-

Recent trends indicate that Bitcoin’s 365-day moving average crossover is historically linked to significant price rallies, underscoring a potential bullish sentiment among investors.

-

As trading platforms experience notable withdrawals, this reflects an increasing adoption of Bitcoin and a sustained demand from enthusiasts and long-term holders.

-

According to crypto analyst Axel Adler, the uptick in miner sales to exchanges might be a signal for looking closely at the long-term MVRV ratio.

As Bitcoin sets new all-time highs, miner activity increases, indicating a robust market; analysts warn of trends to watch in the MVRV metrics.

Bitcoin’s Market Dynamics: Analyzing the MVRV Crossover

Examining the MVRV ratio and its crossover with the 365-day moving average, it has often served as a touchstone for predicting significant price movements. Historical data suggests that once the crossover occurs, swift rallies typically follow, hinting at a potential bullish market scenario. However, caution is warranted as the ongoing multi-year MVRV downtrend indicates a complicated market landscape. Investors should monitor these indicators closely to understand market sentiment.

Understanding Miners’ Influence on Bitcoin’s Supply

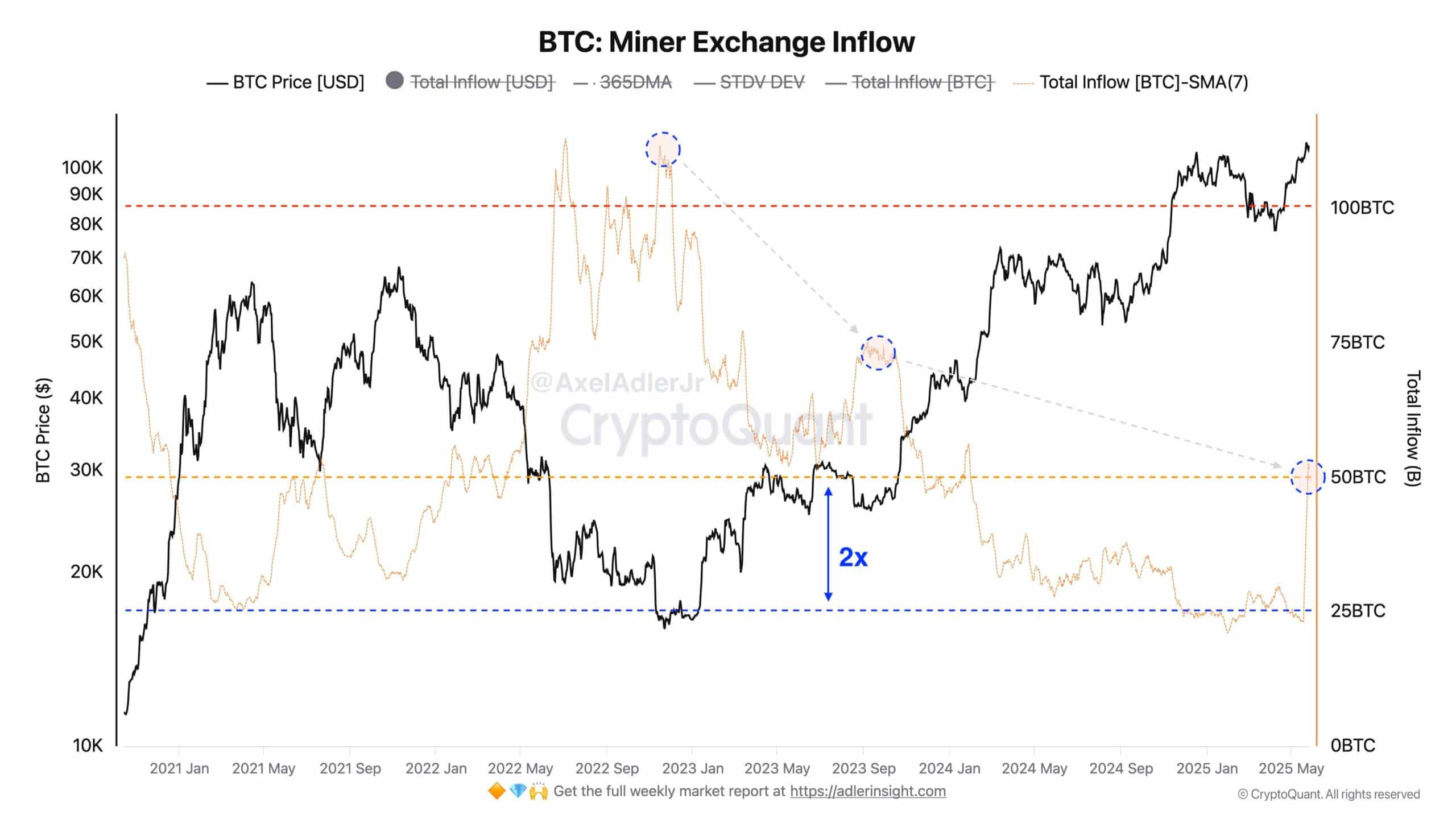

Recent updates show that Bitcoin miners have ramped up their sales significantly. Data reveals that the miner exchange flow recently doubled, peaking at about 50 BTC per day. This trend raises questions regarding the overall market demand and supply balance. While miners are selling more, the exchange reserves have continued a downward trajectory, suggesting that the market is effectively absorbing this additional supply, reflecting a robust demand for Bitcoin.

As pointed out by analyst Axel Adler, a considerable decline in Bitcoin held by over-the-counter (OTC) trading platforms has also been observed. The current holdings have been reduced to just a quarter of what they were in September 2021, indicating a shift in market liquidity and trading strategies.

Future Projections for Bitcoin: The Bullish Sentiment

Burak Kesmeci from CryptoQuant highlighted that the recent crossover of the MVRV ratio above its 365-day moving average is significant. Should this trend hold in the coming weeks, Bitcoin may experience substantial price advancements. However, a note of caution is warranted as the MVRV has shown volatility in historical contexts. Current levels indicate that investors should be vigilant as the MVRV nears levels of 2.7-3, which many consider a critical exit point.

Conclusion

In conclusion, Bitcoin’s current market dynamics, characterized by miner activity and the MVRV crossover, present a complex yet intriguing landscape for investors. While recent trends suggest a possible bullish shift, historical metrics highlight the need for prudent investment strategies. As the market continues to evolve, staying informed about these indicators will be key in navigating Bitcoin’s future.