CryptoRank: OMNIA Token Sales and IEO Details

CryptoRank2024/10/15 07:56

By:CryptoRank

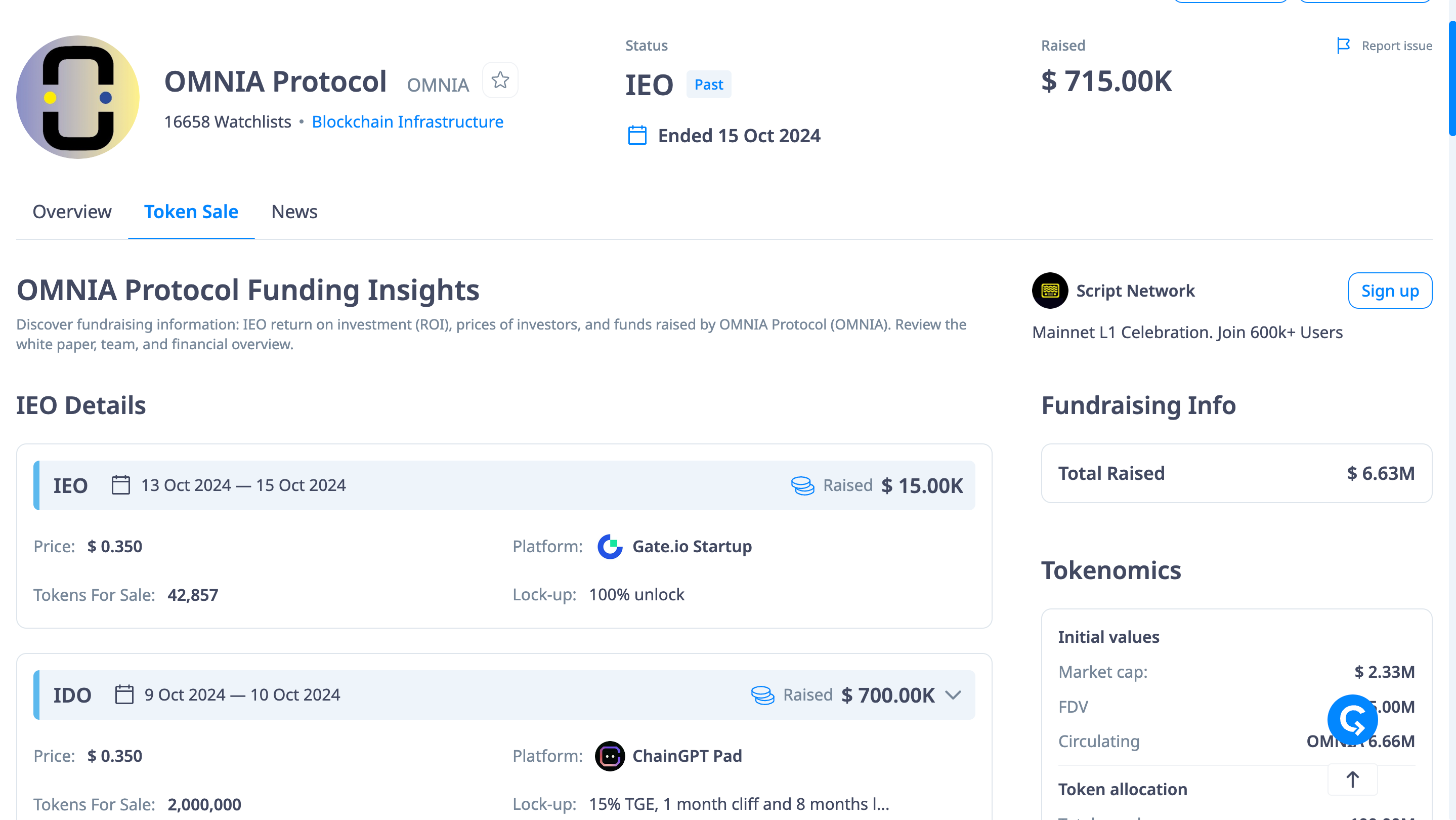

OMNIA Protocol Token Sale Info

IDO on ChainGPT. Details:

-

Price per token: 0.35 USDT per $OMNIA

-

Swap Amount: 2,000,000 $OMNIA

-

Total Raise: $700,000

-

Accepted Currency: USDT

-

Network: Binance Smart Chain

1

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

David Schwartz Delivers His Last Message As Ripple CTO

TimesTabloid•2025/12/20 20:06

Investors Eye GeeFi (GEE) After Selling 5% of Phase 3 at Start While Dogecoin (DOGE) Fails to Break Its Downtrend

TimesTabloid•2025/12/20 20:03

OpenAI, Microsoft Sued Over ChatGPT's Alleged Role in Connecticut Murder-Suicide

Decrypt•2025/12/20 20:01

Pundit Breaks Down Ripple’s XRP Escrow: Why Is It Important?

Newsbtc•2025/12/20 19:45

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$88,184.86

+0.49%

Ethereum

ETH

$2,977.34

-0.11%

Tether USDt

USDT

$0.9996

+0.02%

BNB

BNB

$852.72

-0.30%

XRP

XRP

$1.92

+0.89%

USDC

USDC

$0.9999

+0.02%

Solana

SOL

$125.94

-0.18%

TRON

TRX

$0.2800

+0.21%

Dogecoin

DOGE

$0.1321

-0.56%

Cardano

ADA

$0.3753

-0.80%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now