XRP Futures Show Increasing Sell Orders – Will It Drop Below $2?

XRP's price has plunged amid a futures sell-off and growing short interest, putting the crucial $2 support level at risk. Traders are now eyeing a deeper dip unless buyer momentum rebounds.

XRP has suffered a near 10% decline over the past week, dampening trader sentiment and triggering a wave of sell-side activity in its futures market.

As buying pressure wanes, the altcoin risks plunging below the key support formed at $2 in the near term.

XRP Futures Traders Position for Decline

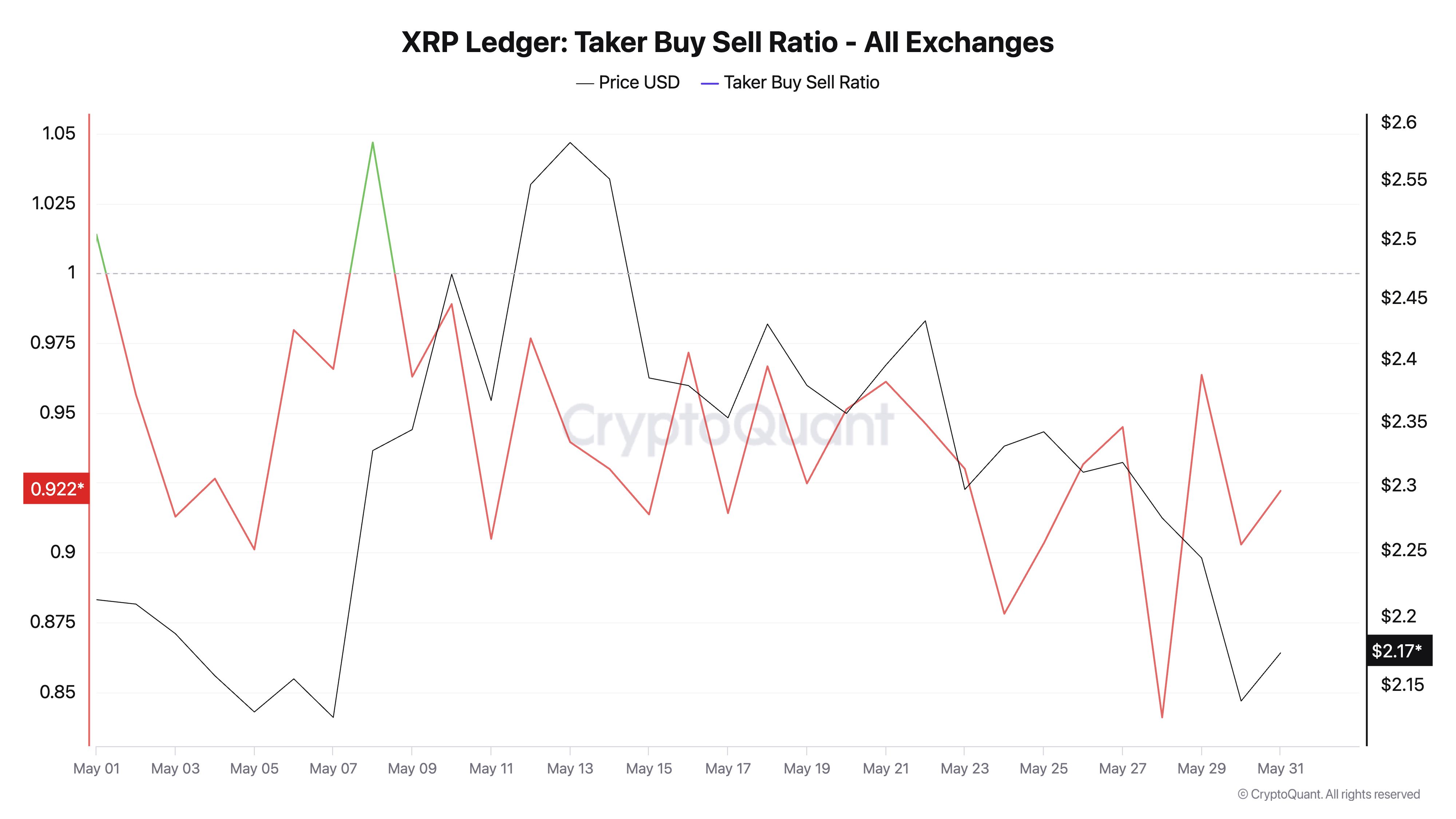

The bearish tone in the XRP market is evident in the token’s taker buy/sell ratio, which has consistently posted negative values for the past two weeks.

This indicates that sell orders dominate buy orders across the XRP futures market. At press time, this stands at 0.92, per CryptoQuant.

XRP Taker-Buy Sell Ratio. Source:

CryptoQuant

XRP Taker-Buy Sell Ratio. Source:

CryptoQuant

An asset’s taker buy-sell ratio measures the ratio between the buy and sell volumes in its futures market. Values above one indicate more buy than sell volume, while values below one suggest that more futures traders are selling their holdings.

The sustained decline in XRP’s taker buy/sell ratio over the past few weeks points to a mounting sell-off among futures traders, many of whom are increasing their exposure to short positions.

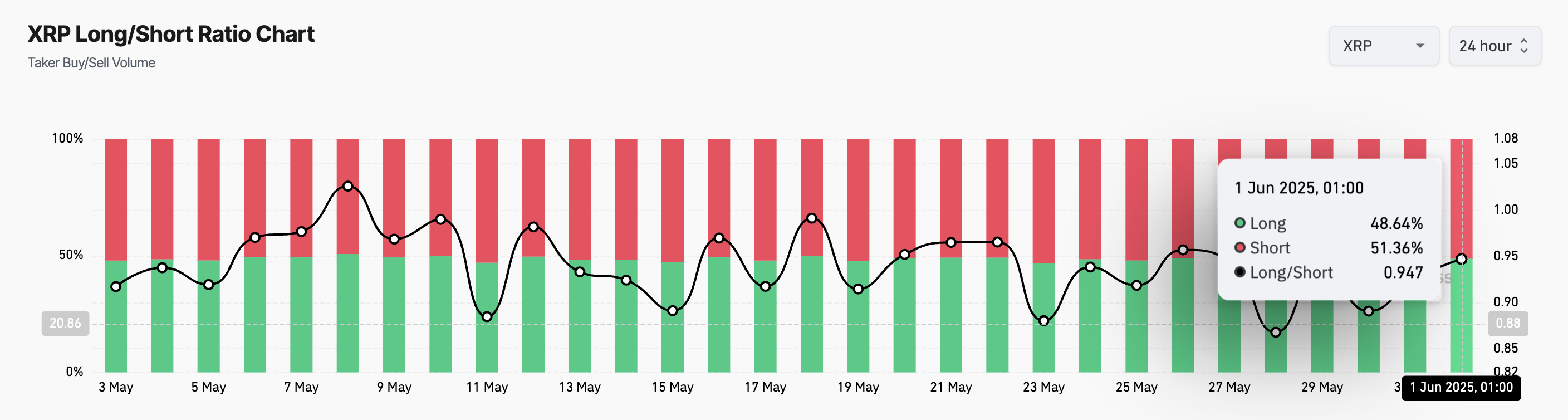

This is reflected by the token’s long/short ratio, which currently stands at 0.94.

For context, this metric has remained below one since May 8, highlighting that traders have been positioning for a downside move for nearly a month.

XRP Long/Short Ratio. Source:

Coinglass

XRP Long/Short Ratio. Source:

Coinglass

The extended demand for short positions suggests that XRP’s price dip is not just a reaction to short-term volatility. It also shows a broader bearish tilt increasingly driven by expectations of lower prices.

Will XRP Hold the $2 Support?

At press time, XRP trades at $2.13. If bearish pressure gains momentum, the token risks slipping below the psychological $2 mark. A breach of this key support line could deepen the ongoing correction and cause XRP to trade below $1.99.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, a resurgence in new demand for the altcoin could invalidate this bearish outlook. If buying surges, the XRP token could witness a bullish correction and climb to $2.29.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.