An early Ethereum investor who participated in its ICO has sold 19,000 ETH, worth $47.54 million. The sale has created a short-term FUD amid Ethereum whale holdings dropping by 1.18% over the last 30 days.

Since other investor categories and active addresses have seen slight increases, the dip might not indicate a deeper downtrend. However, the sale does add to the bearish sentiment around Ethereum even though it is not in deep oversold territory yet.

ETH whale sold ICO accumulation from the Genesis block

An early Ethereum investor who received 150,000 ETH during its Initial Coin Offering (ICO) recently sold 19,000 ETH worth $47.54 million. Lookonchain notes the whale initially paid $46.5K for 150,000 ETH from the Genesis block and now holds ETH worth at least $358 million.

The early investor’s wallet reportedly became active a few days ago after being dormant for two years. The investor recently deposited 12,010 ETH to the Kraken exchange which is valued at $31.6 million.

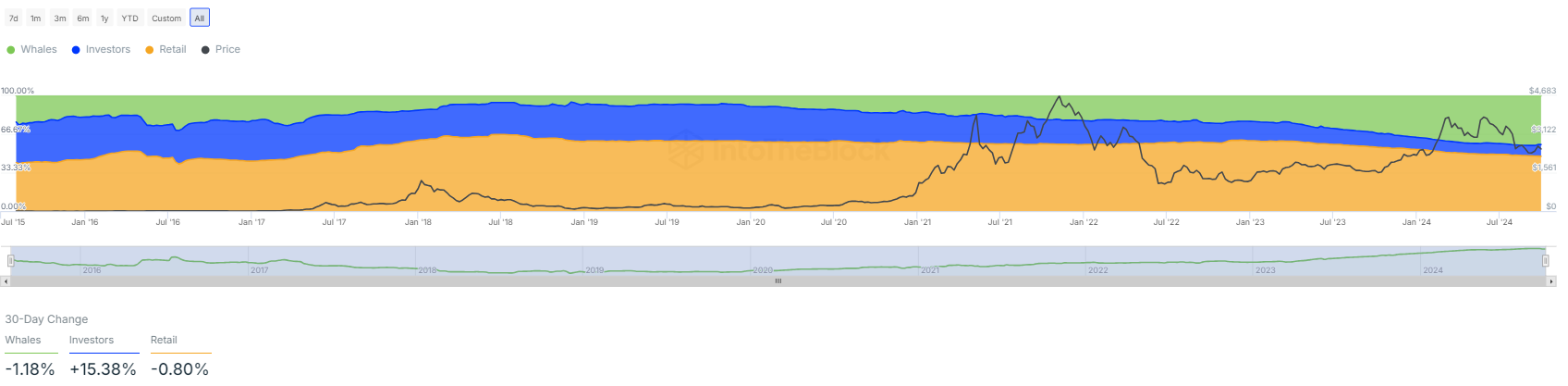

The investor’s decision to liquidate some of their holdings comes as other whales also reduced their holdings by 1.18% in 30 days. According to IntoTheBlock data, retail investors also reduced their Ethereum holdings by 0.8% over the same period but other investors increased by about 15%. Daily active addresses have also seen a minor increase.

ETH concentration by different investors | Source: IntoTheBlock

ETH concentration by different investors | Source: IntoTheBlock

The amount of ETH flowing in and out of large holders’ wallets, who hold 0.1% of the circulating supply, is bearish at press time. Data suggest a negative outflow of 600% over the last 7 days and a negative 60% over 30 days, potentially indicating a transfer of funds to exchanges for liquidation.

Ethereum RSI indicates weakness but not a deeper downtrend

Ethereum weekly fund flows have also been negative for five weeks before turning positive last week. As per CoinShares’ weekly digital asset flows, since early August, Ethereum has lost over $60 million.

On Thursday, Ethereum price took a major dip of 6% and is trading between $2,300 and $2,400.The trading volume is down 22% at about $20 billion in 24 hours. In the last week, Ethereum has underperformed against the crypto market, dipping by 11% while the field only lost 8% based on CoinGecko data.

ETH/USD 1-day price chart | Source:TradingView

ETH/USD 1-day price chart | Source:TradingView

Meanwhile, the ETH/USD 1-day technical chart reveals heightened volatility as news of the ICO whale offloading ETH became headlines. The 14-day Relative Strength Index is under 40, indicating price weakness. The short-term sentiment is bearish but the oversold range is not expected to lead to a deeper downtrend.