Bitcoin Correction to $76,000 Likely a Downside Deviation, According to Crypto Analyst – Here’s Why

An analyst who accurately called Bitcoin’s correction in early 2024 believes BTC remains in a bull market after bouncing from a 2025 low of $76,000.

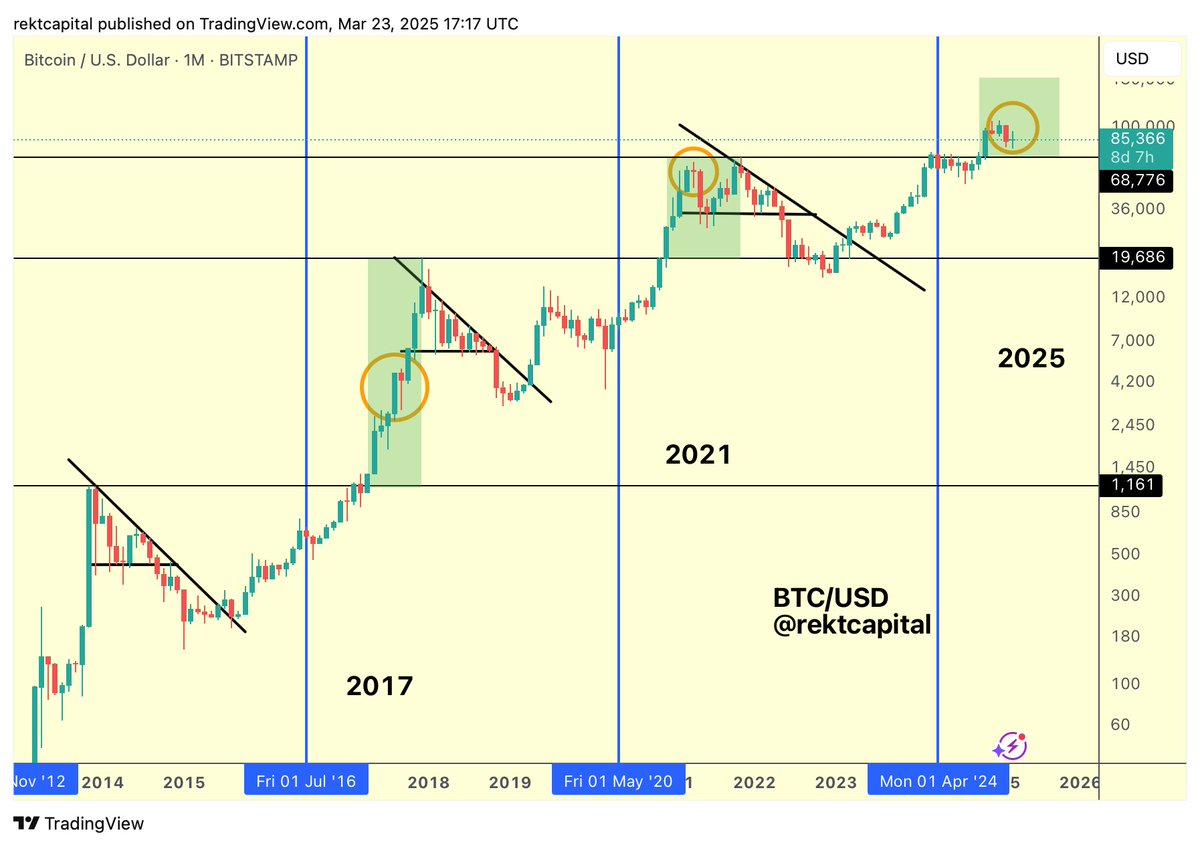

Pseudonymous analyst Rekt Capital tells his 542,00 followers on the social media platform X that Bitcoin’s current bull market cycle has yet to reach a peak.

“BTC bull market progress: 82.5%. (Progress will speed up on parabolic advances and slow down on deeper retraces).”

Source: Rekt Capital/X

Source: Rekt Capital/X

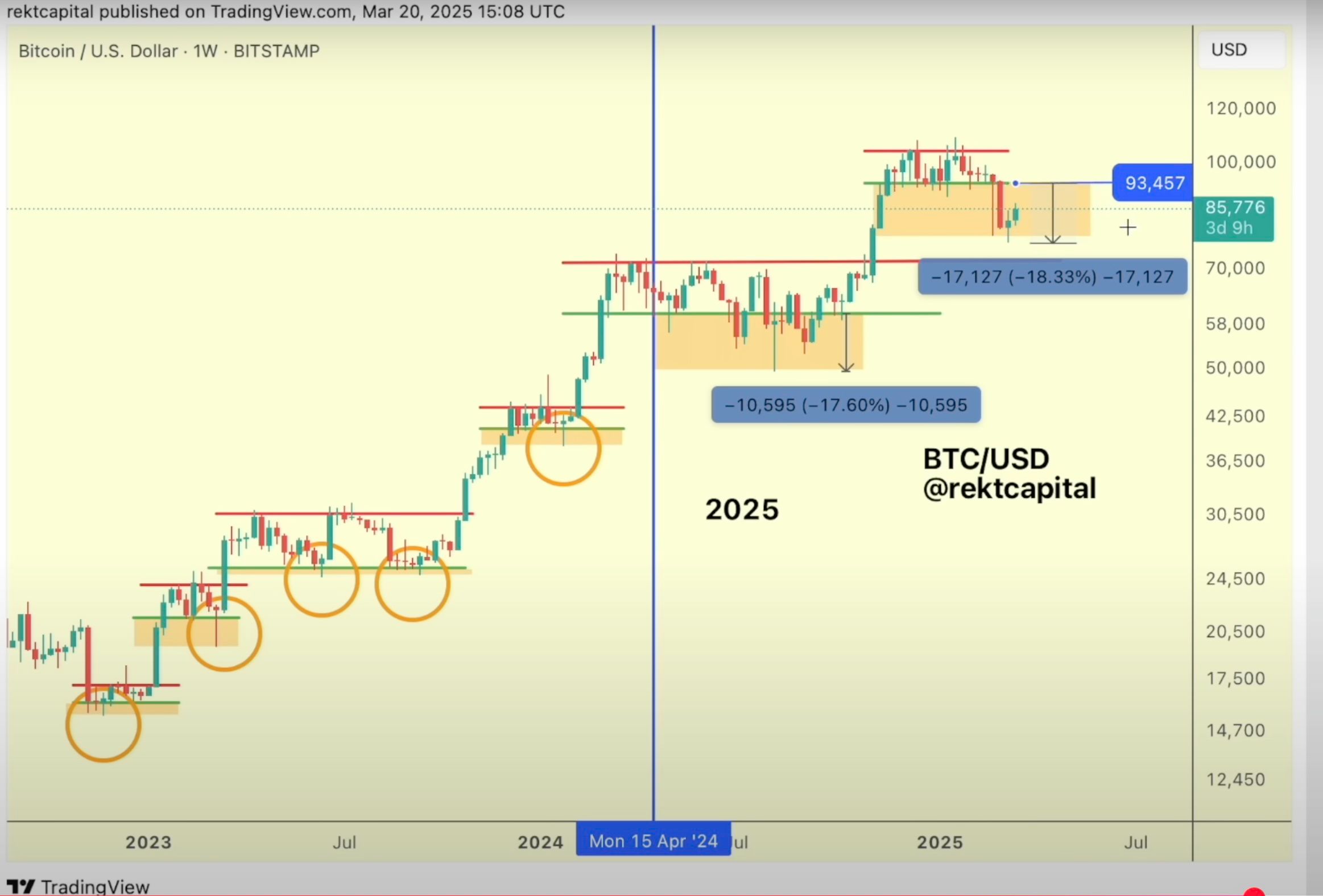

The analyst also tells his 107,000 YouTube subscribers that Bitcoin’s latest correction to $76,000 is not the sign of a beginning bear market based on historical precedence.

“Many people have been talking about this being a bear market, but it does look like it is a downside deviation period very similar to what we’ve seen back in the past. Obviously, these downside deviation periods are changing across time, but it’s really important to look at the charts in a level-headed manner and try and look at it in an unbiased way and not scream bear market whenever we see a pullback that is actually very similar to the one we saw here [in 2024].

This was a 32% pullback [in 2024]. This is a 30% pullback [when Bitcoin corrected to the $76,000 range this month], so very similar downside deviation in that regard, but really important to keep level-headed and look at the data, look at the chart, and zoom out when in doubt.”

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

In technical analysis, a downside deviation is a setup where an asset breaks its immediate support to print a false breakdown before igniting a recovery and rallying to new highs.

Bitcoin is trading for $88,028 at time of writing, up 3.4% in the last 24 hours.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on Bitget listing CSCOUSDT, PEPUSDT, ACNUSDT STOCK Index perpetual futures

Stock Futures Rush: Trade popular stock futures and share $250,000 in equivalent TSLA tokenized shares. Each user can get up to $8,000 TSLA.

Bitget margin trading to support BGB cross margin trading and loans

Bitget margin trading to support BGB cross margin trading and loans