XCN price spikes 43%, pushes Onyxcoin into top 100

Onyxcoin is riding the overall cryptocurrency market sentiment to multi-month highs, with a 43% spike helping the decentralized Web3 protocol climb into the top 100 coins by market cap.

The Onycoin ( XCN ) price hovered above $0.020, double-digits up on the day and rising as t op cryptocurrencies look to mirror Bitcoin ( BTC )’s remarkable surge in the past few days.

XCN’s market cap at the time of writing was $685 million, with a 24-hour volume of over $81 million—representing a 213% increase. The daily trading range, according to market data, was $0.0170 to $0.0201.

Why is XCN surging today?

As Bitcoin smashed past $122,000 and Ethereum ( ETH ) surged past $3,000, the Onyxcoin token rallied more than 16% to reach highs of $0.020. This marked the token’s highest level since mid-May and a significant rebound from the June low of $0.012.

XCN chart

XCN chart

While whale activity has supported XCN in recent weeks, the latest breakout has been fueled by key network developments.

On July 12, the team announced that the highly anticipated improvement proposal for Onyx Points had passed. The OIP-60 proposal will activate points rewards for XCN stakers on the Ethereum network and deploy the protocol’s gas-free wallet. Execution was queued and scheduled to go live within approximately 48 hours.

As the token breaks out of a six-month falling wedge pattern, bullish bets have pushed open interest to $21 million. The 16% jump in OI also coincides with a surge in derivatives volume. According to Coinglass , the broader crypto market rally has triggered a 155% spike in this metric.

Interest in Onyxcoin has intensified in recent weeks due to exchange listing and overall market sentiment .

XCN gained momentum following its listing on the top decentralized exchange PancakeSwap and has also benefitted from previous integrations with Coinbase Wallet, Base, and BNB Chain. However, prices have historically seen sharp pullbacks during broader market downturns.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Pi Network stock price remains under pressure, momentum weakens

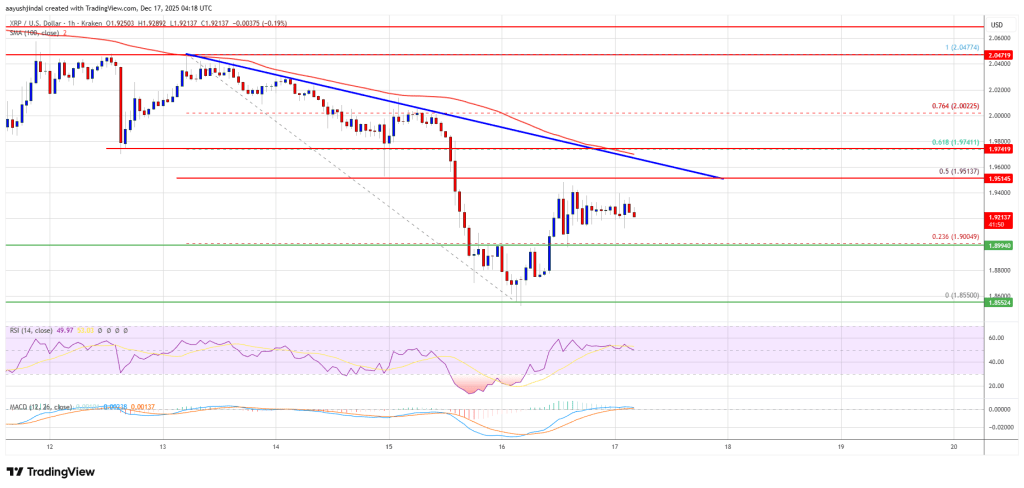

XRP price recovery appears fragile—can bulls break through the price ceiling?

Pantera: 2025 will be a year of structural progress for the crypto market