Bitcoin Whale Activity Signals Warnings for the Market | Weekly Whale Watch

Bitcoin whales are driving nearly half of exchange inflows, triggering market caution as historical patterns hint at a potential price correction.

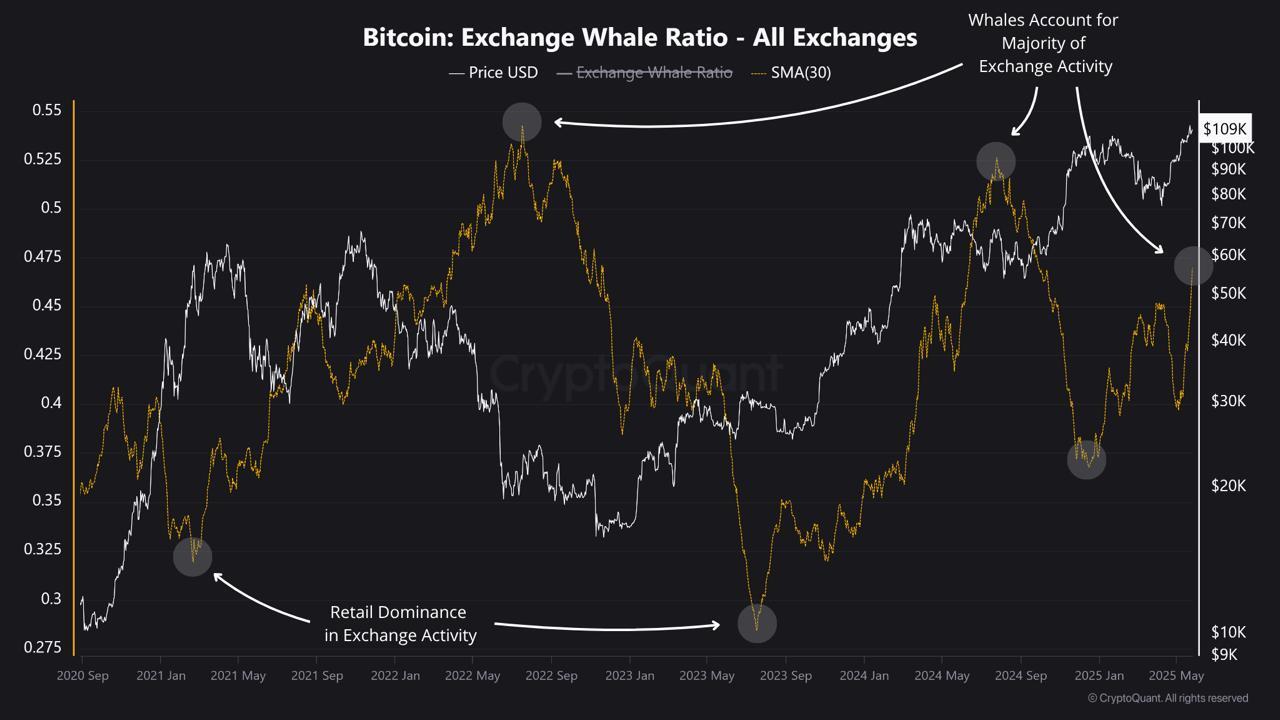

Bitcoin whales are regaining dominance over exchange activity. The Exchange Whale Ratio’s 30-day moving average has surged to 0.47—its highest level in seven months—indicating that nearly half of all BTC inflows to exchanges are now coming from the largest transactions.

Historically, such spikes in whale activity have preceded major market tops, as large holders tend to move funds in preparation to sell. With retail participation fading and whale influence rising, the market may shift into a distribution phase, raising the risk of a short-term correction.

Is a Deeper Bitcoin Crash Coming?

Bitcoin recently surpassed $111,000, making new all-time highs. Yet, profit-taking from whales and another potential macroeconomic downturn has caused BTC to drop over 6%, and it is currently trading at $104,000.

Data from CryptoQuant shows a sharp rise in the Exchange Whale Ratio, suggesting caution.

Historically, when this ratio exceeds 0.5—indicating that whales account for the majority of exchange inflows—price tops often follow.

The Exchange Whale Ratio measures how much of all Bitcoin flowing onto exchanges comes from the ten largest transactions. A 30-day moving average at 0.47 means nearly half of every BTC deposit is a “whale” transaction.

This pattern played out during previous market cycles, such as mid-2022 and late 2024, when elevated whale activity coincided with significant corrections.

The implication is that large holders tend to move funds to exchanges in anticipation of selling, often at or near local peaks.

Bitcoin: Exchange Whale Ratio. Source:

CryptoQuant.

Bitcoin: Exchange Whale Ratio. Source:

CryptoQuant.

In contrast, periods when the whale ratio dips below 0.35 have often marked phases of accumulation or early bull market momentum, dominated by retail participants.

One clear example is mid-2023, when the ratio hit a low point and Bitcoin began to climb steadily afterward.

“There is a growing dominance of large holders in recent exchange activity. This sharp increase mirrors the surge seen in the Exchange Whale Ratio during Bitcoin’s price rally in late 2023 and early 2024,” CryptoQuant analyst JA Maartunn told BeInCrypto.

The current spike in the 30-day moving average of the ratio further reinforces the notion that whales are once again becoming more active in exchange activity.

If history repeats, significant whale selling could trigger a pullback or increased volatility.

While Bitcoin price remains strong for now, this shift in behavioral dynamics suggests the market may be transitioning from accumulation to distribution, increasing the probability of a near-term top or correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Face a Rollercoaster: What Happened in the Past 24 Hours?

In Brief Bitcoin price dropped by 2.4%, influencing overall crypto market sentiment. The top 10 cryptocurrencies saw a general decline over the past 24 hours. Market seeks stability amid cautious investor behavior and potential short-term volatility.