Bitcoin ATH Triggers $539M in Short Liquidations

- Bitcoin’s ATH caused $539M liquidations.

- Major exchanges affected: Binance, HTX, Gate.io.

- Over 118,800 traders were impacted.

Bitcoin reached a new all-time high of $111,936, leading to $539 million in short position liquidations on major exchanges including Binance, HTX, and Bybit.

Major Exchanges Involved

Major exchanges involved in these liquidations include Binance, HTX, and Bybit, where Binance is led by Richard Teng. The largest single liquidation occurred on HTX , totaling $51.56 million.

Market Impact

Bitcoin and Ethereum experienced significant losses, with liquidations totaling $469.87 million for BTC shorts and $156.492 million for ETH. Large-cap altcoins like XRP and SOL also saw increased liquidations.

Institutional buying and leverage use significantly impacted market dynamics, as described by Coinbase Premium data. This rally mirrors the 2021 Bitcoin surge that saw similar short liquidations .

Regulatory and Historical Context

No major announcements from regulators like the SEC have been made post-liquidation. Market speculation suggests U.S. spot BTC ETF inflows could have influenced demand shifts.

Historical data shows that past Bitcoin rallies often lead to high-short liquidations and subsequent price corrections. This incident signals the ongoing interplay between retail speculation and institutional market actions.

Liquidations of this magnitude underscore the volatile nature of leverage in crypto trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Ledger’s Carbon Footprint Matches One Flight

Ripple’s XRP Reaches Crucial Support Amid Price Uncertainty

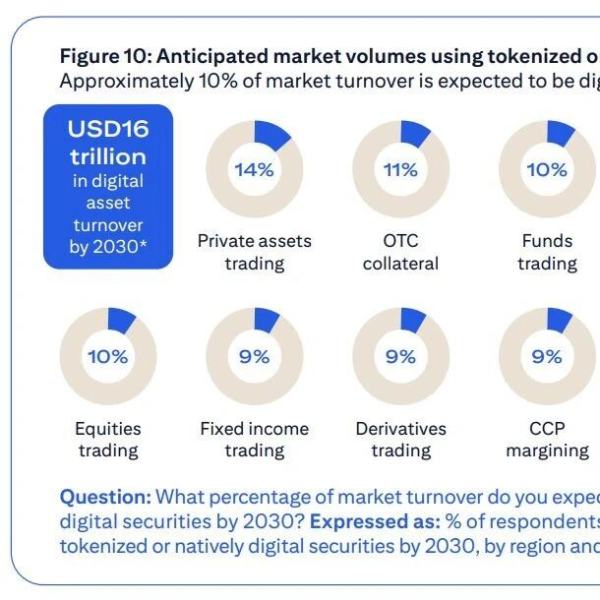

Citi survey: Cryptocurrency expected to account for one-tenth of the post-trade market by 2030

According to Citibank's latest "Securities Services Evolution Report," a survey of 537 global financial executives shows that by 2030, approximately 10% of global post-trade market volume is expected to be processed through digital assets such as stablecoins and tokenized securities.

Texas Instruments: Signs of Slowdown After Tariff-Driven Surge in Demand