Small-cap performance improves as investors focus on economic growth and interest rate outlook

Investors may be turning to small-cap stocks as large-cap tech stocks are reportedly generally pulling back. Traders continue to focus on corporate earnings reports. Billionaire investors said the recent improvement in small-cap performance has benefited from better-than-expected labour market conditions and increased expectations of a Fed rate cut. the Russell 2000 Index rebounded from its lows, with strong performance in the banking sector further supporting small-cap stocks. Despite the improvement in absolute performance, the Russell 2000 to SP 500 ratio chart remains in a downtrend. goldman Sachs says the equity market sell-off has cancelled out and the year-end rally is resonating with clients.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Eric Trump: American Bitcoin continues to increase BTC holdings, soon to surpass GameStop

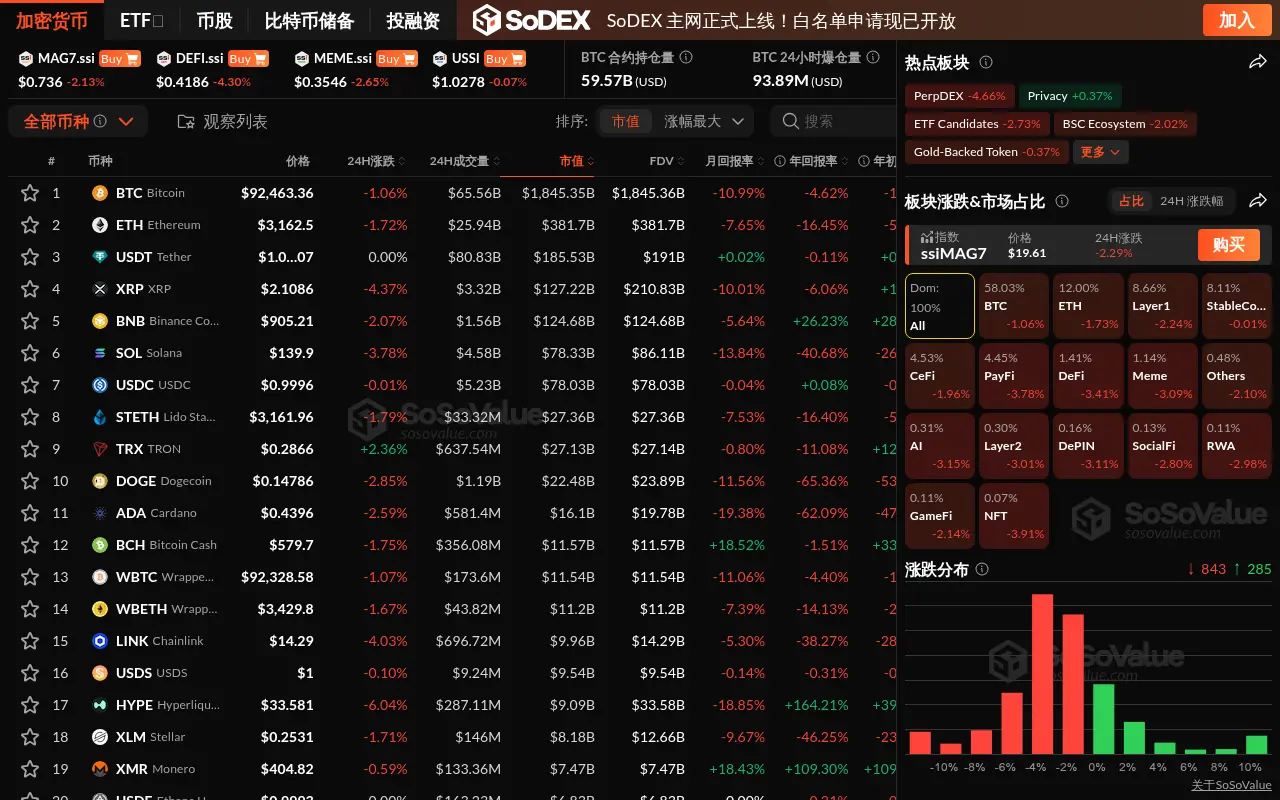

Data: The entire crypto market pulls back, PayFi sector drops nearly 4%

User data from Argentine crypto platform Lemon Cash leaked due to a hack on a third-party service provider