Solana Needs a 40% Rally to Overcome Critical Barrier; Key Holders Support

Solana long-term holders are backing the price with $128 million in accumulation, but SOL still needs a 43% surge to break past $180. Will momentum shift?

Solana (SOL) has faced a recent decline, struggling to regain momentum despite multiple attempts at recovery. The altcoin is currently aiming to breach the $180 resistance level, which has remained a key hurdle.

While long-term holders (LTHs) are supporting the price, SOL still needs stronger momentum to break past this critical level.

Solana Investors Are Hopeful

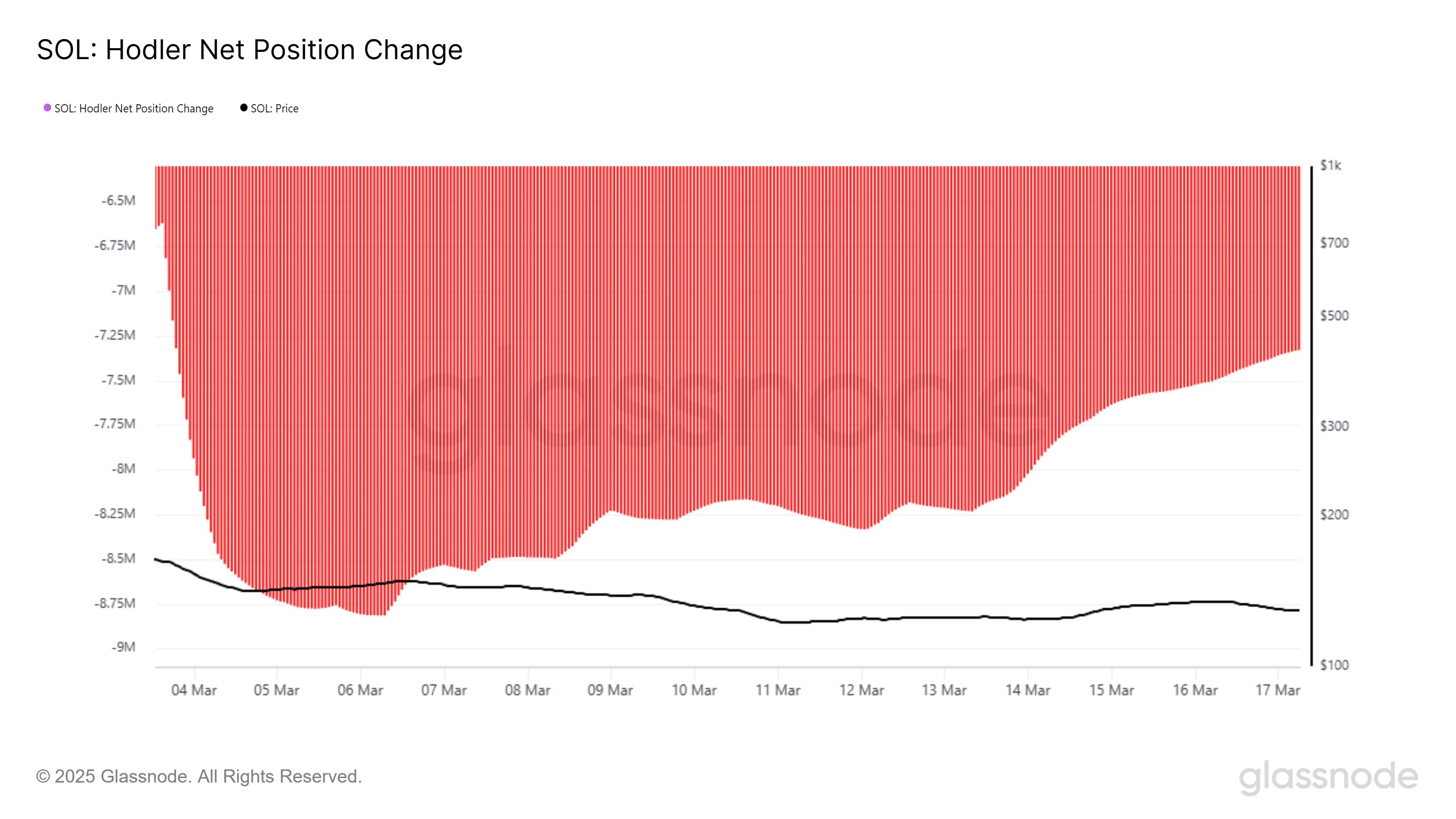

The HODLer Net Position Change metric indicates that Solana holders are rebuying the SOL they previously sold. Over the past week alone, long-term holders have accumulated more than 1 million SOL, worth approximately $128 million. This buying activity signals confidence among investors who anticipate a recovery in Solana’s price.

Historically, increased accumulation by long-term holders has been a bullish sign. As these investors continue buying at lower price levels, it reinforces support and reduces the chances of sharp declines. If this trend continues, it could create the necessary foundation for Solana to attempt another breakout.

Solana HODLer Net Position Change. Source:

Glassnode

Solana HODLer Net Position Change. Source:

Glassnode

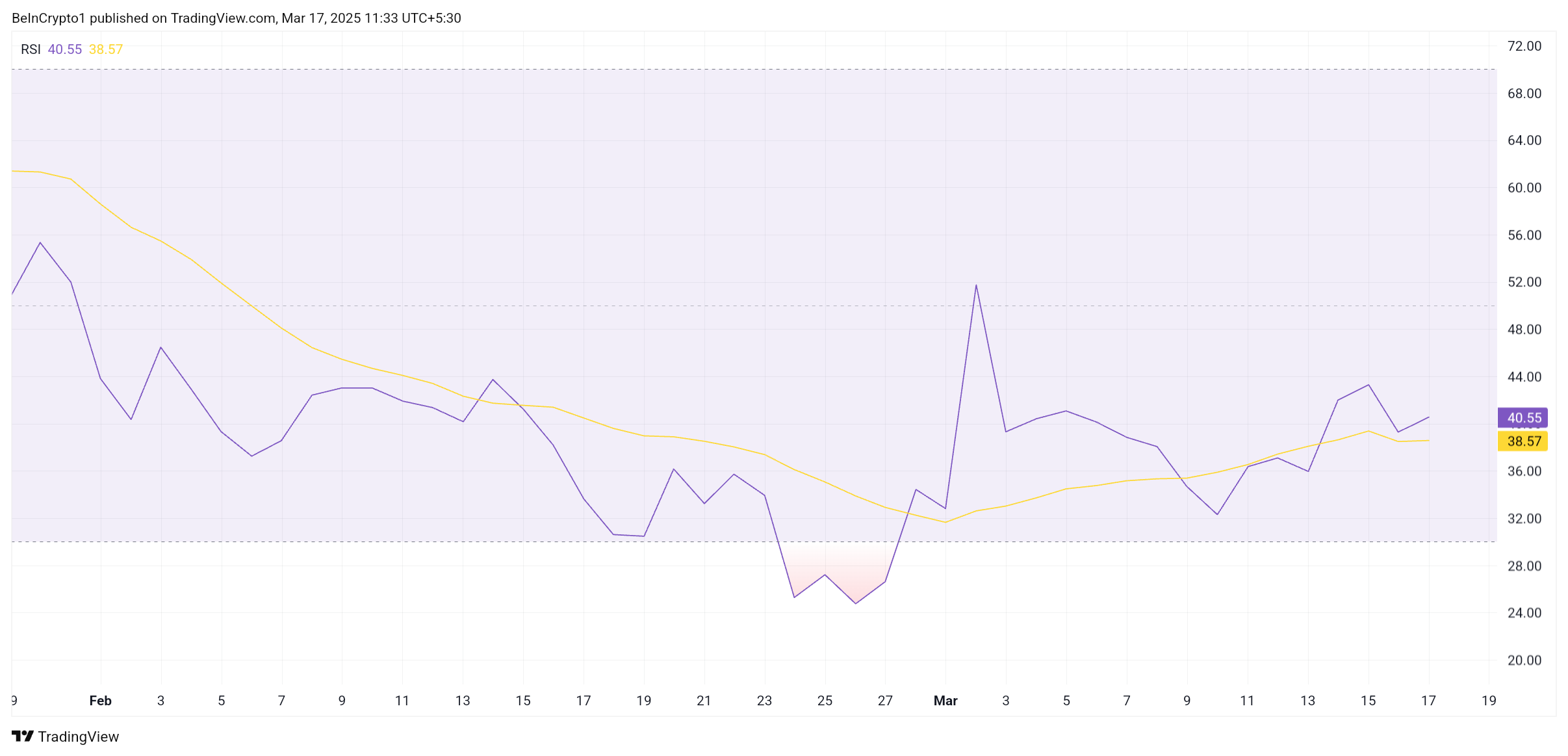

From a technical perspective, Solana is showing signs of improving momentum. The Relative Strength Index (RSI) has been trending upward, indicating a potential shift toward bullish sentiment. However, for confirmation, the RSI needs to breach the neutral 50.0 level and turn it into support.

A rising RSI suggests growing buying pressure, which could help SOL regain lost ground. This would increase the likelihood of Solana making another attempt at breaking its key resistance levels.

Solana RSI. Source:

TradingView.

Solana RSI. Source:

TradingView.

SOL Price Recovery Remains Uncertain

Solana is currently trading at $128, and the crypto token’s price is down by 5.5% in the last 24 hours. Despite the decline, SOL is holding above the $126 support level while attempting to breach the $135 resistance. The long-term target remains at $180, a crucial milestone for bullish confirmation.

Breaking past $180 has been a challenge, with Solana failing to attempt it in recent weeks. To reach this level, SOL would need to rally 40%, which becomes more achievable if it first breaches $161. Sustained buying pressure and improving market sentiment could help facilitate this move.

SOL Price Analysis. Source:

TradingView.

SOL Price Analysis. Source:

TradingView.

On the downside, if Solana fails to breach $148 or struggles to move past $135, it could lose its current support levels. A drop below $126 and $118 would expose SOL to further declines, potentially testing $109. This scenario would invalidate the bullish outlook and shift momentum back to the bears.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?