Ethereum Supply Shock Intensifies With 29% of ETH Locked in Staking

Ethereum’s tightening supply from record staking and leveraged shorts signals a possible bullish breakout—or another sharp correction.

Ethereum (ETH) is on the verge of a dramatic supply shock as leveraged short positions soar to unprecedented levels, staking hits historic highs, and exchange liquidity plummets.

Will this be bullish for ETH, or will another “Black Thursday” event be created?

ETH Supply Shock Gaining Momentum

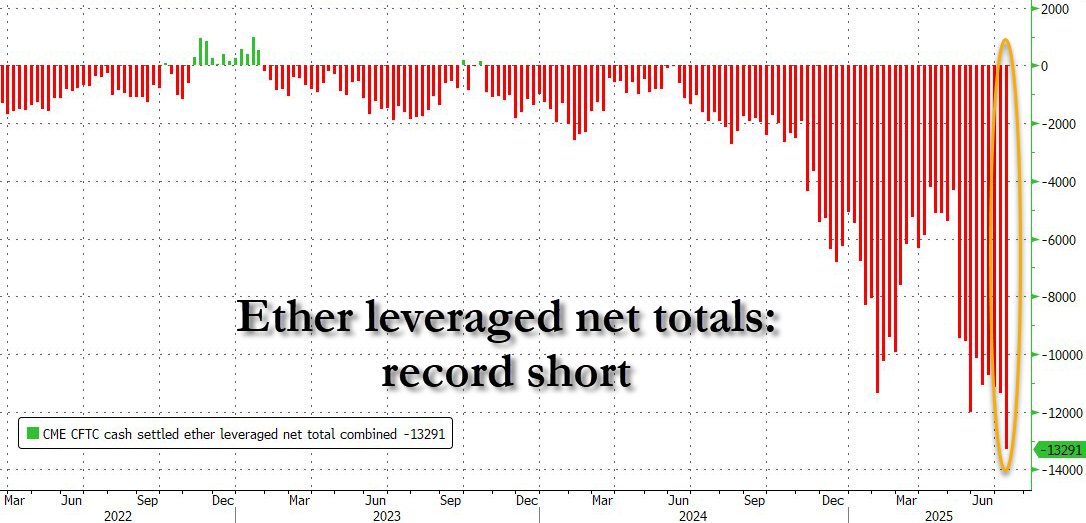

A chart posted by ZeroHedge on X highlights the Ethereum supply shock with leveraged short positions reaching a record -13,291 in aggregate OTC and cash contracts. This marks the sharpest drop since early 2025, signaling aggressive hedge fund activity.

Ether leveraged the biggest shorts on record. Source:

ZeroHedge

Ether leveraged the biggest shorts on record. Source:

ZeroHedge

Crypto expert Fejau notes on X that this isn’t driven by bearish sentiment but by a basis trade strategy. Hedge funds exploit price differences between ETH futures on CME and spot markets, securing consistent profits amid contango.

“Reason for the huge ETH shorts is basis trade. Funds can capture an annualized basis of 9.5% by shorting the CME futures and buying ETH spot with a staking yield of 3.5% (this why its mostly ETH not BTC) for a delta neutral 13%.” Fejau explained.

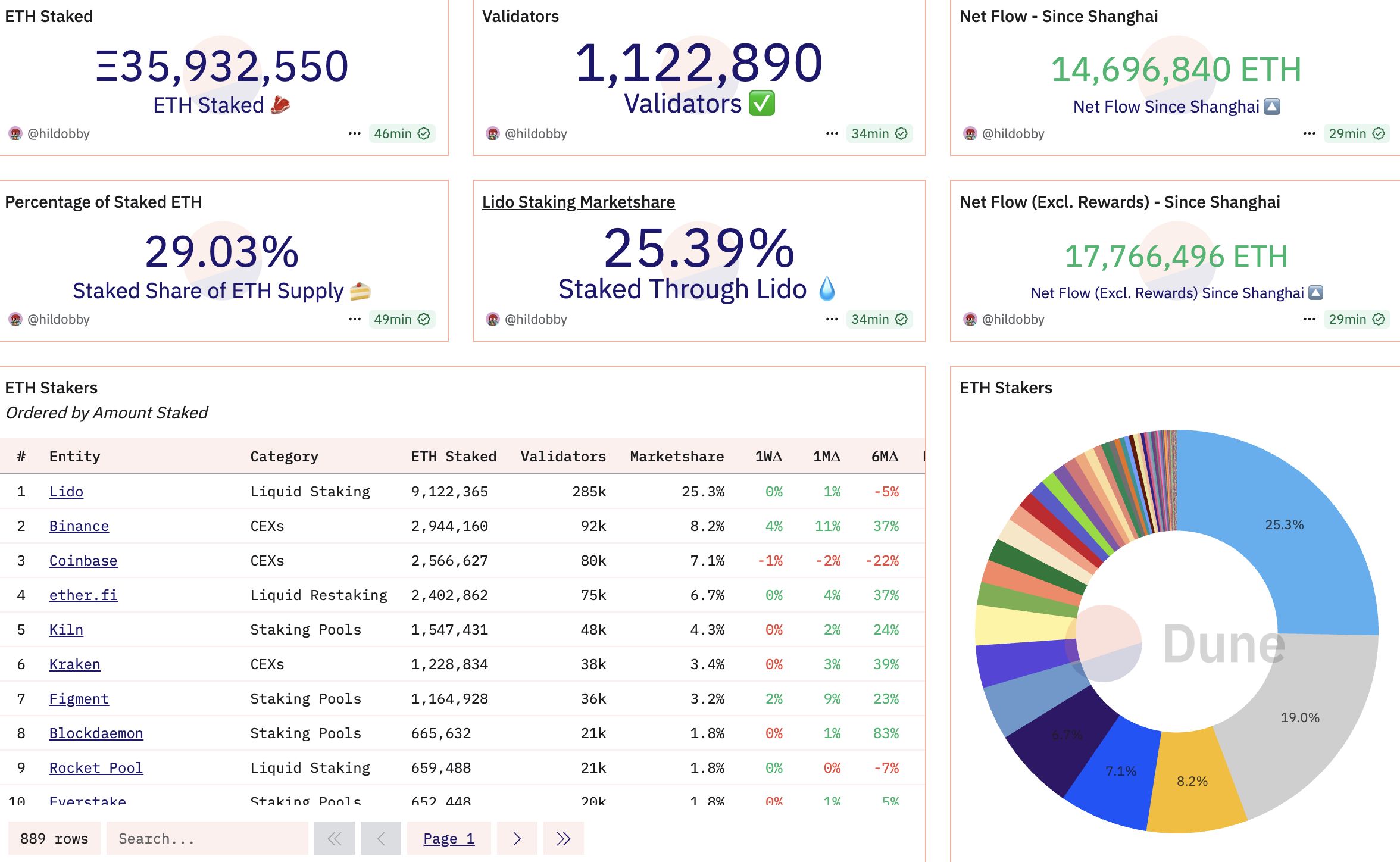

The ETH supply shock is further intensified by staking surging to an all-time high. According to Dune Analytics, over 29.03% of the total supply is locked, leaving roughly 121 million ETH circulating.

ETH staking ratio. Source:

Dune

ETH staking ratio. Source:

Dune

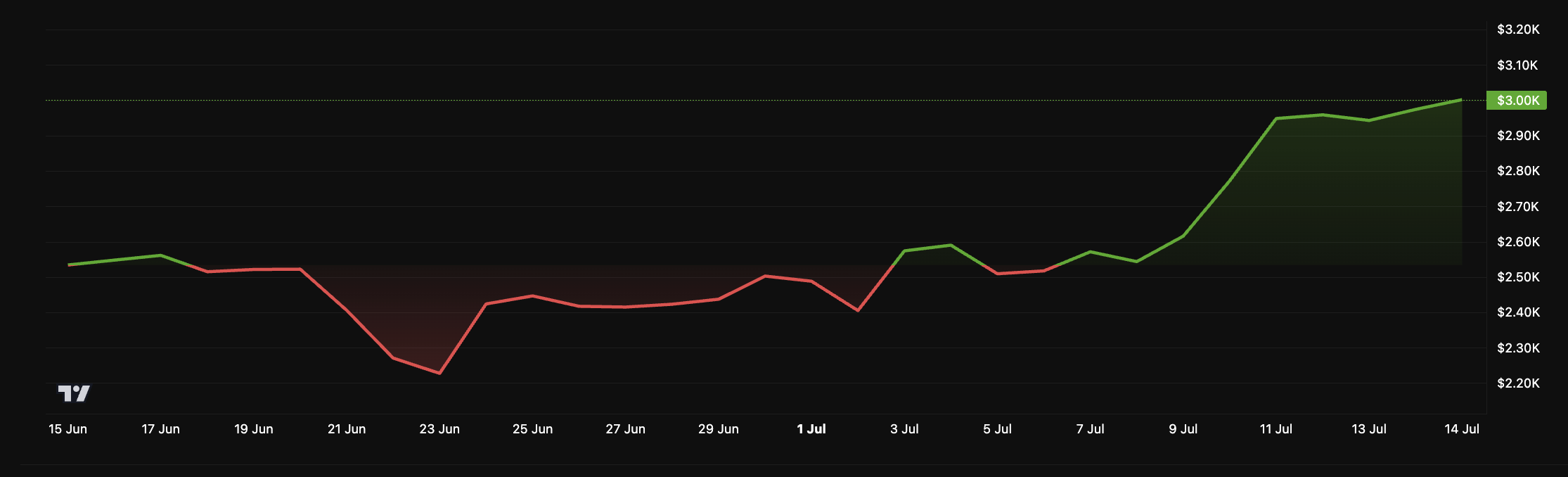

On-chain data also shows that ETH has been leaving exchanges recently, coinciding with the price of ETH returning to its current $3,000 mark. This is partly due to the accumulation strategy of whales or large companies like SharpLink.

Reduced liquidity also contributes to the upward pressure on prices when demand exceeds supply. Last Friday, 140,120 ETH valued at approximately $393 million were withdrawn from crypto exchanges.

“More than 140,000 ETH, worth roughly $393 million, flowed out of exchanges, marking the largest single-day withdrawal in over a month,” Sentora noted.

MerlijnTrader on X forecasts ETH hitting $10,000 in this cycle, propelled by a potential short squeeze and staking dynamics. ETF staking approvals are expected by year-end, reinforcing the ETH supply shock narrative.

Yet, risks loom large. The basis trade, while lucrative, is vulnerable to sudden volatility, as seen in 2020’s “Black Thursday.” If the Ethereum supply shock fails to drive a price surge, funds could face losses, shaking market confidence.

ETH price action. Source:

BeInCrypto

ETH price action. Source:

BeInCrypto

ETH has broken back above the $3,000 mark at the time of this writing. However, the current price is still 38% below the all-time high it reached in November 2021.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.