Solana Restaking Protocol Solayer Releases 2025 Roadmap

Solayer’s InfiniSVM introduces cutting-edge hardware acceleration for Solana, while a lattice hash proposal addresses scalability bottlenecks.

Solayer has unveiled its ambitious 2025 roadmap, introducing the revolutionary Solayer InfiniSVM, a hardware-accelerated SVM blockchain.

Described as the culmination of their vision, InfiniSVM boasts an infinitely scalable multi-execution cluster architecture. It is interconnected via Software-Defined Networking (SDN) and Remote Direct Memory Access (RDMA). This setup enables 100 Gbps performance while maintaining atomic state integrity.

Solayer to Solve Solana’s Scalability Challenges

Solana’s network bandwidth currently consumes nearly 0.8 Gbps per validator, pushing the limits of modern consumer-grade peer-to-peer internet. This constraint often leads to validator propagation failures, connection drops, and consensus disruptions.

Scaling beyond current network demands requires more than software optimization—it necessitates significant physical computing advancements. Solayer InfiniSVM addresses these challenges by dynamically sharing a single execution machine into infinite machines based on application demand.

By offloading components such as sequencing, scheduling, and storage onto programmable hardware switches, Solayer achieves a 1-millisecond transaction confirmation time. This breakthrough paves the way for a decentralized network capable of processing billions of transactions per second.

“Solayer is the first to present hardware offloading of a decentralized network. For each second, we can process billions of people transferring USDC and millions of people aping the same memecoin on Raydium,” the roadmap indicated.

The roadmap also introduces a Hybrid Proof-of-Authority-and-Stake consensus mechanism. Mega leaders can execute up to one million transactions per second (TPS) and coordinate verification through provers. Solayer’s suite of products, including sSOL and sUSD, will be integrated as native yield-bearing assets.

Users can stake, restake, earn, and spend these assets both on-chain and in real-world applications. According to Solayer, their innovations mark the first successful hardware offloading in a decentralized blockchain network. They envision a future where tasks like 8K video streaming, large-scale gaming, and trading occur seamlessly on the Solayer chain.

Solana’s Complementary Scalability Proposal

Meanwhile, in a recent GitHub post, Solana developers proposed addressing scalability issues through an upgrade — SIMD-215 — which introduces a lattice-based homomorphic hashing function. This method changes how the Solana network verifies and traces user accounts, aiming to scale to billions of accounts while optimizing computational efficiency.

Currently, the Solana network frequently recalculates the state of all accounts, a process that becomes increasingly burdensome as user numbers grow. The Accounts Lattice Hash proposal eliminates this bottleneck by enabling instant verification of account states.

The upgrade significantly reduces the computational workload by processing only changed accounts. As explained by Republik Labs, this is akin to cleaning only the rooms that have been used in a house. Solana Labs co-founder Anatoly Yakovenko highlighted the “state growth problem” in a May 2024 post.

“The problem comes down to this simple thing; new account creation has to create new accounts. This means that a new account has to prove that it is new somehow. This is trivial to do if the runtime has a full global index of all the accounts. But that kind of way of proving that the account is new is expensive, every node has to have a full index of all the accounts in the runtime,” Yakovenko explained.

This global indexing is computationally expensive for network nodes. By contrast, the proposed lattice system simplifies this process, eliminating the need for full recalculations.

If implemented, the Accounts Lattice Hash upgrade could dramatically enhance the speed and efficiency of the Solana network. It would enable the blockchain to handle exponential user growth without sacrificing performance.

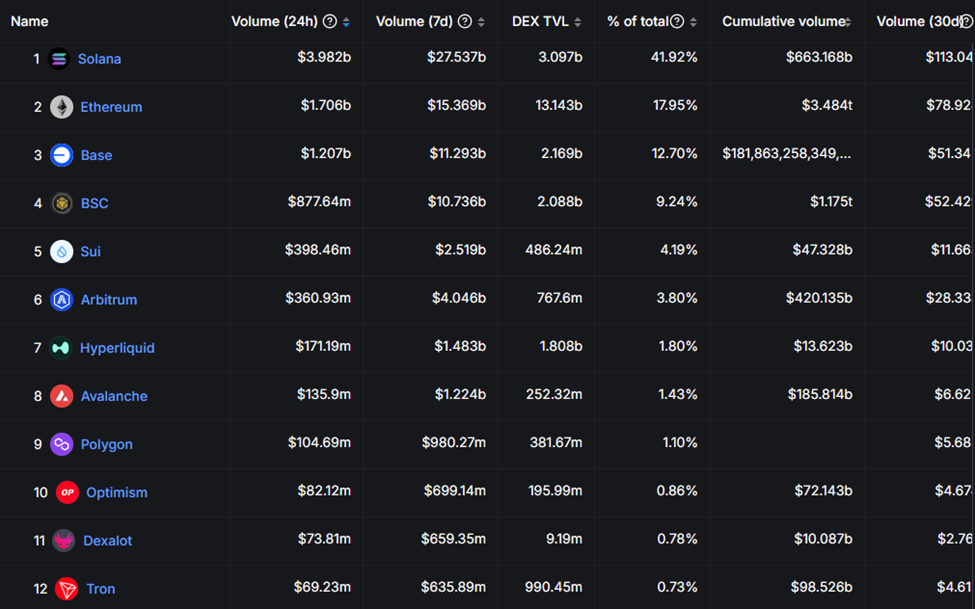

Meanwhile, Solana remains a dominant force in decentralized finance (DeFi), surpassing Ethereum in trading volume across its decentralized exchanges (DEXs). According to DefiLlama, Solana’s DEXs recorded over $113 billion in trading volume last month, compared to Ethereum’s $78.9 billion.

Solana Tops DEXs Volume By Chain. Source:

DefiLlama

Solana Tops DEXs Volume By Chain. Source:

DefiLlama

The launch of Solayer InfiniSVM and the potential adoption of the Accounts Lattice Hash system position Solana to achieve new milestones in blockchain scalability and efficiency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."