CATS on why some cats getting big bags while others ended up with just dust

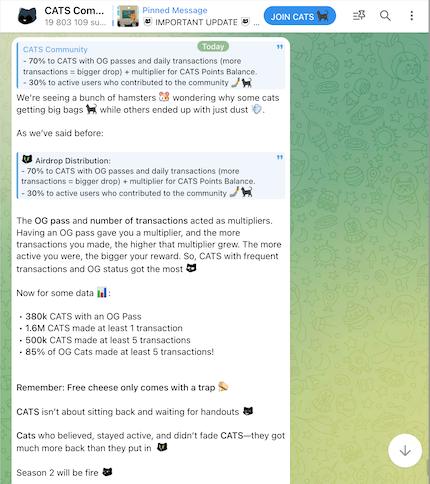

We’re seeing a bunch of hamsters wondering why some cats getting big bags while others ended up with just dust.

As we’ve said before:

Airdrop Distribution:

- 70% to CATS with OG passes and daily transactions (more transactions = bigger drop) + multiplier for CATS Points Balance.

- 30% to active users who contributed to the community

The OG pass and number of transactions acted as multipliers. Having an OG pass gave you a multiplier, and the more transactions you made, the higher that multiplier grew. The more active you were, the bigger your reward. So, CATS with frequent transactions and OG status got the most

Now for some data :

• 380k CATS with an OG Pass

• 1.6M CATS made at least 1 transaction

• 500k CATS made at least 5 transactions

• 85% of OG Cats made at least 5 transactions!

Remember: Free cheese only comes with a trap

CATS isn’t about sitting back and waiting for handouts

Cats who believed, stayed active, and didn’t fade CATS—they got much more back than they put in

Season 2 will be fire

P.S. We know that a small group of CATS still has issues with uncounted OG passes or transactions, even though most of the problems were handled and solved before the airdrop. We want to ensure that no cat receives fewer CATS than they deserve

Soon, we’ll be opening a CATS hotline for airdrop/balance issues to make sure every cat is taken care of

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Discover How Cryptocurrency Avoids Hitting Rock Bottom

Zcash Pullback Triggers $17 Million Withdrawal From Exchanges

What to Expect Next for Solana (SOL) Price? Here Are the Levels You Must Watch