A prominent whale recently increased its Ethereum position, buying 1,958.27 ETH at an average price of $3,253.

This brings the whale’s 25th swing trade position to 7,292.28 ETH, valued at approximately $23.74 million.

Despite the accumulation, the whale currently holds an unrealized loss of $385,000 due to Ethereum’s recent price decline.

Ethereum Investors Opt to Accumulate, Exchange Balances Drop

Ethereum has experienced a 12% decline over the past week, leading to notable investor losses. However, sentiment appears to be shifting as holders opt to accumulate rather than sell.

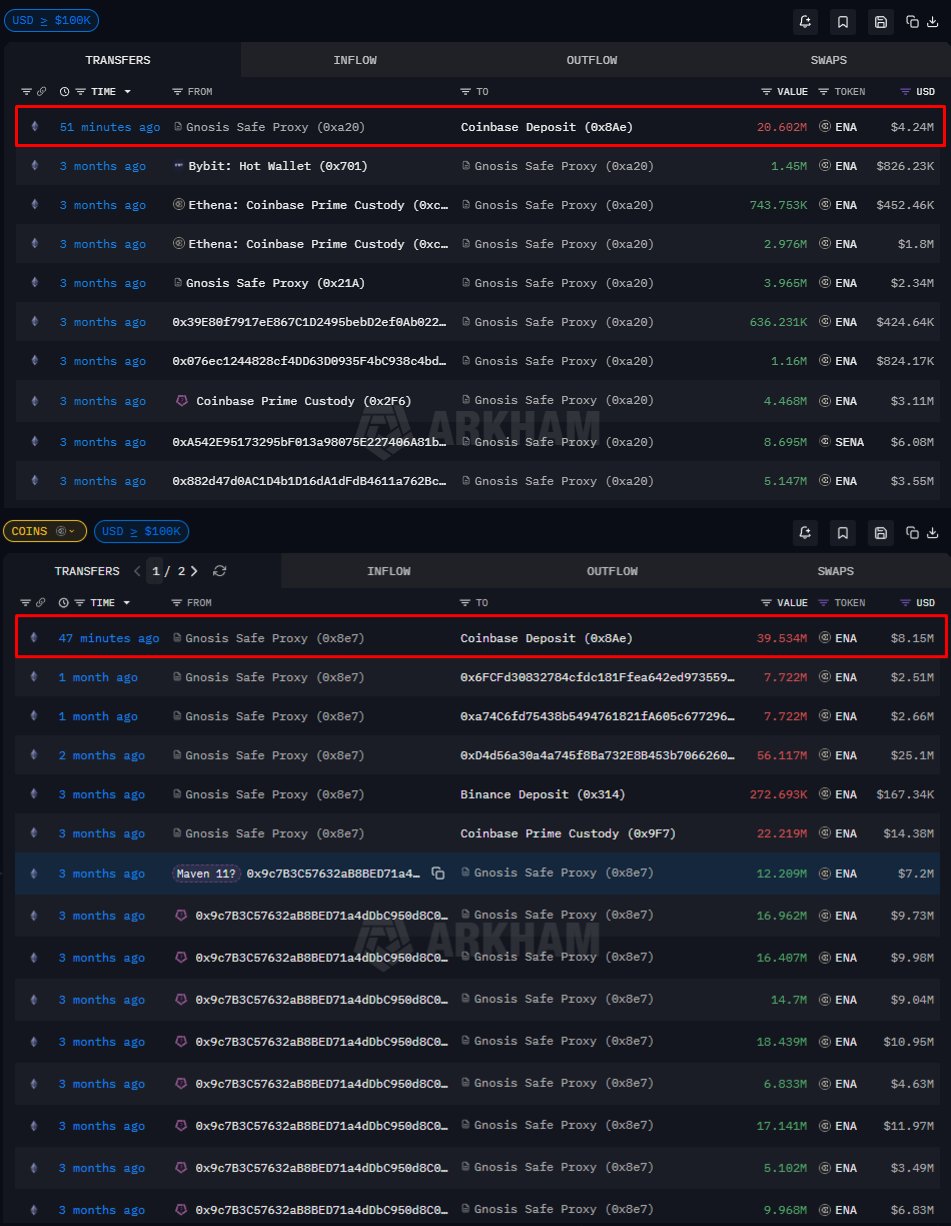

This week, Ethereum balances on exchanges decreased by 12.5 million ETH, equating to approximately $815 million moved to private wallets.

This trend reflects a strategic response to lower prices and signals optimism about Ethereum’s potential recovery.

This accumulation pattern suggests bullish sentiment among investors, as the reduced availability of Ethereum on exchanges could exert upward pressure on its price in the coming days.

Technical Indicators Suggest a Key Resistance at $3,327

Ethereum is currently trading at $3,114, with its next critical resistance at $3,327. Overcoming this level could pave the way for a recovery toward $3,524, where recent accumulation has occurred. The IOMAP data (In/Out of the Money Around Price) suggests bullish momentum from accumulation may aid in breaching these resistance levels.

However, failure to surpass $3,327 could lead to further declines. A drop to $3,028 would erase recent gains, dampen sentiment, and prolong the bearish outlook.

Flipping $3,327 into support is key for Ethereum to regain bullish momentum and target higher levels.

Breaching $3,524 would validate recovery prospects and encourage further accumulation. On the downside, a failure to sustain momentum risks deepening Ethereum’s decline, potentially delaying its recovery for the foreseeable future.