Toncoin attempts recovery but faces bearish signals

Toncoin (CRYPTO:TON) has shown a modest upward movement in the last 24 hours following several days of declines.

Despite this minor recovery, the overall outlook remains cautious, with potential bearish signals suggesting that the downtrend may persist.

TON has been in a steady decline since late July, reaching a high near $6.00, and is currently trading around $4.72, marking a slight increase of 1.09%.

Toncoin's price is below the 50-day moving average of approximately $6.074, which serves as a resistance level, indicating a bearish short-term trend.

The price also remains under the 200-day moving average at around $5.907, pointing to a longer-term bearish outlook.

Additionally, the chart shows an impending death cross—where the 50-day moving average crosses below the 200-day moving average—further signaling a potential downward trend for TON.

The Relative Strength Index (RSI) for Toncoin currently stands at 33.77, placing it in the oversold region.

This suggests that while the price has seen a prolonged decline, there may be a possibility for a reversal or a temporary recovery.

For a confirmed reversal, TON would need to break above the 50-day and 200-day moving averages.

Toncoin is also struggling to regain its position among the top ten cryptocurrencies.

It currently has a market capitalization of approximately $11.9 billion, trailing about $200 million behind Cardano (ADA), which holds the tenth position.

Over the past week, TON has seen the most significant decline among the top 20 assets, dropping over 11%.

Despite low market activity, Toncoin's funding rate has shown a slight positive shift, rising to about 0.0073%, indicating some short-term optimism.

However, a sustained recovery will require more substantial increases in activity and positive sentiment to counter the prevailing negative trends.

At the time of writing, the Toncoin (TON) price was $4.93.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Leading DEXs on Base and OP will merge and expand deployment to Arc and Ethereum

Uniswap's new proposal reduces LP earnings, while Aero integrates LPs into the entire protocol's cash flow.

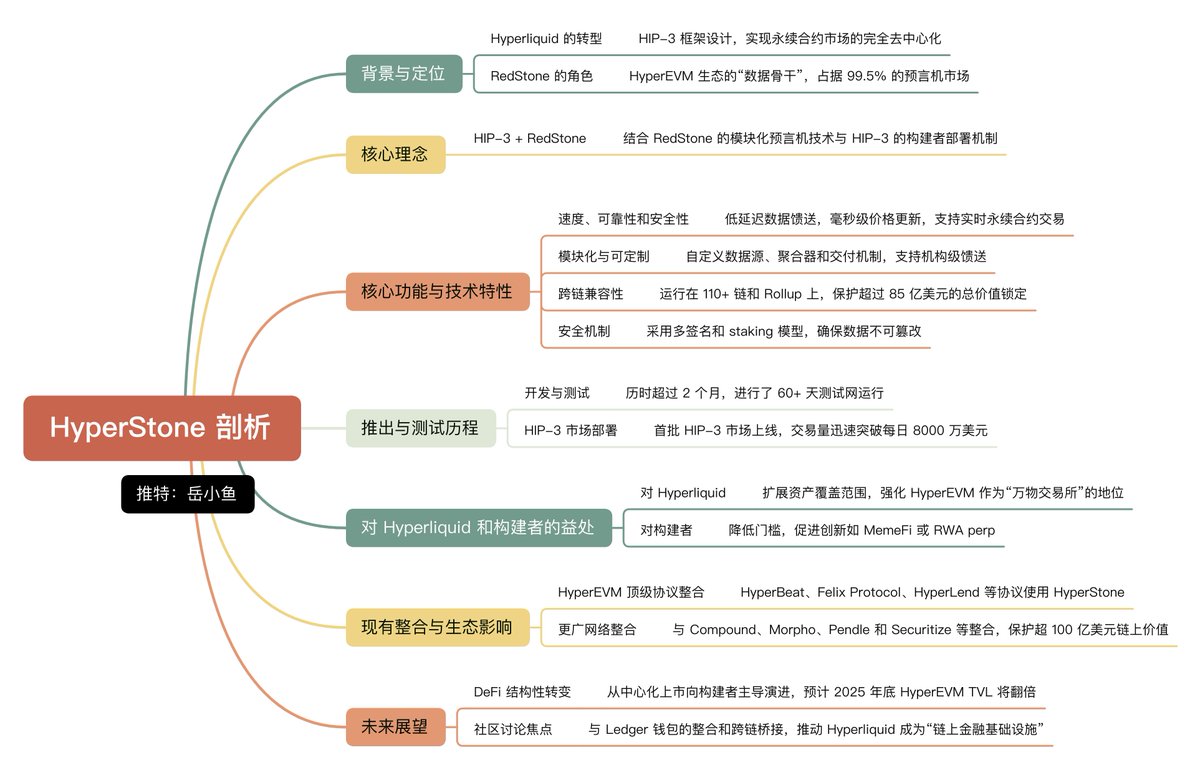

The Future of Hyperliquid: HIP-3 and HyperStone

The future of Hyperliquid lies in HIP-3, and the foundation of HIP-3 is HyperStone.

A New Era of Token Financing: A Milestone for Compliant Fundraising in the United States

Asset issuance in the crypto industry is entering a new era of compliance.

Circle, the First Stablecoin Stock, Releases Q3 Financial Report: What Are the Highlights?

By the end of the third quarter, the circulating supply of USDC reached $73.7 billion, representing a year-on-year increase of 108%.