DOGS, a Telegram-native meme coin, is down around 30% after it began trading on August 26. The token hit a market cap of over $600 million in 10 hours of trading and continues to be under $630 million at press time.

The arrest of Telegram CEO Pavel Durov impacts the TON-based token. The community has joined a #FREEDUROV campaign across social media while the token plummets.

Dogs token plummet within a day of launch

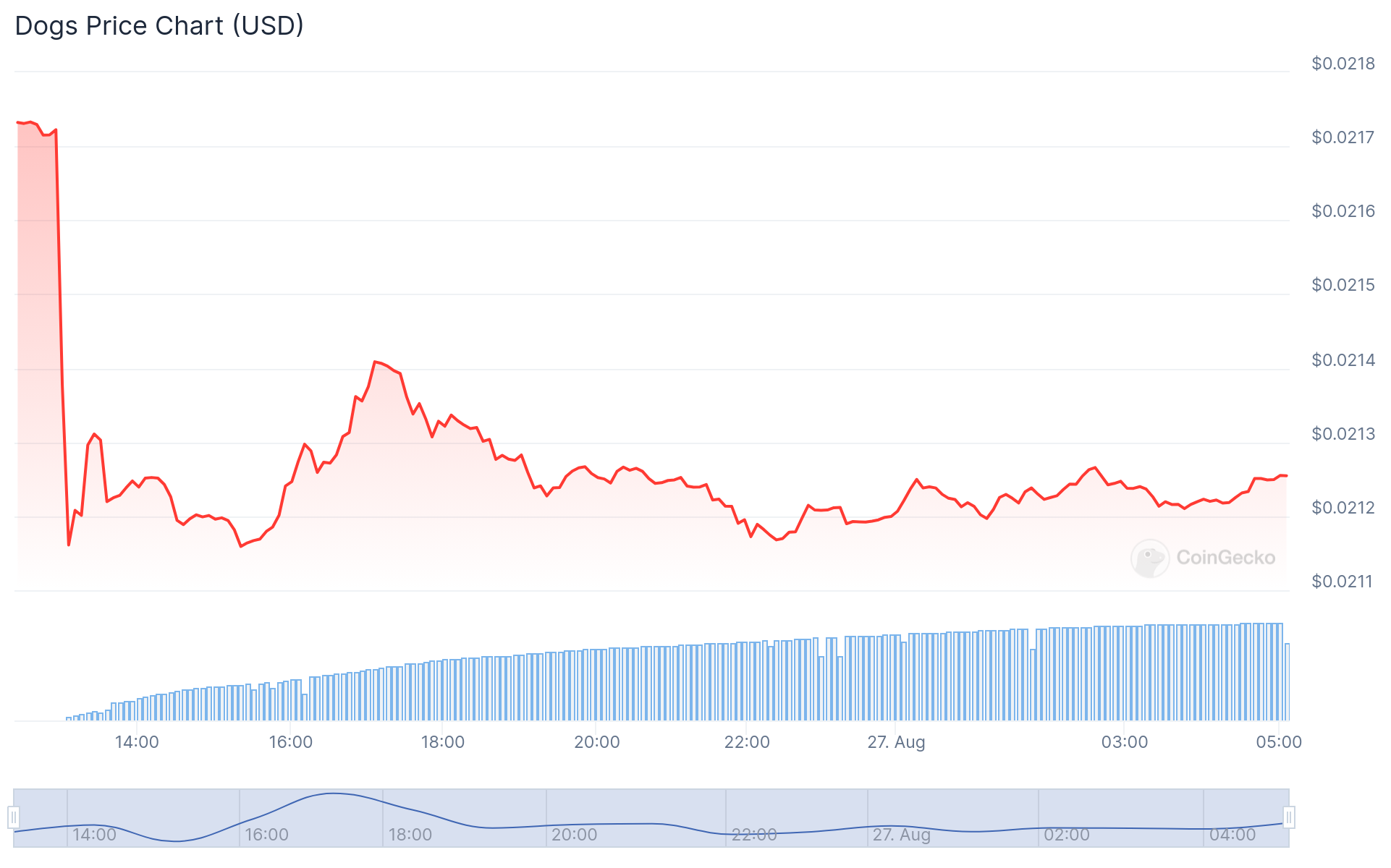

DOGS began trading on major centralized exchanges on August 26, 12 pm UTC. The platforms that listed the token reportedly included Binance, Bybit, OKX, Bitget, and Gate. The Telegram native meme coin made a market cap of $624 million in the first 10 hours of trading with a volume of $1.74 billion. At press time, the token is down 30% and continues to lose on the hourly charts on CoinGecko.

DOGS 1-day price chart | Source: Coingecko

DOGS 1-day price chart | Source: Coingecko

The trading launch of the Dogs token came on the sidelines of the arrest of Telegram founder and CEO Pavel Durov. Durov is also the founder of the social platform VK and first created DOGS’ mascot Spotty. The community has also joined in a # FREEDUROV campaign with the founder holding a DOGS frame as the face of the campaign.

Dogs airdrop claims are under process

Meanwhile, not all users have received the token airdrop as it has put pressure on the Ton chain. The project has said that TON and Telegram Wallet teams are in the process of fulfilling all on-chain claims. They also found that some accounts have been using bots to unfairly claim free airdrops. The DOGS project has confirmed that several of these accounts were removed, and their tokens were frozen on exchanges.

On Binance , the DOGS/USDT trading pair is priced under $0.0013000 and has seen a jump of 130% in 24 hours. The highest price it reached was $0.0018000, and the lowest price on the exchange was $0.0005454. Over 407 billion DOGS tokens were traded in the past 24 hours on the platform.

Meanwhile, Toncoin (TON) , the native token of The Open Network (TON) blockchain, has also lost at least 7% of value in 24 hours. CoinGecko data reveals that it has lost at least 20% on the weekly charts on the back of Durov’s arrest.