Bitcoin demand slumps amid Middle East tensions, analysts cite selling pressure

Quick Take CryptoQuant’s Net Taker Volume metric remains subdued since the escalation of tensions in the Middle East on Tuesday. Despite the impact of Middle East tensions on bitcoin, QCP Capital analysts view the dip as temporary and anticipate the “Uptober” rally will continue.

Demand for bitcoin has remained subdued since tensions in the Middle East escalated on Tuesday, according to an analyst.

CryptoQuant data shows that the Net Taker Volume metric has significantly decreased since an escalation of tensions in the Middle East, when Iran fired more than 180 ballistic missiles at Israel on Tuesday in response to Israeli attacks on Hezbollah positions in southern Lebanon.

"Buying pressure has remained subdued since the Iran strike," CryptoQuant analyst J.A. Maartunn told The Block. "The drop in net taker volume by over $150 million signals significant selling pressure, while the fact that it hasn’t exceeded $100 million since Tuesday suggests a lack of strong buying momentum."

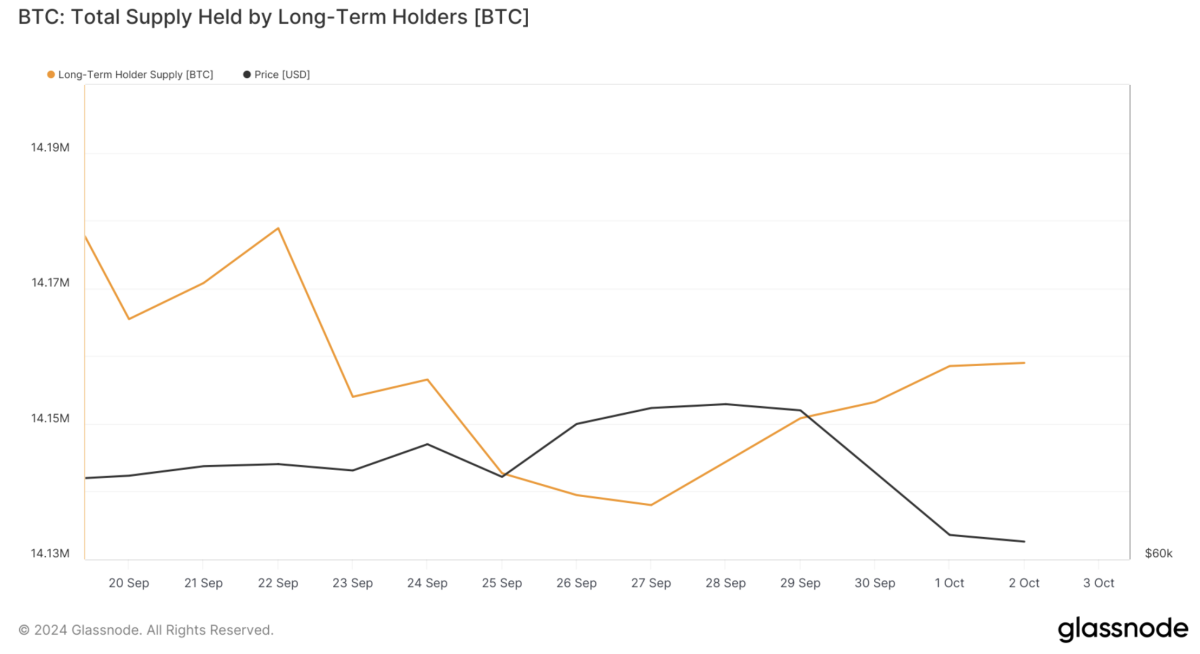

Bitwise Research Analyst-Europe Ayush Tripathi also pointed to an increase in the supply of bitcoin held by long-term holders—investors who have held their bitcoin for at least 155 days—despite the recent decline in prices. The increase in the supply of bitcoin held by long-term holders since the beginning of October suggests that while short-term demand has weakened, there is still confidence in bitcoin as a long-term investment.

Bitcoin BTC -3.11% long-term holders accumulate bitcoin during this week's market sell-off. Image: Glassnode.

Despite this sluggish demand, QCP Capital analysts believe the downturn is temporary. They highlighted the strong correlation between the performance of cryptocurrencies and U.S. stocks , predicting that as equities recover, crypto markets will follow suit.

"Macroeconomic factors, particularly in the U.S., are currently driving the price of risk assets," they said. The analysts pointed to the latest U.S. ADP National Employment report , which showed stronger-than-expected job growth in September, as a sign of labor market strength that could encourage the Federal Reserve toward a more dovish stance on interest rates.

"The ADP payroll report beat expectations, and tomorrow's non-farm payroll report will be key in confirming a strong U.S. labor market. A combination of expected rate cuts and labor strength could boost risk assets," QCP Capital analysts said.

In cryptocurrency market trading on Thursday, investors remained cautious as they awaited a potential Israeli response to Iran’s missile strikes. Bitcoin has held just above the $60,000 mark, while Ethereum dropped below $2,400. Bitcoin’s price fell by 2.8% in the past 24 hours and was sitting at around $60,286 at 12:30 p.m. ET, according to The Block’s Bitcoin Price Page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin mining is experiencing its worst crisis in 15 years!

Yearn Finance Recovers $2.4M After Hack in an Unprecedented Rescue Mission

Crypto Investors Return As ETP End Bearish Streak

Kalshi Extends Prediction Market Reach With Tokenized Contracts on Solana