LIBRA Creator Hayden Davis Tied to Wolf of Wall Street WOLF Token

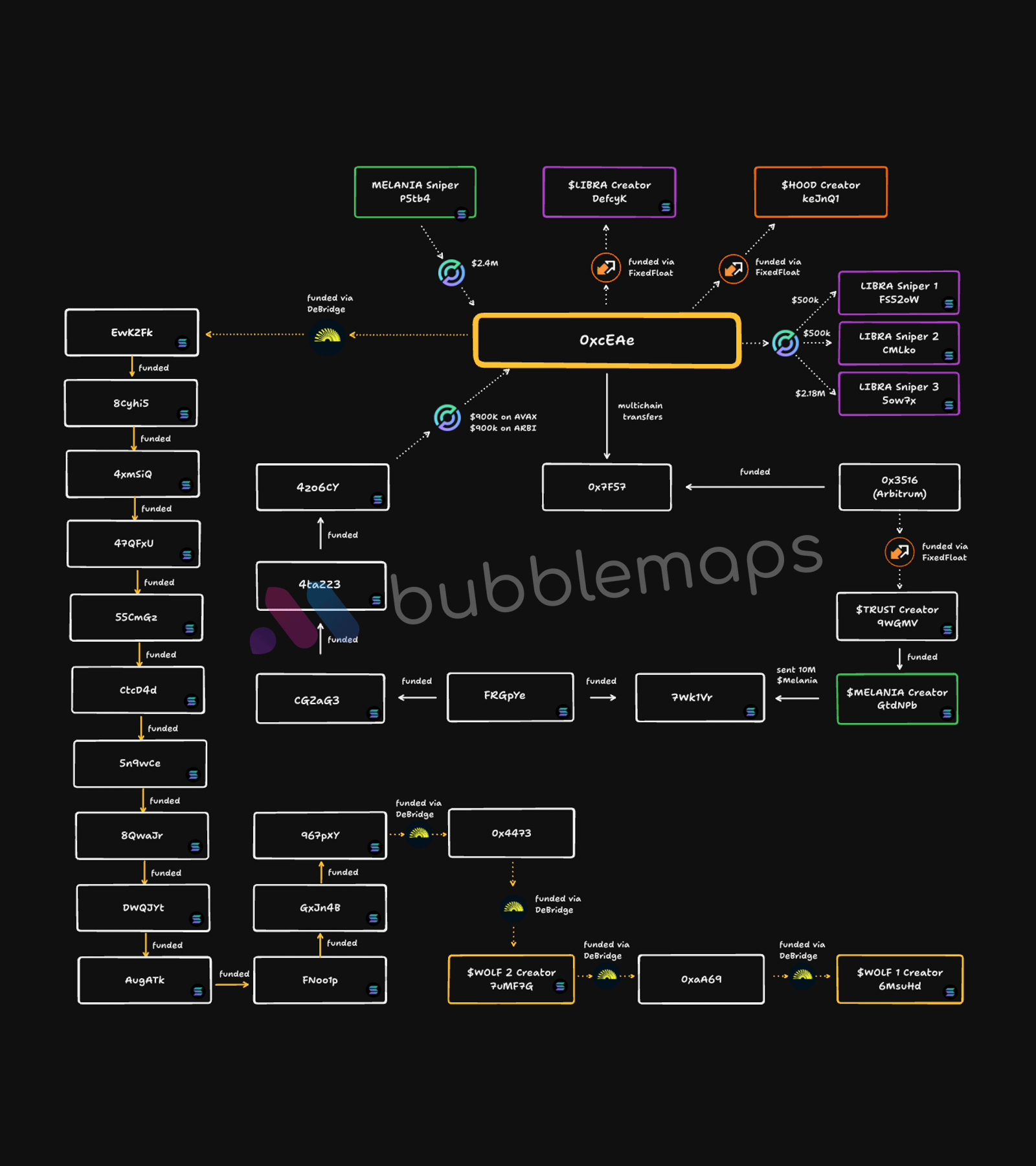

Blockchain analysis by Bubblemaps linked WOLF to Hayden Davis, revealing concentrated insider holdings and raising concerns about a potential rug pull.

Hayden Davis, the creator behind the controversial LIBRA meme coin, has reportedly launched a new token called WOLF. The token is themed after popular figure Jordan Belfort, AKA ‘Wolf of Wall Street’, who was rumored to be launching his own meme coin.

Davis’ latest venture emerges amid ongoing scrutiny over his role in the LIBRA scandal.

On-Chain Data Connects WOLF to MELANIA and LIBRA Meme Coin

On March 15, blockchain analytics firm Bubblemaps reported that Davis launched WOLF. The firm revealed that he used the same funding sources as his previous tokens, including MELANIA and LIBRA.

WOLF’s debut coincided with rumors that Jordan Belfort, known as the “Wolf of Wall Street,” was planning to introduce a token under the same name. The announcement triggered a flood of WOLF-branded tokens in the market, including Davis’ version.

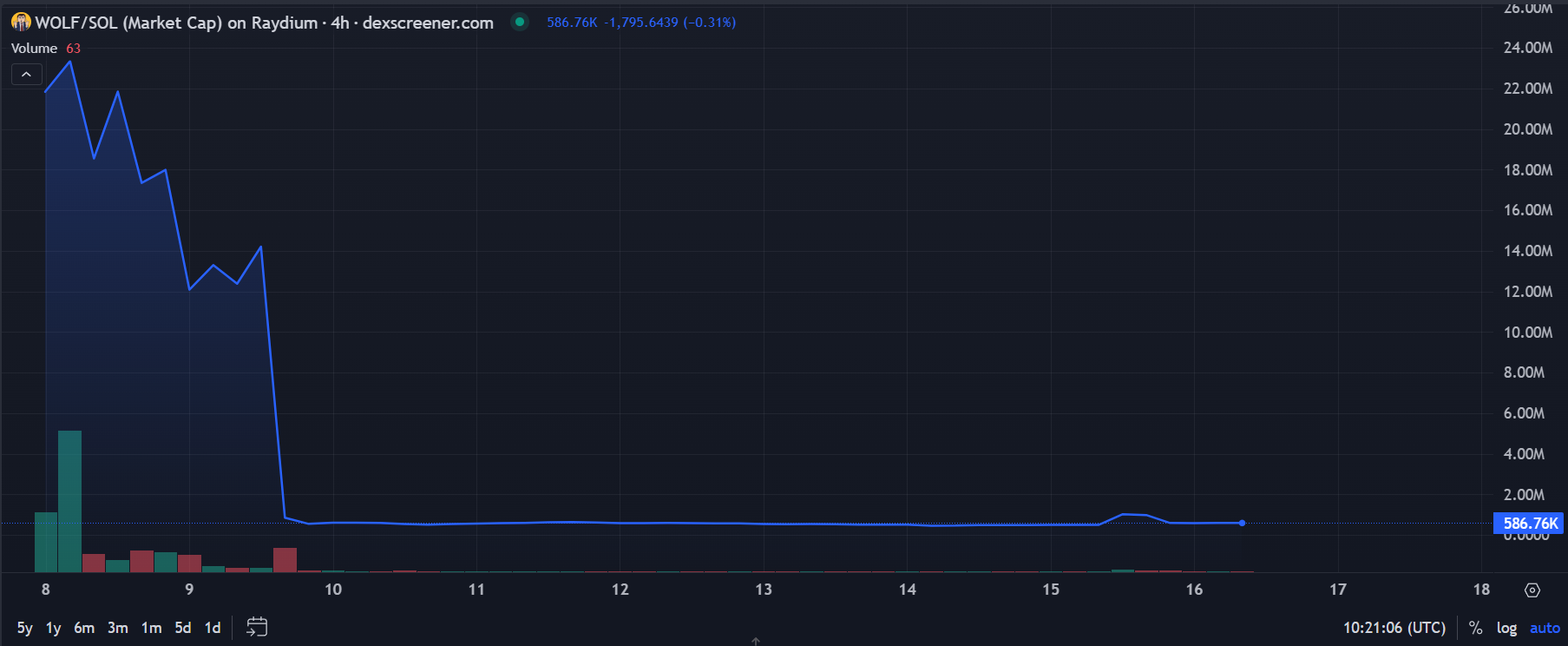

The new token gained traction after the WallStreetBets (WSB) community amplified its visibility, pushing its market cap to $40 million.

However, like other Davis-related coins, the surge was short-lived, as WOLF’s value collapsed in what analysts suspect was a rug pull. Blockchain data showed that a small group of wallets held 82% of the token’s supply, indicating insider control.

Hayden Davis Connection to WOLF Meme Coin. Source:

Bubblemaps

Hayden Davis Connection to WOLF Meme Coin. Source:

Bubblemaps

Further analysis by Bubblemaps traced the token’s origin through multiple wallet transfers. It was eventually linked to an address connected to Davis, reinforcing suspicions of his involvement.

“Starting with the WOLF creator 6MsuHd, we followed funding transfers back across 17 addresses and 5 cross-chain transfers. All led to a single address: OxcEAe. The same one owned by Hayden Davis,” Bubblemaps stated.

WOLF Token Pump-and-Dump. Source:

DEX Screener

WOLF Token Pump-and-Dump. Source:

DEX Screener

Davis’ Troubled History in Meme Coins

Davis’ latest project comes amid ongoing scrutiny over his role in the LIBRA meme coin scandal. His troubles began when LIBRA, a token he helped create, became the center of a political firestorm involving Argentine President Javier Milei.

On February 14, Milei briefly endorsed LIBRA, which sent its market cap soaring past $4 billion. However, the surge was followed by a catastrophic crash, wiping out over 99% of its value.

Blockchain analysts discovered that key insiders—who held large amounts of LIBRA before Milei’s endorsement—cashed out over $100 million shortly after his post.

Davis later confirmed his involvement in the project and also admitted to launching a token linked to US First Lady Melania Trump.

Following these events, authorities in Argentina have launched an investigation into the LIBRA incident. Additionally, Argentine lawyer Gregorio Dalbon has called for an Interpol Red Notice against Davis, a move that could facilitate his arrest and possible extradition.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Bollinger Bands repeat ‘parabolic’ bull signal from late 2023

Bitcoin adds $732B in new capital this cycle as market structure transforms

[English Long Read] Restaking Track Review: Truths, Misconceptions, and the Unfinished Journey