Berachain’s PoL v2 Upgrade Shifts Token Incentives

- The PoL v2 upgrade reallocates rewards, impacting BERA and BGT tokens.

- Focuses on increasing BERA staking yield.

- Strengthens overall Berachain ecosystem incentives.

The upgrade is set to optimize Berachain’s incentive architecture , encouraging increased BERA participation and supporting the network’s economic engine. Analysts indicate BERA staking rates and protocol value may rise post-implementation.

Berachain’s latest proposal, PoL v2, realigns the rewards mechanism within its blockchain network architecture. Reallocating the 33% of rewards traditionally allocated to the BGT governance token to the BERA Staking Module, strengthens BERA stakeholder incentives. This adjustment seeks to boost yield for BERA, Berachain’s native token, by directly enhancing its long-term economic value.

Key Players and Governance

Key players in this shift include Berachain’s founding team and governance members. The proposal was detailed in an official forum post, emphasizing the upgrade’s role in reinforcing BERA as the network’s economic core. Berachain’s PoL v2 Upgrade aims to optimize reward flows, ensuring protocol value while maintaining a strong governance framework for BGT stakeholders.

The immediate effects of this upgrade could heighten BERA’s market position, potentially boosting participation within its staking module. Analysts anticipate shifts in asset yield alignments, which may drive overall protocol growth. The BGT token, affected by reduced direct incentives, remains integral within governance frameworks, promising future adaptations to align with protocol evolution.

PoL v2 marks a meaningful evolution of Berachain’s incentive architecture. It creates direct, flexible yield for BERA holders, maintains a strong ecosystem around BGT, and sets the stage for future protocol-layer value capture mechanisms. – Berachain Foundation, Official Statement, Berachain

Financial implications include a possible reevaluation of BERA and BGT valuations, with direct staking incentives likely enhancing overall market confidence in BERA. Observers forecast increased protocol TVL and staking activity, bolstered by the strengthened incentive structure. Though no direct regulatory impact is noted, the upgrade underscores a focused approach to sustaining Berachain’s economic strategies.

Future expectations for Berachain involve further technical and economic participation scaling, aligning with broader industry trends towards sustainable blockchain ecosystems. The network’s ability to adapt reward structures in response to evolving market dynamics reflects its commitment to maintaining relevance and user value within the cryptocurrency landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Germany unveils Nvidia supercomputer, says Europe is closing AI gap with US and China

Share link:In this post: Germany launched Jupiter, an Nvidia-powered supercomputer, now the fourth-fastest in the world. Chancellor Friedrich Merz said the machine helps Europe compete with the US and China in AI. The US GAIN AI Act may block future exports of high-end chips like Nvidia’s to foreign countries.

Authors compound Apple’s AI struggles with fresh content use lawsuit

Share link:In this post: Authors Grady Hendrix and Jennifer Roberson sued Apple, alleging their books were used without consent to train its OpenELM AI models. The lawsuit claims the iPhone maker relied on pirated datasets and failed to seek permission, compensate or credit the authors. Microsoft, Meta, OpenAI, and Anthropic also face lawsuits over alleged misuse of copyrighted works for AI training.

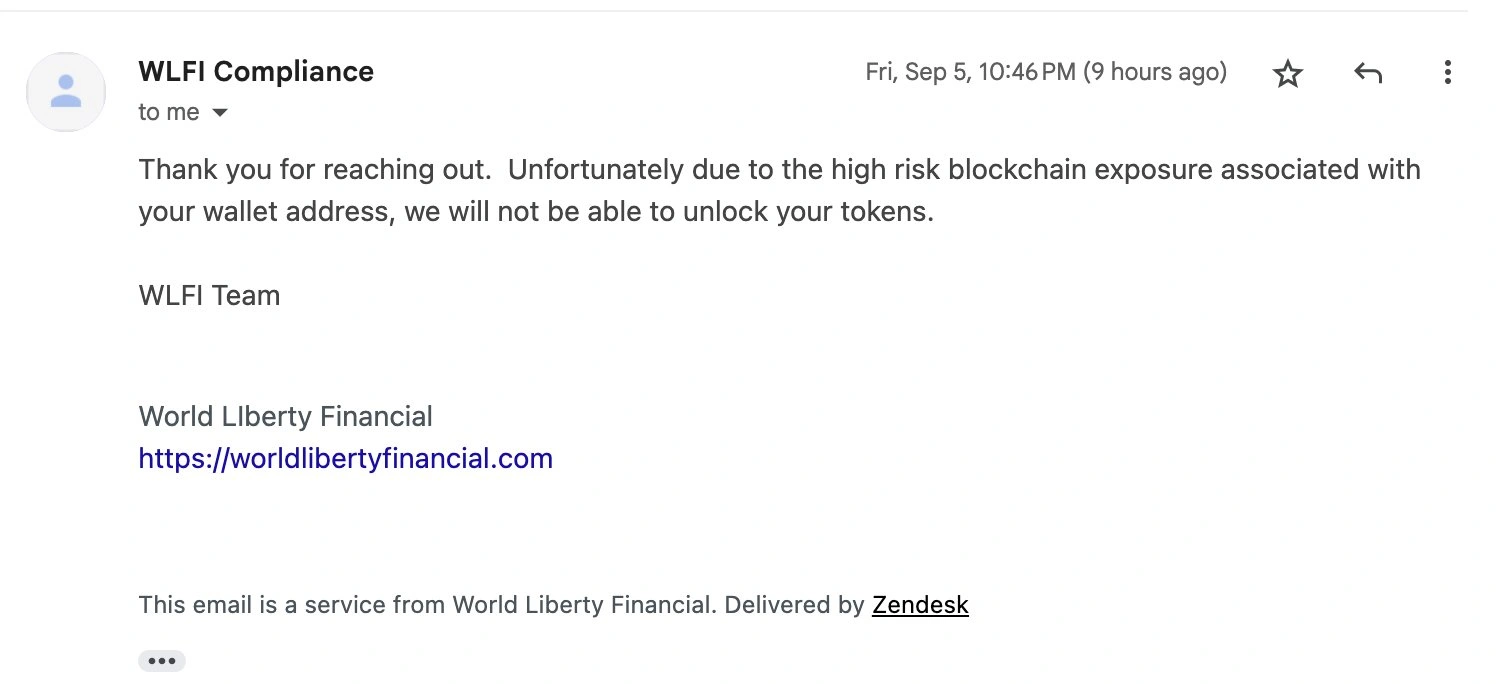

Trump-linked WLFI attracts criticism for ‘debanking users’ with token freezes

Share link:In this post: WLFI is getting some heat as Justin Sun’s frozen WLFI has started to be compared to debanking users. Sun claimed about 600 million tokens on September 1 and has accused WLFI of freezing those tokens after a blacklisting on Thursday. Another investor claims his funds were also locked after a risk assessment that only happened post-distribution.

A Review of Major Market Crashes in Crypto History

The cryptocurrency market often experiences low performance and high volatility in September. Historical crash data shows that the decline rate has gradually slowed, dropping from an early 99% to 50%-80%. Recovery periods vary depending on the type of crash, and there are significant differences between institutional and retail investor behavior. Summary generated by Mars AI. The content generated by the Mars AI model is still being iteratively updated for accuracy and completeness.