched a new all-time high of $1.85 recently before pulling back to $1.79.

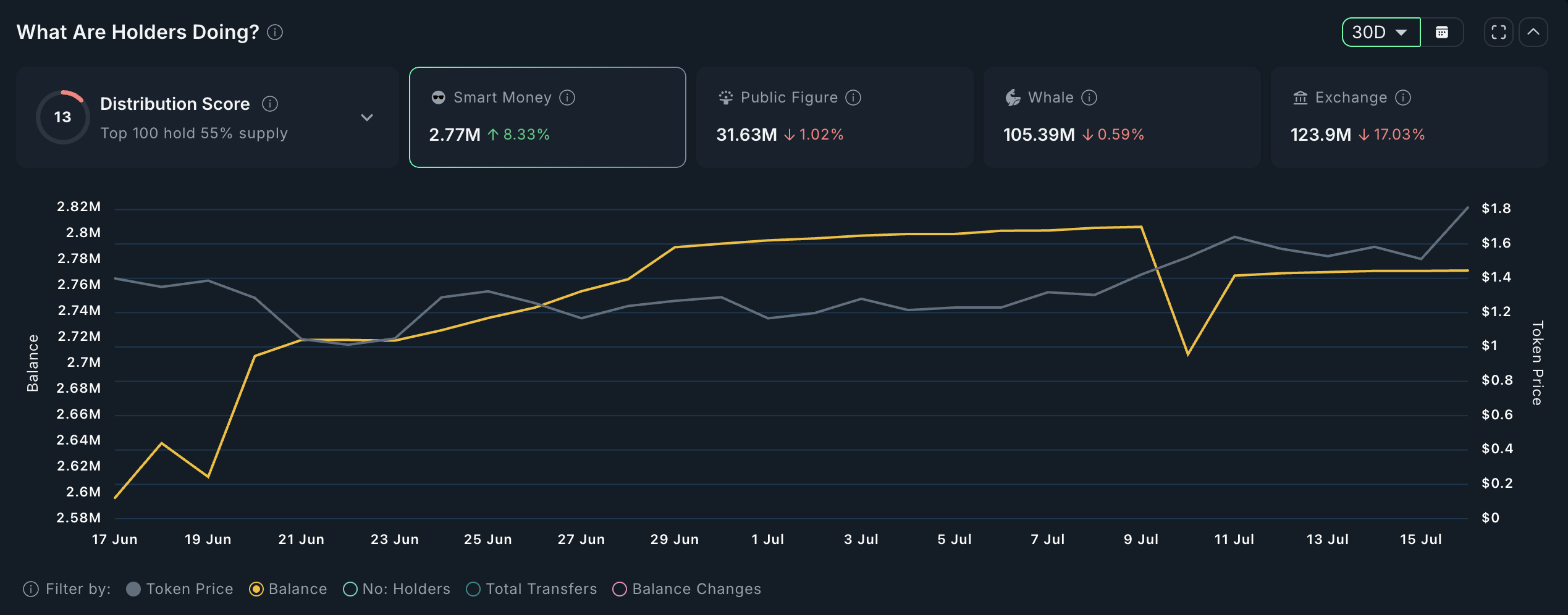

On-chain data shows a rise in smart money holdings and a decline in exchange inflows over the past 30 days, suggesting accumulation may be building beneath the surface. With consolidation underway just below the highs, traders are watching closely for a potential breakout toward $2.

Smart Money Accumulation and Distribution Trends Look Positive

According to Nansen, smart money wallets now hold 2.77 million SPX, up 8.33% in the past 30 days. This increase equals over 213,000 tokens added during the period, currently valued at roughly $383,000.

In contrast, exchanges have dropped their SPX holdings by more than 17% this month, a sign of diminishing sell pressure.

SPX price and dropping exchange reserves:

SPX price and dropping exchange reserves

SPX price and dropping exchange reserves:

SPX price and dropping exchange reserves

The distribution score remains moderately high at 13, suggesting 55% of supply is still held by the top 100 wallets; something to watch in case whales decide to rotate out. Still, with exchange outflows and smart wallet inflows in sync, the setup looks more bullish than not.

Holder Count on the Rise

Moreover, Santiment data confirms that retail is following the smart money. The number of SPX wallets has now surpassed 43,700, up from approximately 41,800 in mid-June.

3-month holder count trend for SPX:

3-month holder count trend for SPX

3-month holder count trend for SPX:

3-month holder count trend for SPX

This rising holder count, especially during price surges, often confirms confidence across the board, not just among institutional players.

SPX Price Action Looks Bullish

SPX price recently broke past the 0.618 Fibonacci retracement level at $1.847, touching a new high of $1.85. The next resistance lies at the 0.786 level, around $2.09. That’s an approximate surge of 17%.

If bulls can reclaim and hold above $1.85, the $2.00 psychological barrier could fall quickly.

SPX price analysis:

SPX price analysis

SPX price analysis:

SPX price analysis

A fallback scenario would see SPX retest the $1.67 and $1.49 levels, which acted as previous resistance-turned-support zones. But for now, buyers remain in control, and momentum is pointing north. A complete bullish trend invalidation would come in if SPX drops under $0.92.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid (HYPE) Attracts Attention with Dynamic Price Movements

Stunning Bitcoin Price Prediction: $160K Target by 2026 as Tokenized Assets Explode to $490B

Ethereum Foundation refocuses to security over speed – sets strict 128-bit rule for 2026