Bitcoin Dominance Returns to 48-Month High, Will Price Catch Up?

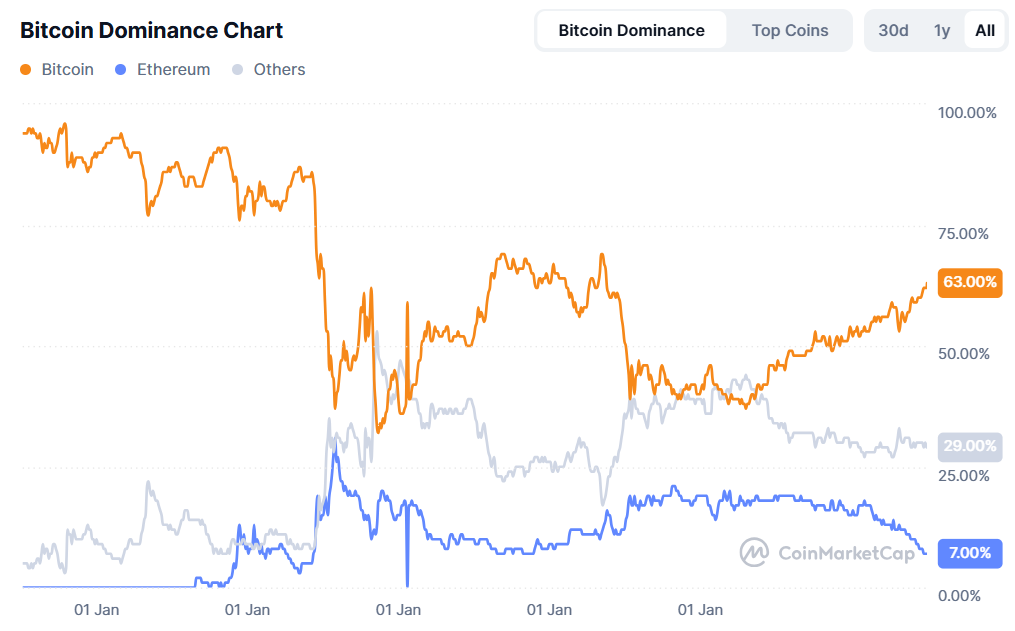

Bitcoin (BTC), the world’s leading digital currency, is showing promise as it has regained dominance in the cryptocurrency space. According to CoinMarketCap data, Bitcoin Dominance (BTC.D) has hit 63.5% after its price skyrocketed by 3%.

Bitcoin reclaims market share as altcoins retreat

For clarity, BTC.D refers to the percentage of the total crypto market capitalization that comprises Bitcoin. This recent rise signals that Bitcoin has rebounded and is dominating the crypto market's list of assets.

Notably, despite being a leading asset, Bitcoin has not reached the 60+% level since March 3, 2021, when it reached 60.3%. Interestingly, BTC.D is ascending and could climb to between 66% and 70% before the end of the next quarter.

This resurgence after a long 48-month period suggests that Bitcoin’s price might record a significant uptick in the coming days, despite reservations about the current bull rally.

As of press time, Bitcoin is changing hands at $90,250, following a 3.26% increase in its price. Investors have also shown significant interest, as trading volume jumped by 35.68% to $36.87 billion.

Bitcoin is currently 18.58% away from its previous all-time high (ATH) of $109,114.88, which it achieved in January 2025.

The current development is likely to support BTC's breach of the psychological $100,000 level. If momentum is sustained, the asset could push toward a new ATH, as some projects predict BTC will reach $150,000 before the end of 2025.

Meanwhile, Ethereum’s dominance has dropped by 1.63% to 7.1%. The remaining altcoins stand at 29.4%.

Bitcoin builds momentum amid investor confidence

The resurgence in Bitcoin Dominance might have triggered investors to pivot to digital assets after U.S. tariff concerns. Despite the 90-day pause, the global market still remains on the edge.

This dilemma might see investors shifting from traditional assets like bonds to crypto, with Bitcoin a clear favorite.

In the last 24 hours, Bitcoin’s open interest has registered a 7.09% uptick as investors commit to the asset’s future. A total of 710,620 BTC, valued at $63.73 billion, have been committed to Bitcoin’s future price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.