U.S. Spot Bitcoin ETFs Hit $750 Billion in Trading Volume Within One Year

In just one year, U.S. spot Bitcoin exchange-traded funds (ETFs) have crossed a major milestone, exceeding $750 billion in total trading volume since their introduction in January 2024.

After launching to much anticipation, spot Bitcoin ETFs rapidly gained traction, reaching $100 billion in volume by March 2024 and doubling that figure by April, fueled by Bitcoin’s surge to an all-time high close to $74,000.

However, as the overall crypto market slowed down, Bitcoin’s price consolidation between $50,000 and $70,000 for several months resulted in a dip in ETF trading activity.

A major rebound occurred after the U.S. presidential election in November 2024, with Bitcoin’s rally following Donald Trump’s pro-crypto stance, propelling spot Bitcoin ETFs past the $500 billion mark in just one week.

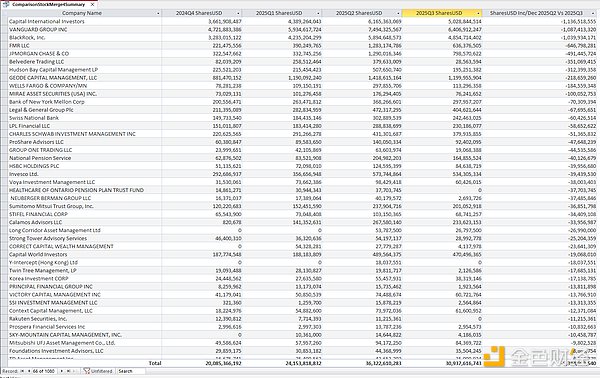

By the end of trading on Thursday, U.S. spot Bitcoin ETFs had reached a cumulative volume of $753.2 billion.

This makes them among the most traded ETFs in the world, rivaling traditional financial products like the Vanguard SP 500 ETF (VOO) and the Invesco QQQ Trust (QQQ) Nasdaq-100 Index.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US CFTC officially approves cryptocurrency spot products, reshaping the regulatory landscape from the "crypto sprint" to 2025

US crypto regulation is gradually becoming clearer.

Controversial Strategy: The Dilemma of BTC Faith Stocks After a Sharp Decline

SOL price capped at $140 as altcoin ETF rivals reshape crypto demand

Will USDT Collapse? A Comprehensive Analysis of Seven Years of FUD, Four Crises, and the Real Systemic Risks of Tether