Shibarium Upgrade Sparks SHIB Rally – Can It Propel Shiba Inu to $1?

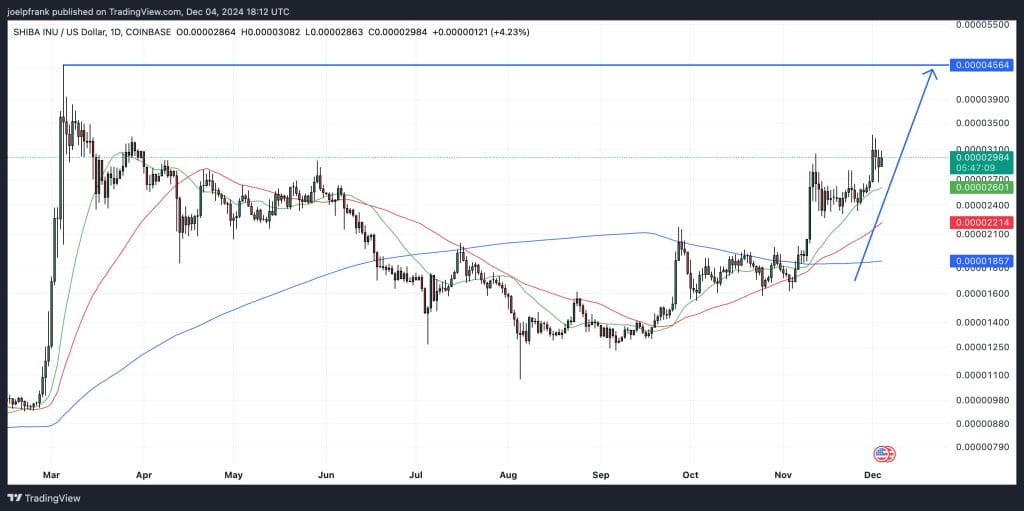

SHIB could soon retest its record highs as meme markets continue to heat up.

Shibarium Upgrade Sparks SHIB Rally / Source: Cryptonews.com

Shibarium Upgrade Sparks SHIB Rally / Source: Cryptonews.com

The Shiba Inn (SHIB) price is looking perky in wake of an exciting new Shibarium upgrade, which could help power further development in the layer-2 Ethereum scaling blockchain ecosystem.

SHIB was last trading around $0.00002959 but continues to power higher into the end of 2025 as meme season continues to heat up.

The latest Shibarium upgrade, called the Heimdall Bor hard forks, brings better compatibility with Ethereum in wake of its Dencun upgrade earlier in the year, and features a new upgradeable burn contract.

As meme season accelerates, SHIB could soon see a fresh acceleration to the upside and challenge its 2024 highs in the $0.000045 area, price predictions suggest.

A retest of record highs above $0.000080 for the SHIB price are also a possibility in this bull market. That would mark around 2.5x gains from current levels, making SHIB a strong candidate for best meme coin to buy now in wake of the Shibarium upgrade.

But could SHIB ever reach $1?

Shibarium Upgrade – Can It Send SHIB to $1?

SHIB currently has a circulating supply of around 584 trillion. A price of $1 would require SHIB to reach a market cap higher than the combined value of all financial assets in the world right now.

That’s an unrealistic expectation, to say the least. But if that supply was to be drastically reduced, then perhaps $1 could be possible.

Indeed, the latest Shibarium upgrade does feature an upgradeable burn contract. It remains unclear how far and fast the new upgrade, deployed at address 0x541 on block 8200512 , will reduce supply.

But the Shibarium website says this upgradeable burn contract will “support exciting future updates and enhancements” and “adds a significant feature that will help reduce the total token supply, providing additional value for holders”.

According to SHIBBurn.com , over 410 trillion SHIB tokens have been burnt so far, amounting to over 40% of the initial supply.

Perhaps, in time, the supply can be reduced from the hundreds of trillions to the billions following this Shibarium upgrade, and then SHIB would be in with a shot of hitting $1.

Alternative Meme Coin to Consider

SHIB has big upside potential in the months ahead, with meme season expected to extend into early 2025.

However, its already bloated market cap – last around $18 billion according to CoinMarketCap.com – suggests the room for further exponential gains is limited.

Crypto traders looking for the next 100x coin might want to look at smaller, newer coins that are showing good early momentum.

One coin that has caught the attention of the team at cryptonews.com is a new cat-themed Ethereum meme coin called Catslap (SLAP).

SLAP’s market cap was around $66 million, according to DEXTools. But the new meme coin is enjoying surging social media engagement as traders flock to partake in its fun slap-to-earn game and ahead of a major announcement.

SLAP stakers are also able to benefit from yields of as much as 40%, making this new coin also one of the top passive income opportunities in crypto right now.

Check Out Catslap Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.