US spot Bitcoin and Ether ETFs See $38.3B inflows in 2024

The United States saw substantial growth in its spot Bitcoin (CRYPTO:BTC) and Ether (CRYPTO:ETH) exchange-traded funds (ETFs) during their launch year, with total net inflows of $38.3 billion in 2024.

Bitcoin ETFs led the way with $35.66 billion in net inflows, surpassing early expectations from industry analysts.

The top performer was BlackRock's iShares Bitcoin Trust ETF (IBIT), which garnered $37.31 billion.

Following IBIT were Fidelity's Wise Origin Bitcoin Fund (FBTC) and ARK 21Shares Bitcoin ETF (ARKB), which received $11.84 billion and $2.49 billion in net inflows, respectively.

The Bitwise Bitcoin ETF (BITB) saw $2.19 billion.

Despite a strong start, Bitcoin ETFs experienced a decline toward the end of the year, with $1.33 billion in outflows since December 19.

Five of the last six trading days recorded net outflows, with IBIT seeing its largest outflow of $188.7 million on December 24.

Retail investors drove around 80% of the demand for Bitcoin ETFs, with institutions yet to take the lead.

However, analysts, including Bitwise’s CIO Matt Hougan, expect more institutional participation in 2025, particularly with the launch of additional clearinghouses for spot Bitcoin ETF trading.

Meanwhile, spot Ether ETFs saw a total of $2.68 billion in net inflows since their launch on July 23.

The iShares Ethereum Trust ETF (ETHA) and Fidelity Ethereum Fund (FETH) led with $3.52 billion and $1.56 billion, respectively.

Despite underperforming Bitcoin and Solana in 2024, Bitwise projects a strong rebound for Ether in 2025, with a possible price of $7,000, driven by increased activity on Ethereum layer 2s and the growth of stablecoins and real-world asset tokenisation.

At the time of reporting, the Bitcoin price was $93,367.34 and the Ethereum price was $3,400.58.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

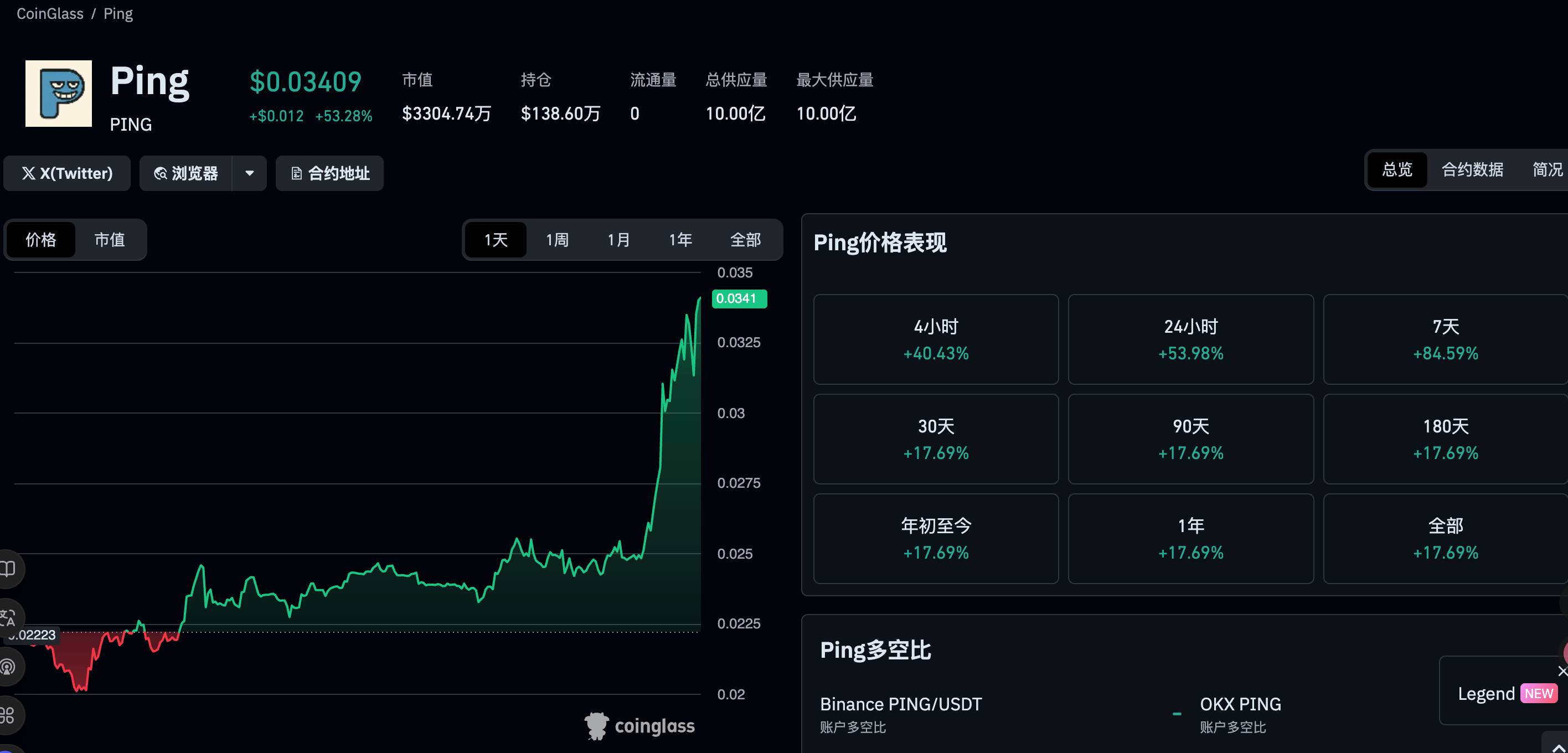

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

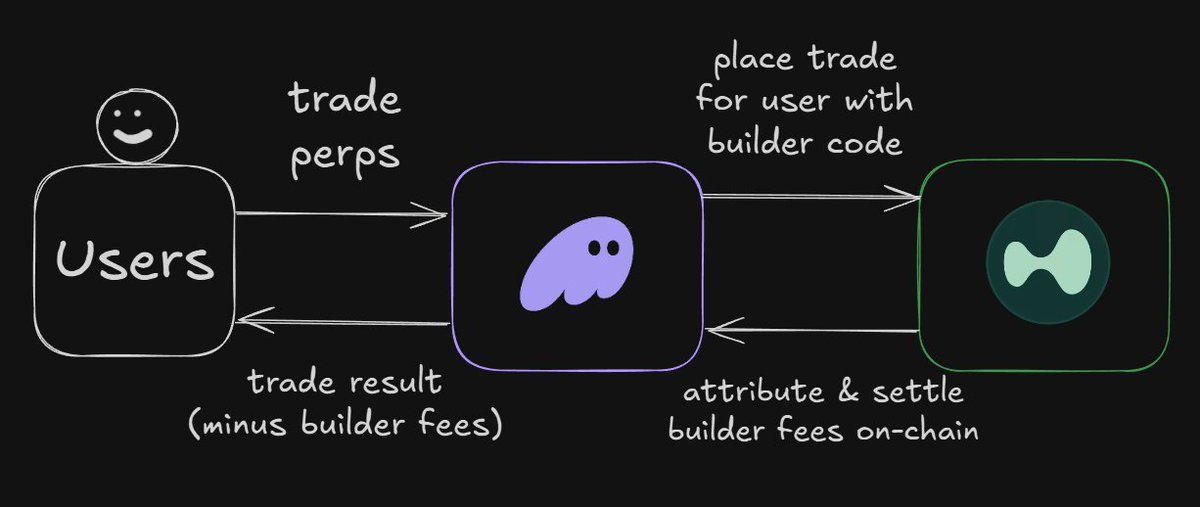

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

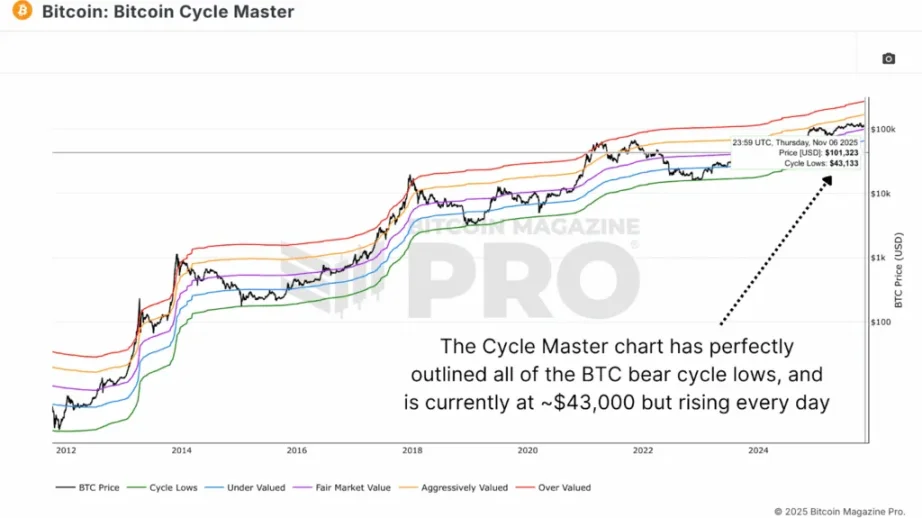

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.