Strategy (MSTR) entered the top 5 of the most active stocks on the US market. After the recent Bitcoin (BTC) rally above $90,000, Strategy drew more attention as a proxy for exposure to the leading coin.

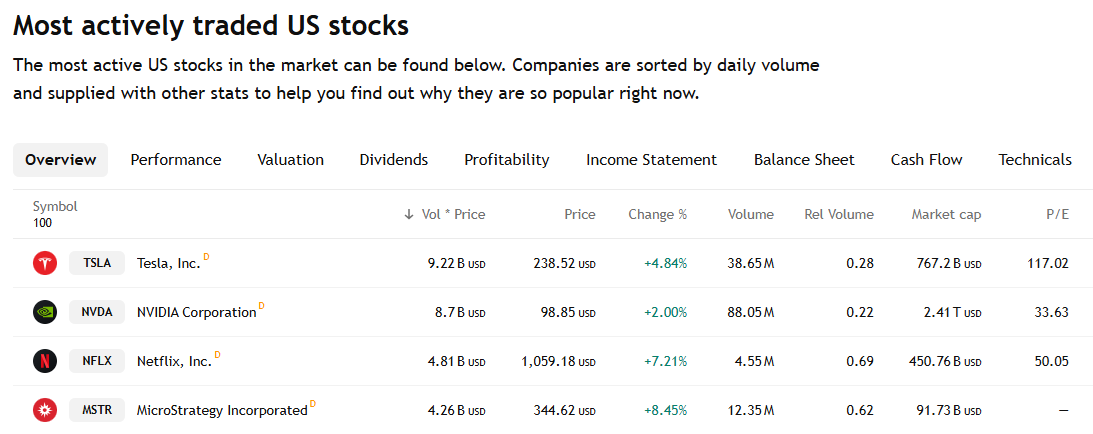

Strategy (MSTR) was one of the biggest gainers, trailing the Bitcoin (BTC) rally above $90,000. MSTR shares traded with $4.26B volume, becoming the fourth most active stock after Netflix (NFLX).

The MSTR activity followed the BTC rally, achieving $4B in volumes within just two hours. MSTR is becoming the de facto tool for mass BTC adoption, as it is bought for exposure. The recent recovery is also the first higher high for MSTR in the past six months. The stock has been depressed after BTC slipped from its peak above $109K, mostly due to skepticism about solvency and the effect of a more serious BTC drawdown.

MSTR was among the most actively trading stocks, as the market attempted a recovery through the tech sector. | Source: Tradingview

MSTR was among the most actively trading stocks, as the market attempted a recovery through the tech sector. | Source: Tradingview

During the MSTR rally, BTC gained to $90,773.25, the highest level since the beginning of March. The BTC and MSTR recoveries arrive after several weeks of markets in the red, pressured by the uncertainty of US tariffs. The recent recovery signals the markets are still ready to reflect hype and exuberance.

Strategy also continues to place new MSTR emissions, which go toward acquiring more BTC . The MSTR stock also responded with the strongest rally among the top 5 tech stocks, gaining 8.45% in the past day. The rally followed the most recent BTC acquisition from April 21. MSTR achieved its main goal of supporting BTC with purchases while benefiting from the BTC rally.

Strategy (MSTR) rally coincides with other crypto stock gains

MSTR extended its rally from the April 8 lows of $237.95, rallying to $347.04. MSTR is still far from its peak of $473 from the end of 2024. MSTR tracks the performance of BTC closely, as the company’s entire plan is to depend on a bullish trend for crypto.

The MSTR breakout is stronger compared to Coinbase Global (COIN), which is still trading near its yearly lows. COIN traded around $192.34, up from recent lows of $151.48, coinciding with the April 8 market correction.

The recent crypto market recovery was also reflected in crypto-related stocks. Most of those crypto-related or adjacent stocks are also showing buy signals, with the top stocks posting ‘Strong Buy’.

MSTR is held in multiple high-grade funds, with the latest acquisitions from March 2025. American Funds Growth Fund recently announced it allocated another $1.03B to MSTR stock, acquired at an average price of $307 per share. Most funds have allocated less than 1% of their portfolio to MSTR, with the exception of T-REX 2X Long MSTR Daily Target ETF, with more than 78% MSTR allocation.

Attention on Strategy (MSTR) may continue in the coming weeks, in anticipation of the May 1 earnings report. The results for the turbulent Q1 will be announced in a live video at 5:00 PM Eastern Time. Strategy has announced it achieved a yield of up to 12.1% during Q1, with an overall favorable average price for holding BTC.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now