Why These Altcoins Are Trending Today — January 2

As 2025 begins, altcoins like VIRTUAL and KEKIUS are making waves. Read about their recent price jumps and what could be next for these trending altcoins.

As 2025 kicks off, investors are optimistic for a year of stronger gains. Interestingly, bar a few, most of the altcoins trending today have seen their prices increase in the last 24 hours.

According to CoinGecko, two of the top three altcoins — Virtuals Protocol (VIRTUAL) and Kekius Maximus (KEKIUS) — have recorded impressive double-digit growth, while ai16z (AI16Z) has bucked the trend with a decline. Here are the details.

Virtuals Protocol (VIRTUAL)

Throughout Q4 of last year, VIRTUAL was a regular on the trending list as one of the top-performing altcoins. Today, January 2, it continues to capture attention, surging by 23.60% in the last 24 hours.

VIRTUAL’s sustained rise could be attributed to the growing buzz around AI and gaming, which has propelled the altcoin to new heights. Following the price increase, VIRTUAL now trades at $4.89.

On the daily chart, VIRTUAL continues to hit a higher high, indicaitng notable demand for the altcoin. The Relative Strength Index (RSI) reading has also increased, indicating notable bullish momentum around the token.

Virtuals Protocol Daily Analysis. Source:

TradingView

Virtuals Protocol Daily Analysis. Source:

TradingView

Should this trend continue, the altcoin’s value could climb to $6. However, if demand for the Virtuals Protocol token drops, it might face correction. In that case, the value could decline to $2.90.

Kekius Maximus (KEKIUS)

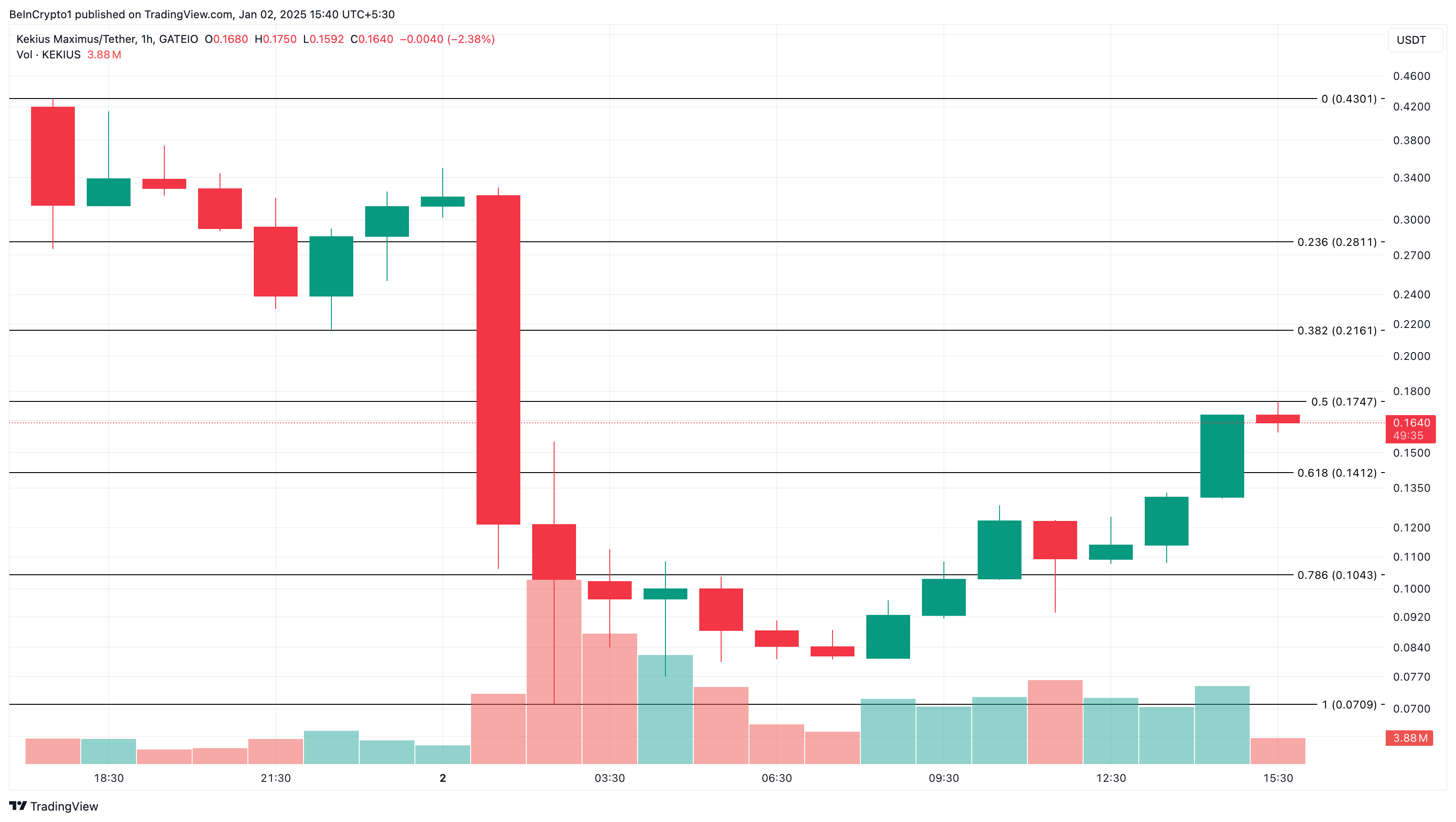

Unlike VIRTUAL, Kekius Maximus price has decreased by 50% in the last 24 hours. However, that is not the major reason it is part of the altcoins trending today.

Earlier on, the meme coin built on Ethereum recorded a mind-blogging increase after Elon Musk changed his X handle to Kekius Maximus. However, yesterday, the Tesla CEO switched back to his original name, causing the meme coin’s market cap to fall by $300 million within an hour.

However, the 1-hour chart shows that the token has erased some of those losses. If sustained, KEKIUS value might rally toward $0.28 in the short term. On the flip side, if bears take over the price action, it could decline to $0.10.

Kekius Maximum 1-Hour Analysis. Source:

TradingView

Kekius Maximum 1-Hour Analysis. Source:

TradingView

ai16z (AI16Z)

Ai16z, a token deployed by venture capital led by AI agents, has increased by 20% in the last 24 hours, which is why it is trending. Beyond that, the bullish sentiment around AI agent cryptos is another reason it is on the list.

As of this writing, AI16Z trades at $2.27. On the 4-hour chart, the Bull Bear Power (BBP) has remained in the positive region. This indicates that bulls are in control of the altcoin’s direction.

ai16z 4-Hour Analysis. Source:

TradingView

ai16z 4-Hour Analysis. Source:

TradingView

Should this remain the same, then the token’s value might rally toward $3.50. However, if bears have the upper hand, the trend might change. If that is the case, AI16Z could decline to $1.73.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of MMT Token: Analyzing Driving Forces and Assessing Its Sustainability in the Cryptocurrency Market

- Momentum (MMT) token surged 1,300% in November 2025, driven by product innovation, regulatory clarity, and institutional investment. - Strategic moves included a Sui-based perpetual futures DEX, CLARITY Act/MiCA 2.0 compliance, and $10M funding for cross-chain expansion. - Institutional holdings rose 84.7%, while on-chain activity showed growing utility in real-world asset tokenization and governance models. - Risks persist: 3M tokens moved to OKX, $109M in liquidations, and 20.41% circulating supply cre

The Financial Wellness Aspect: The Influence of Investor Actions on Market Results

- Behavioral economics integrates psychology to explain how emotional, intellectual, and environmental wellness shape investor decisions and market outcomes. - Emotional resilience reduces cognitive biases like loss aversion, while intellectual engagement through AI tools improves long-term investment returns according to 2024-2025 studies. - Environmental factors such as ESG frameworks and workplace wellness programs demonstrate measurable economic benefits, including 20% higher productivity and reduced f

Regulatory Changes in U.S. Agriculture: The Impact of USDA Policy Decisions on Long-Term Investments in Livestock and Poultry Industries

- USDA’s 2023–2025 Organic Livestock and Poultry Standards (OLPS) impose stricter animal welfare rules, with phased compliance until 2029 to ease small producers’ adjustments. - Compliance costs for organic producers are high initially but projected to yield $59.1–$78.1 million annual benefits via enhanced consumer trust and premium pricing. - Investors favor scalable, tech-driven operations amid OLPS-driven capital shifts, though small producers face compliance challenges and market exit risks in poultry

ZK Atlas Enhancement: Marking a Milestone for Scalable Blockchain Frameworks

- ZKsync's 2025 Atlas Upgrade revolutionizes blockchain with 43,000 TPS, $0.0001 per-transaction costs, and sub-second finality via Airbender zkVM. - Modular EVM compatibility attracts Deutsche Bank , Sony , and $15B institutional investment, accelerating DeFi, NFTs, and cross-border payments. - ZK rollups' TVL surges to $28B, with 60.7% CAGR projected through 2031, driven by Bitcoin ETF inflows and $7.59B ZKP market growth by 2033. - Regulatory clarity under U.S. GENIUS Act and EU MiCA accelerates adoptio