This is the calm before the storm? Ethereum’s supply on exchanges has hit a near-decade low, and some analysts are whispering about a potential price explosion.

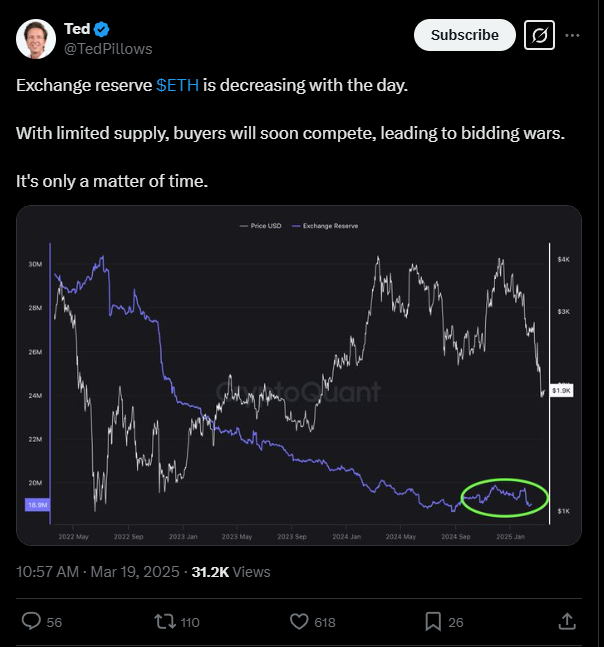

The numbers are stark, only 8.97 million Ether are left on exchanges, down 16.4% since January.

It’s like the whole crypto market is holding its breath, waiting for the other shoe to drop.

Ether is for long term holding?

But here’s the thing, this isn’t just about numbers, it’s about sentiment. Investors are moving their Ether into cold storage, which means they’re betting big on a future price growth.

It’s a classic supply shock scenario, because less Ether available on exchanges could lead to a bidding war if demand stays strong.

Of course, this is a pretty big if. And if history repeats itself, like it did with Bitcoin, we might be in for a nice rally. Second if. Thing are quite uncertain, huh.

The downtrend is over? Up only?

Now, I know what you’re thinking, isn’t Ether in a slump? Yeah, it’s down 26% over the past month, and those spot ETFs have seen some serious outflows.

But sometimes, the darkest hour is just before the dawn.

Crypto traders like Crypto General and Ted are calling it, a big supply shock is likely coming, and it’s just a matter of time before Ether starts to skyrocket.

Ether to $10k?

Some are even talking about prices reaching $8,000 to $10,000. That’s a long shot, but hey, stranger things have happened in crypto.

But let’s not forget, Ether’s performance against Bitcoin has been lackluster lately, and this is a really polite way to saying it’s slowly bleeding out against BTC for years.

But as Scott Melker, aka The Wolf of All Streets, said, either Ethereum bounces here and this is a generational bottom, or it’s over. So, have fun?

Have you read it yet? The battle for crypto supremacy: Can XRP dethrone Ethereum?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.