- U.S. Ethereum ETFs recorded 15 consecutive days of inflows, totaling $837 million.

- ETHA led the market with $15.86 million in daily inflow and $3.77 billion in net assets.

- Grayscale’s ETH saw $9.37 million in inflow, while ETHE recorded no new inflow and $4.29 billion in total outflows.

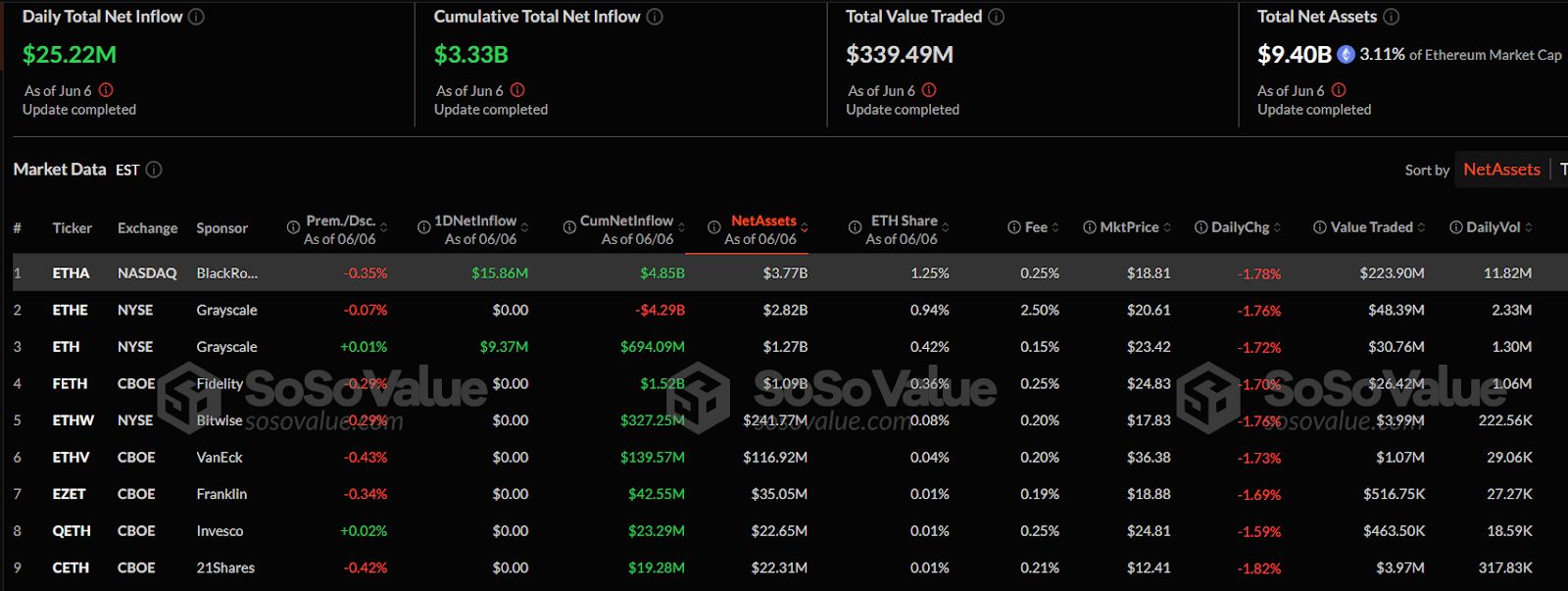

U.S.-listed spot Ethereum ETFs have now reported 15 straight trading days of net inflows . Total net inflows reached $837 million over the streak. Daily net inflow for that date stood at $25.22 million. Cumulative inflows since inception totaled $3.33 billion. The total net assets under management across all Ethereum ETFs amounted to $9.40 billion, accounting for 3.11% of Ethereum’s total market capitalization. Daily trading volume across all funds came to $339.49 million.

ETHA Tops Market with Leading Asset Value and Inflows

As of the latest update by SoSoValue , ETHA, sponsored by BlackRock and listed on NASDAQ, led the day with $15.86 million in net inflow. Its cumulative net inflow rose to $4.85 billion. ETHA also had the highest net asset value among peers at $3.77 billion. Its daily trading volume reached 11.82 million shares with a market price of $18.81.

Source:

SoSoValue

Source:

SoSoValue

ETHA ended the day with a 1.78% price drop and traded $223.90 million in value. The ETF was trading at a 0.35% discount to its net asset value. Grayscale’s ETH, listed on NYSE, followed with a daily net inflow of $9.37 million. Its cumulative net inflow increased to $694.09 million. ETH closed at $23.42, a decrease of 1.72% for the day.

The ETF recorded a trading volume of 1.30 million shares and $30.76 million in value traded. Grayscale’s other ETF, ETHE, recorded no inflow on June 6. ETHE maintained $2.82 billion in net assets but recorded cumulative outflows totaling $4.29 billion. It closed at $20.61, down 1.76% for the day.

Fidelity, Bitwise, VanEck Maintain Long-Term Inflows

Fidelity’s FETH reported no new inflow but maintained $1.52 billion in total cumulative inflows. The ETF held $1.09 billion in net assets and closed at $24.83, dropping 1.70%. It recorded a trading volume of 1.06 million shares and $26.42 million in value traded.

ETHW by Bitwise also recorded no new daily inflow. However, its total net inflow stood at $327.25 million, with net assets at $241.77 million. ETHW closed at $17.83 after falling 1.76% on the day. VanEck’s ETHV ETF held $116.92 million in assets. Cumulative inflows reached $139.57 million. ETHV closed at $36.38, down 1.73%.

Franklin’s EZET closed at $18.88, with net assets of $35.05 million and a cumulative inflow of $42.55 million. QETH, sponsored by Invesco, closed at $24.81, down 1.59%. Net assets stood at $22.65 million, with $23.29 million in cumulative inflow. 21Shares’ EETH closed at $12.41 after a 1.82% daily decline. EETH held $22.31 million in assets and recorded no new inflow.