Date: Sat, March 29, 2025 | 10:40 AM GMT

The cryptocurrency market is witnessing downside pressure, wiping out the recovery gains from earlier this week. Ethereum (ETH) has declined by over 6% in the last 48 hours, dipping below the $1,875 mark, which has added selling pressure across memecoins too.

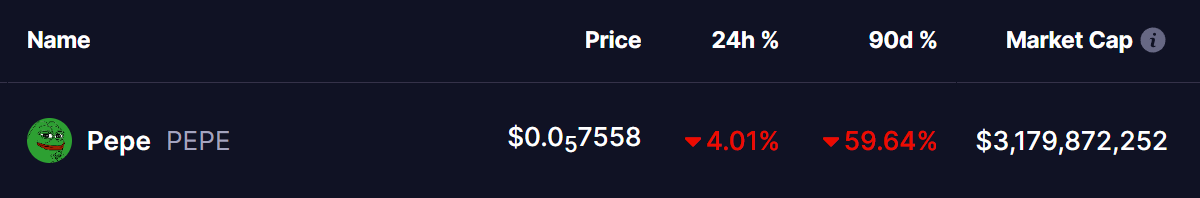

Amid this downturn, Pepe (PEPE) has also faced a decline, dropping over 4% today and extending its 90-day correction cycle to nearly three months of continuous losses. However, despite the recent bearish price action, a strong technical pattern is emerging, hinting at a possible trend reversal in the near future.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Its Falling Wedge Breakout

On the daily chart, PEPE saw an impressive 265% rally in November 2024. However, following that uptrend, the price entered a correction phase, forming a falling wedge pattern, which led to an 80% drop to a low of $0.0000052, where it finally found support.

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

With that bounce, PEPE managed to break out from the wedge’s descending trendline at $0.0000079, as well as reclaiming the 50-day moving average (50 MA), reaching a short-term high of $0.00000918 before pulling back. Now, amid broader market weakness, PEPE is retesting its breakout trendline, currently trading around $0.0000075.

If buyers step in at this level and successfully push the price higher, it could confirm a rebound and propel PEPE toward the next key resistance zone at $0.000010. A successful breach above this level could see the price targeting the 200-day MA and the $0.00001475 price zone, representing a potential 91% rally from current levels.

The MACD indicator is showing signs of a bullish crossover, indicating that selling pressure might be easing. If momentum strengthens, it could confirm a shift towards a recovery phase.

What’s Next for PEPE?

With PEPE currently retesting its breakout trendline, a successful bounce and a move above $0.000010 could confirm a recovery phase and trigger a bullish continuation toward higher price targets. If the broader market stabilizes, PEPE could see renewed buying interest, potentially marking the end of its prolonged downtrend.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.