$174 Million FET Accumulation Pushes Price Toward Resistance

FET's 31% surge over the past week is driven by $174 million in whale accumulation, bringing it close to breaking its $1.72 resistance level.

Artificial Superintelligence Alliance (FET) has been on an uptrend, gaining 31% over the past week. This rally is driven by increased whale accumulation, indicating heightened interest from large-scale investors.

FET’s double-digit price surge has brought it near the upper boundary of the horizontal channel it has traded within since June. The key question is whether this momentum will trigger a breakout above this critical resistance level.

FET Whales Drive Rally

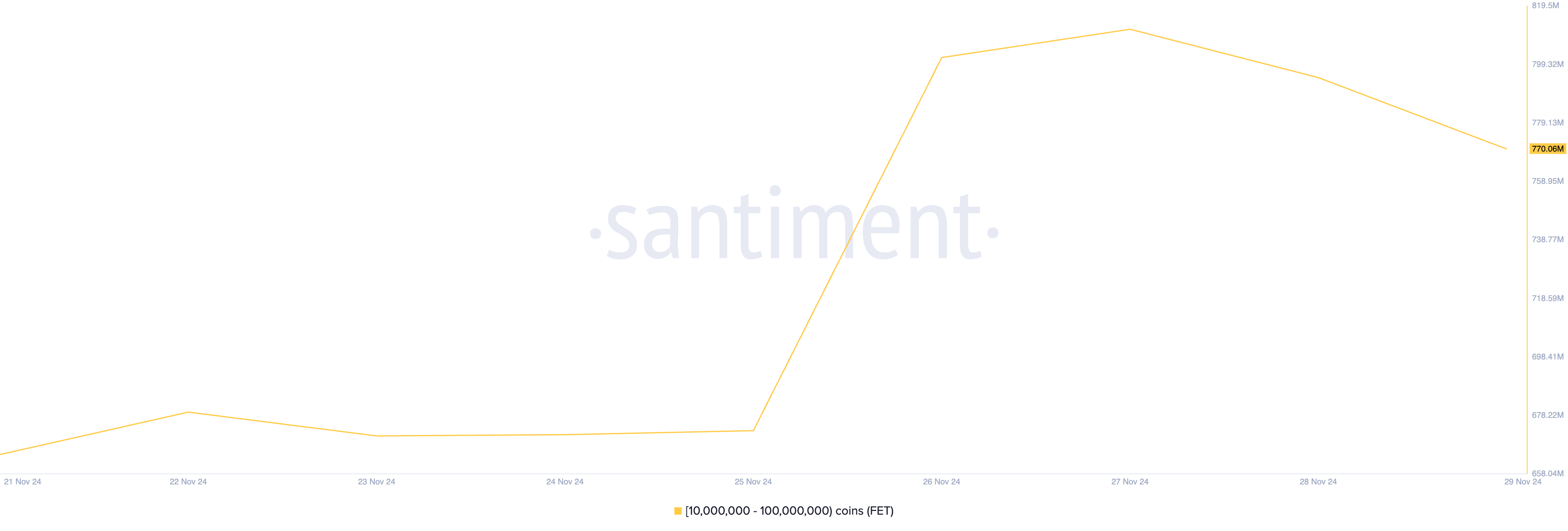

BeInCrypto’s analysis of FET’s on-chain performance has revealed a significant rise in whale accumulation over the past week. Data from Santiment reveals that, in the past seven days, whale addresses holding between 10 million and 100 million FET tokens have collectively purchased 106 million tokens valued at $174 million at current market prices.

When whales accumulate more coins, it signals confidence in the asset’s future value. This heightened demand often influences retail interest, which increases buying pressure and drives up the asset’s price.

FET Supply Distribution. Source:

Santiment

FET Supply Distribution. Source:

Santiment

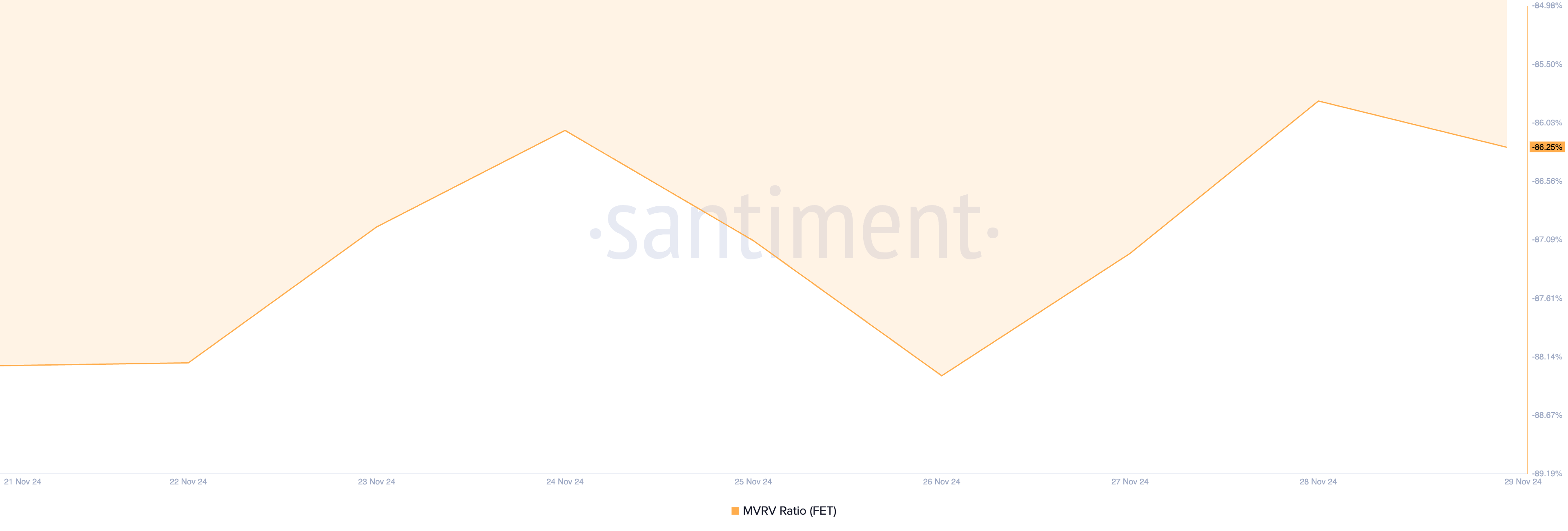

This surge in whale accumulation is largely attributed to FET’s undervalued status, as indicated by its negative market value to realized value (MVRV) ratio. Santiment reports that FET’s current MVRV ratio stands at -86.25%.

The MVRV ratio compares an asset’s market capitalization to the total value of coins purchased at their realized price, offering insights into whether the asset is overvalued or undervalued relative to its historical cost basis.

FET MVRV Ratio. Source:

Santiment

FET MVRV Ratio. Source:

Santiment

Historically, investors view negative MVRV ratios as a buying opportunity, recognizing that the asset trades below its historical acquisition cost and may rebound. This expectation of a rebound has led FET whales to increase their holdings in recent days.

FET Price Prediction: A Rally Above $2 Is Possible

On a daily chart, FET has traded within a horizontal channel since June. This channel is formed when an asset’s price fluctuates between parallel support and resistance levels, indicating a period of consolidation or range-bound trading. Since June, FET has faced resistance at $1.72 and has found support at $1.09.

FET Price Analysis. Source:

TradingView

FET Price Analysis. Source:

TradingView

At press time, FET trades at $1.63, attempting to break above the upper line of this channel. If successful, this will propel its price to trade at $2.09. Conversely, a failed attempt to breach resistance will send FET’s price toward support at $1.35.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADA, ETH, XRP Climb as Bitcoin Zooms Above $93K, But Traders Warn of ‘Fakeout Rally’

Last Cycle’s Signal King Murad: 116 Reasons Why the 2026 Bull Market Will Come

I do not agree with the view that the market cycle is only four years; I believe this cycle may extend to four and a half or even five years, and could last until 2026.

Ethereum completes Fusaka upgrade, team claims it can unlock up to 8x data throughput

Major upgrades, which used to take place once a year, are now happening every six months, demonstrating that the foundation still maintains strong execution capabilities despite recent personnel changes.

Glassnode: Is Bitcoin Showing Signs of a 2022 Crash Again? Beware of a Key Range

The current bitcoin market structure is highly similar to Q1 2022, with over 25% of on-chain supply in a loss, ETF capital flows and spot momentum weakening, and the price relying on key cost basis areas.