RoOLZ Community Sale Info

RoOLZ is the first IP of RoOLZ Studio Inc. - a Community Orientated Entertainment company with RoOLZ Season 1 as its first IP. RoOLZ LLC is a company that is integrating Animated Content, Mobile Apps on Telegram with Digital Collectibles which shall be known by its Ticker: $GODL.

More information on RoOLZ will be published soon.

-

A community sale in the crypto world is a type of token sale where a project reserves a portion of its token supply to its community members.

-

The aim of this is to reward community participation and ownership amongst the community.

-

The Community Sale is taking place in October in the RoOLZ App.

-

The Community Sale has the same valuation as our private investors.

$GODL is the ticker and name of the RoOLZ token. $GODL is used for Governance, Staking, Rewards and Play To Earn Mechanics. $GODL can be used to influence the outcome of the Anime, sponsor RoOLZ episodes or in-app, or decide on future content to be produced.

RoOLZ has raised $1M in funding from (Institutional) Private investors as Yolo Ventures, Contango Digital and TON Ventures. These investors allow the RoOLZ Company to produce further content, pay its employees, and build new apps surrounding the Entertainment Studio.

The valuation for RoOLZ ($GODL) is the same for Private Investors as participants in the Community Sale and is accessible to the public

📱 The RoOLZ App Stats

RoOLZ currently has 8M App Users, with 3.5MAU. RoOLZ has 5M+ followers on Telegram, 650K on Twitter, and 450K combined on Instagram Tiktok. App Link: T.me/roolzquest_bot

Participation happens in the RoOLZ Telegram App on sale date (expected on OCT 25): T.me/roolzquest_bot *This sale is for >1000 GEM Holders, that have connected their wallet.*

Access can be acquired by owning a RoOLZ NFT that can only be acquired from GetGems. You can earn a Level 50, 75 or 100 NFT by playing the game (also tradable on GetGems). If you own these NFT's on the snapshot date you can participate.

NFTs can be found and bought here:

RoOLZ Game

You can also receive one of these NFTs by playing the game free of cost. Level NFT's are also given as a prize to community events. Just follow us and get yours! Participation Tiers:

💎 Diamond: Tier: 6+ RoOLZ NFT's or GOD NFT Max Purchase: $1000 Min Purchase: $500 🥇 Gold Tier: RoOLZ NFT or Level 100 NFT Max Purchase: $300 Min Purchase: $100 🥈 Silver Tier: Level 75 NFT Max Purchase: $100 Min Purchase: $50 🥉 Bronze Tier: Level 50 NFT Max Purchase: $50 Min Purchase: $25 OCT 25: 1000 GEM Holders 8,000,000 GODL (1%) of Supply Max Purchase: $50 Min Purchase: $25

-

Name: $GODL

-

Total Supply: 800,000,000

-

Community Sale Supply: 96,000,000

-

Price $0.01

-

Valuation: $8,000,000 FDV

-

Est. Market Cap: $2,900,000 on TGE

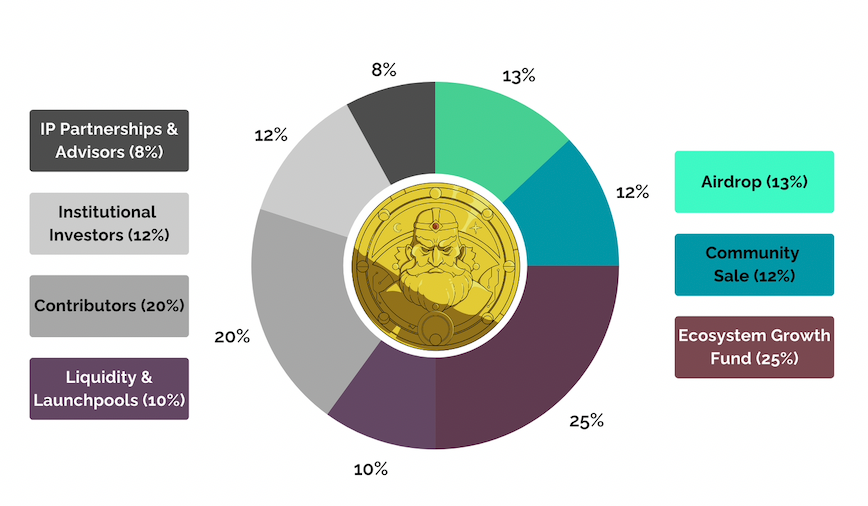

$GODL Distribution

Highlights:

-

13% Airdrop, 100% on TGE

-

12% Community Sale, 100% on TGE

-

Rest is on a Vesting Schedule

-

Community Sale Private Sale Participants joint at the same valuation

-

Price can fluctuate based on denominator (TON) with which participants participate

-

Contributors: The Contributors behind RoOLZ will get 0% on TGE and are on a vesting schedule to foster long-term commitment to RoOLZ

|

Airdrop |

Gem- NFT Holders |

13% |

100% at TGE |

|

Community Sale |

Community Participants |

12% |

100% at TGE |

|

Ecosystem Growth Fund |

IP Funding, Play-to-Earn, development |

25% |

Over 2 years |

|

Liquidity Launchpools |

$GODL Token Liquidity for CEX and DEX Listings |

10% |

At listing |

|

Contributors |

Team and builders behind RoOLZ |

20% |

0% at TGE, 1 Year Vesting |

|

Institutional Investors |

Strategic Investors, fueling expansions |

12% |

TGE Unlock, 11-month vesting |

|

IP Partnerships Advisors |

Collaborations of New IP launching through RoOLZ Token Launch Partners |

8% |

0% at TGE, 1 Year Vesting |

Other Explainers:

More information on the Airdrop coming soon.

TGE stands for Token Generation Event. This is the day the tokens will get listed on Exchanges and you can Claim your tokens.

Disclaimer:

We reserve the right to amend this information from time to time. If any part of this information is deemed invalid by law, the rest of the agreement will still be binding. Please, re-check this document closer to the date. Read the disclaimer at the top of this page - none of this information is investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating How Vitalik Buterin's Advancements in ZK Technology Are Shaping Blockchain Investment Trends

- Vitalik Buterin's GKR protocol boosts Ethereum's scalability, enabling 43,000 TPS via ZK computation. - Institutional adoption accelerates with ZK-based compliance solutions, attracting BlackRock and Deutsche Bank partnerships. - ZK startups like zkSync and StarkNet secure $55M+ in funding, with market caps surging as infrastructure matures. - Investors target ZK-EVM compatible projects and hybrid models, aligning with Ethereum's 2026 roadmap.

ZK Technology's 2025 Price Increase: Sustained Value Driven by Blockchain Integration and Growing Institutional Engagement

- ZK technology's 2025 price surge stems from on-chain adoption and institutional investments, signaling a structural market shift. - ZK rollups now process 15,000 TPS with $3.3B TVL, driven by infrastructure upgrades and 230% developer engagement growth. - 35+ institutions including Goldman Sachs deploy ZKsync for confidential transactions, while Nike/Sony adopt it for supply-chain transparency. - Market fundamentals project 22.1% CAGR to $7.59B by 2033, validating ZK as blockchain's foundational infrastr

DASH Experiences 150% Price Jump and Growing Institutional Interest: Examining Blockchain’s Strength During Economic Uncertainty

- DASH surged 150% in June 2025 driven by tech upgrades, institutional interest, and favorable policies. - Platform 2.0 enhanced scalability and token support, positioning DASH as a competitive blockchain platform. - Institutional adoption grew in 2025 Q3-Q4 via merchant integrations in emerging markets and decentralized governance. - Macroeconomic factors like Fed policies and M2 growth boosted liquidity, while volatility persisted due to tightening markets. - Future growth depends on 2026 regulatory clar

The Increasing Importance of Stablecoins in Institutional Investment Strategies

- In 2025, U.S. GENIUS Act and EU MiCA regulations drove institutional adoption of USDC as a compliant, transparent stablecoin. - USDC's 98% U.S. Treasury-backed reserves and monthly audits made it preferred over USDT for regulated entities. - Institutions used USDC to reduce settlement delays by 35% and improve Sharpe ratios by 12% through yield-generating strategies. - With $73.7B circulation and $140B Q3 transaction volume, USDC became a 24/7 global liquidity tool for emerging markets.