Worldcoin Crash Coming? Key Levels To Watch

2025/07/02 20:20

2025/07/02 20:20Worldcoin (WLD) price has been one of the most talked-about digital assets in recent months, grabbing attention for its bold vision of a universal digital identity and its volatile price swings. After peaking near $1.80 earlier this year, WLD price has faced steady selling pressure, leaving traders wondering if a bigger breakdown is on the horizon. In this article, we’ll dive deep into the latest daily chart, key technical signals like the RSI, and critical support levels to help you understand where Worldcoin price might be heading next.

Why Worldcoin Price Could Crash?

One of the biggest reasons Worldcoin’s price could face sustained downward pressure is the growing controversy around its core concept: universal digital identity. Vitalik Buterin , co-founder of Ethereum and one of the crypto space’s most respected thinkers, has openly warned that platforms like Worldcoin pose a real threat to the pseudonymity that has defined internet and crypto culture for decades.

In his detailed critique , Buterin points out that even with advanced privacy technologies like zero-knowledge proofs, Worldcoin’s “one-person-one-ID” system could slowly dismantle the freedom users have to operate under multiple pseudonymous profiles.

This concern isn’t just philosophical — it has practical and political implications that could trigger regulatory pushback and user distrust. If millions of people realize that linking their entire online footprint to a single biometric ID makes them vulnerable to surveillance or coercion, adoption could stall, and those who already hold WLD tokens may choose to exit. Even the promise of universal proof-of-personhood loses its appeal if the trade-off is an irreversible erosion of online privacy.

Additionally, Buterin’s warning about coercion highlights a deep weakness in Worldcoin’s pitch. If governments, employers, or large platforms can force people to link all their online activities to one World ID, that ID becomes a single point of failure. Any breach, misuse, or abuse could expose a user’s entire digital life, shattering confidence in the system overnight. In the crypto world, trust is everything — and once trust erodes, token prices tend to follow.

The market also knows that Worldcoin isn’t the only answer to fake accounts and bots. Buterin’s “pluralistic identity” vision offers a compelling alternative, where multiple tools — social graphs, wallets, passports, biometrics — coexist. If developers and users flock to this more flexible approach, Worldcoin’s core utility could weaken, dragging its token value down with it.

Finally, the fact that Worldcoin is expanding partnerships and pushing for mass adoption at a time when questions about surveillance and privacy are escalating could amplify reputational risks.

A single privacy scandal — whether real or perceived — could trigger a sell-off. For traders watching the charts, these fundamental headwinds reinforce what the technicals already hint at: unless Worldcoin can address deep concerns about anonymity and misuse, its price may struggle to hold key supports and could continue sliding below the $0.80 mark.

Worldcoin Price Prediction: What Does the Current Daily Chart Reveal?

WLD/USD Daily Chart- TradingView

WLD/USD Daily Chart- TradingView

The daily Heikin Ashi chart for Worldcoin (WLD) price shows a persistent downtrend since its peak in early May, where WLD touched nearly $1.80. The price has since halved, now consolidating near $0.88. The candlesticks show a tightening range, hinting at an imminent move. The lower highs and weak bullish candles suggest that sellers still dominate.

Is the RSI Signaling Further Downside?

The Relative Strength Index (RSI 14) sits at around 40.22, with the average line around 36.92. An RSI below 50 indicates prevailing bearish momentum. Notably, during the last bounce in late April, RSI crossed above 70, which marked the temporary top near $1.80. Since then, the RSI has consistently failed to break above 50, a clear sign that bulls lack strength.

If RSI drops below 40 again and touches the oversold region (below 30), we could see a sharper sell-off. Statistically, the last time RSI dropped from 45 to 30, WLD price fell by around 35% in ten days . If we apply a similar percentage drop from the current level of $0.88, the projected price could test the $0.55 zone.

- Calculation:

Current Price: $0.88

Possible drop: 35% → $0.88 - (0.35 × $0.88) ≈ $0.57

Which Support Levels Should You Watch?

The chart shows key horizontal support levels around $0.80, $0.65, and $0.55. The $0.80 level has acted as a psychological support in the last two weeks. If the price closes below this level with strong volume, it could trigger a slide to $0.65.

Heikin Ashi candles are showing smaller bodies with lower wicks, indicating indecision. Such patterns often precede a breakout or breakdown. If the next few daily candles open and close below $0.85, it would strengthen the bearish thesis.

Is There Any Chance for a Short-Term Reversal?

Although the overall sentiment is bearish, a sudden push above $0.90 could invalidate this downside scenario. To regain bullish momentum, Worldcoin price must close and hold above the $1.00 resistance level with increasing volume. The RSI must also break above 50 and ideally trend toward 60–70 to confirm a sustainable reversal.

However, given the weak RSI, continued lower highs, and lack of bullish news, such a move seems unlikely in the short term.

Worldcoin Price Prediction: Where Is WLD Price Headed Next?

Based on the current daily chart, the dominant trend remains downward. Unless there is a strong bullish catalyst, Worldcoin price is more likely to test the $0.80 support soon. If it breaks, the next likely target is $0.65–$0.55 in the coming weeks.

Investors should watch the $0.80 support and RSI levels closely for confirmation. If RSI falls toward 30 again, expect sellers to push WLD price further down. Any close above $0.90 could hint at a short-term bounce, but sustainable upside remains capped unless a strong reversal pattern forms.

Summary:

- Trend: Bearish

- Key Support: $0.80, $0.65, $0.55

- Resistance: $0.90, $1.00

- RSI: Weak, trending below 50

Outlook: High chance of breakdown toward $0.55–$0.65 zone if $0.80 fails.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

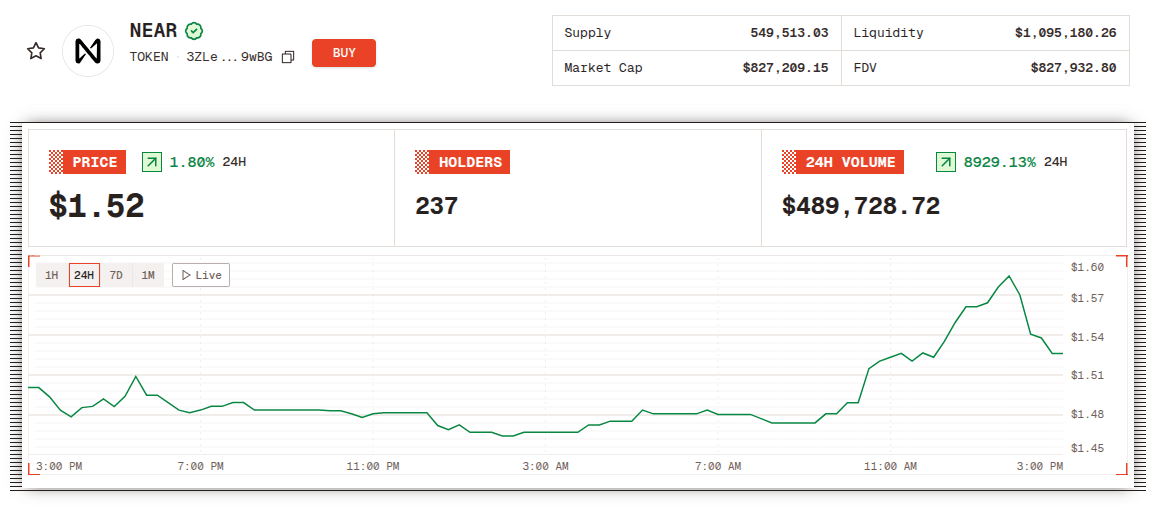

NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral

Market Strategist: Everyone Gave Up On XRP. Here’s Why

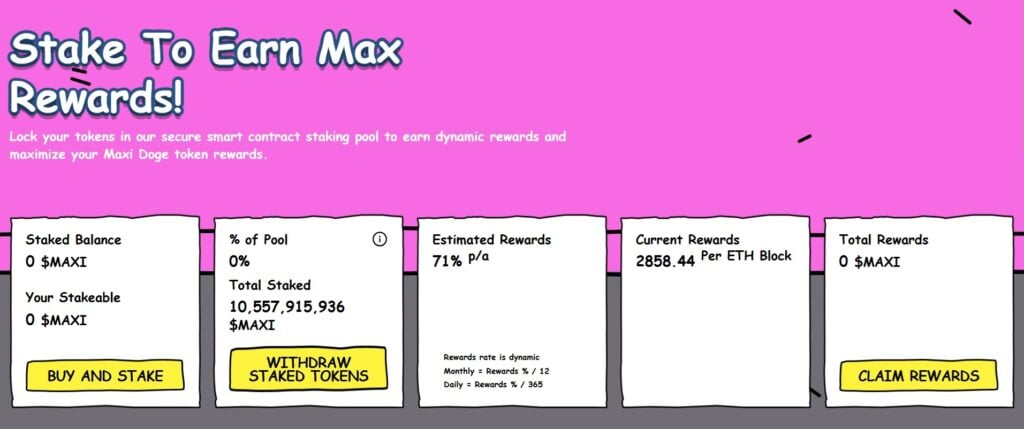

Best Crypto Presales: New Crypto Coins Set to Lead the Market Recovery

Tezos Art Ecosystem Growth in 2025: Flagship Events, Institutional Programs, and Artist Sales