A monthly market review by publicly traded US-based crypto exchange Coinbase shows that while the crypto market has contracted, it appears to be gearing up for a better quarter.

According to Coinbase’s April 15 monthly outlook for institutional investors, the altcoin market cap shrank by 41% from its December 2024 highs of $1.6 trillion to $950 billion by mid-April. BTC Tools data shows that this metric touched a low of $906.9 billion on April 9 and stood at $976.9 billion at the time of writing.

Venture capital funding to crypto projects has reportedly decreased by 50%–60% from 2021–22. In the report, Coinbase’s global head of research, David Duong, highlighted that a new crypto winter may be upon us.

“Several converging signals may be pointing to the start of a new ‘crypto winter’ as some extreme negative sentiment has set in due to the onset of global tariffs and the potential for further escalations,” he said.

Macroeconomic woes cause crypto turmoil

The report notes that lower venture capitalist interest “significantly limits the onboarding of new capital into the ecosystem,” which is felt primarily in the altcoin sector. The cause of that, according to Duong, is the current macroeconomic environment:

“All of these structural pressures stem from the uncertainty of the broader macro environment, where traditional risk assets have faced sustained headwinds from fiscal tightening and tariff policies, contributing to the paralysis in investment decision making.“

According to Coinbase researchers, those facts have resulted in “a difficult cyclical outlook for the digital asset space,” and warrant continued caution in the next four to six weeks. Still, the report’s author said that the market is likely to change directions explosively:

“When the sentiment finally resets, it’s likely to happen rather quickly and we remain constructive for the second half of 2025.“

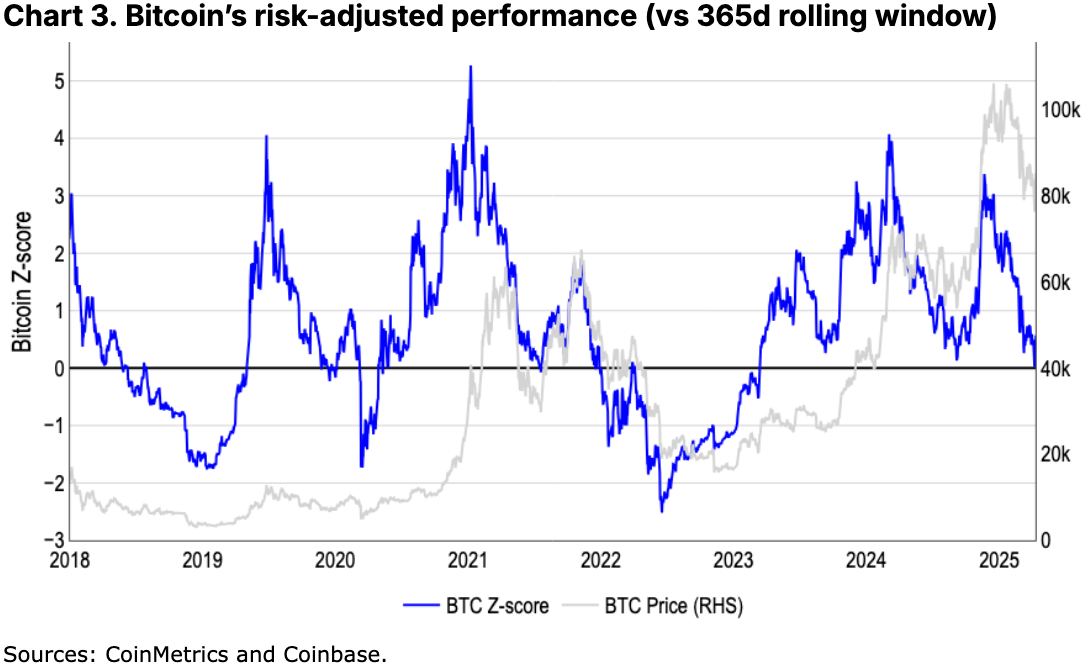

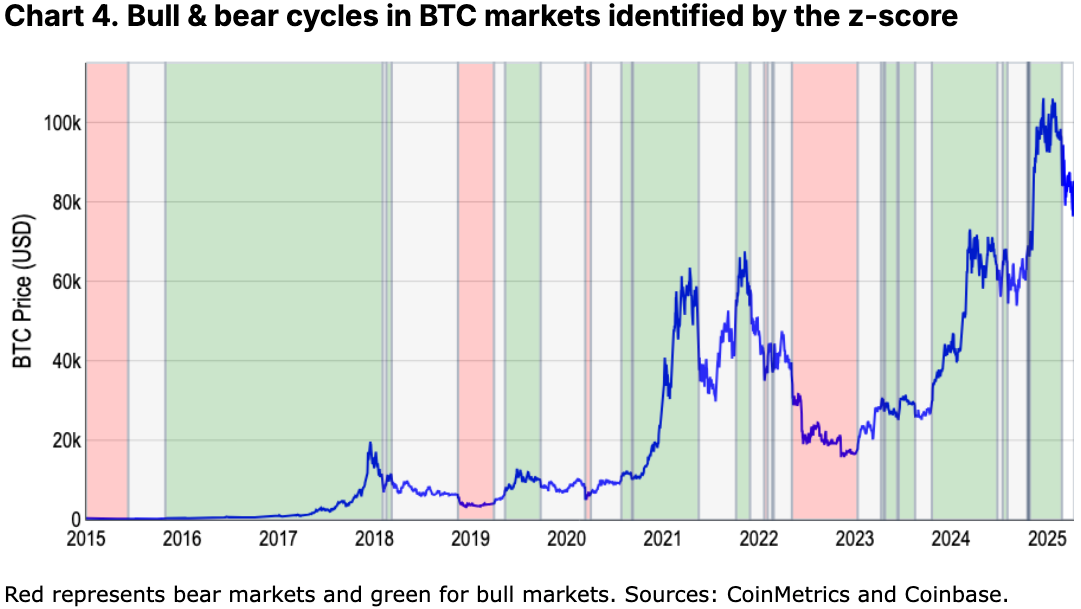

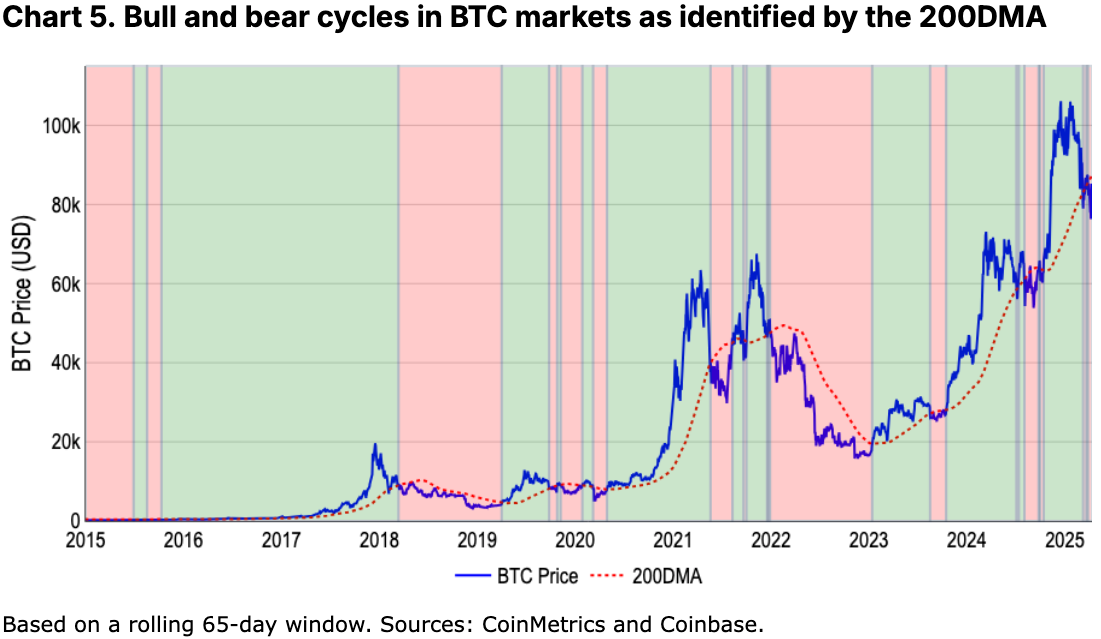

Duong cited some metrics to indicate when the crypto market is moving between bull and bear market phases , including risk-adjusted performance and the 200-day moving average .

Another metric was the Bitcoin ( BTC ) Z-score, which compares market value and realized value to identify overbought and oversold conditions. A Z-score shows how unusual current price performance is when compared to historic data.