Berachain liquid staking protocol Infrared releases points program ahead of token launch in Q3

Quick Take Infrared has launched a points program to reward user participation. The points will convert into the Infrared token expected to launch in Q3, co-founder Raito Bear told The Block.

Infrared Finance, a liquid staking protocol built on Berachain, has launched a points program to incentivize user participation ahead of its token launch later this year.

The program includes retroactive rewards for early users, Infrared said Wednesday. There is no fixed supply of points, and they will be dynamically allocated based on eligible activities, Infrared's pseudonymous co-founder and CEO Raito Bear told The Block.

Eligible activities include contributing to Infrared's proof-of-liquidity vaults, providing liquidity for key trading pairs on decentralized exchanges like Kodiak and BEX, and staking iBGT and iBERA — Infrared's liquid staking tokens for Berachain's BGT and BERA tokens. Users earn more points the longer they stake or provide liquidity on the protocol, Infrared said.

The points program goes live today and is backdated to include activity since Infrared's launch in February. The program is expected to run for around three months, Raito said.

"Users can track their points in real-time via our dashboard, and we're also collaborating with partners like Pendle to support additional points-based integrations and rewards," Raito added.

Infrared points will be converted into tokens

The points will eventually be convertible into Infrared's upcoming native token, Raito said, adding that the exact conversion ratio will be announced closer to the token generation event or TGE.

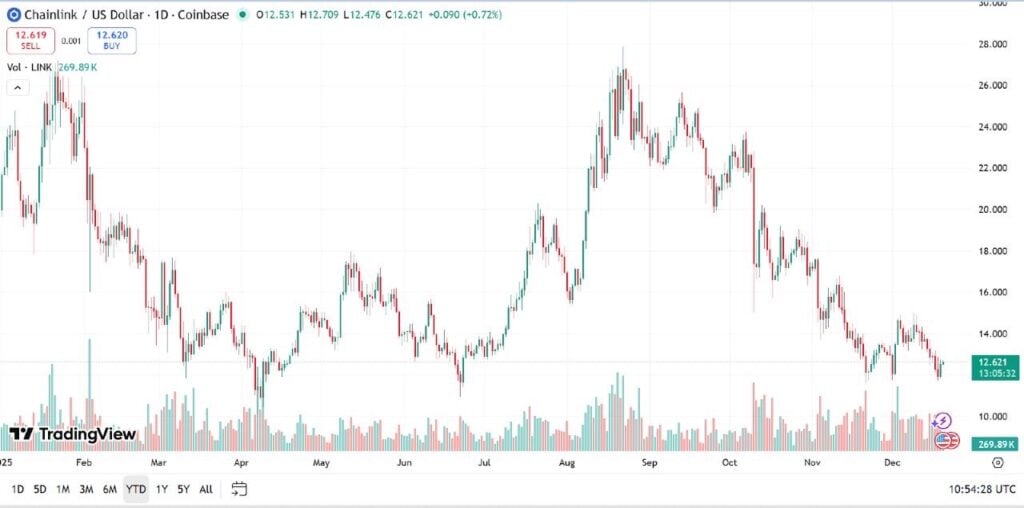

Infrared is targeting to launch its token in the third quarter of this year, subject to market conditions and other relevant factors, according to Raito. Details around the token's ticker and total supply are still being finalized and will be shared closer to the TGE, Raito added.

Infrared said it is the first project within the Berachain ecosystem to launch a points program. Infrared enables liquid staking and rewards for Berachain's BGT and BERA tokens through iBGT and iBERA.

The protocol was incubated by the Berachain Foundation's Build-a-Bera program and currently leads the Berachain ecosystem in total value locked (TVL), with over $1.5 billion in assets, according to DeFiLlama .

Infrared has raised $18.75 million in total funding to date through simple agreements for future tokens (SAFTs), with backing from notable investors, including YZi Labs (formerly Binance Labs) , Framework Ventures and NGC Ventures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Cryptos to Invest In for 2026 – Top 7 List

200 Million XRP Shocks the XRP Army

A crypto trader loses $50 million USDT to address poisoning scam

Arthur Hayes Claims to Those Waiting for the Altcoin Season: “The Altcoin Season Never Ended Anyway”