US Bitcoin ETFs hit 8-day winning streak as BlackRock logs $224M net inflows

Key Takeaways

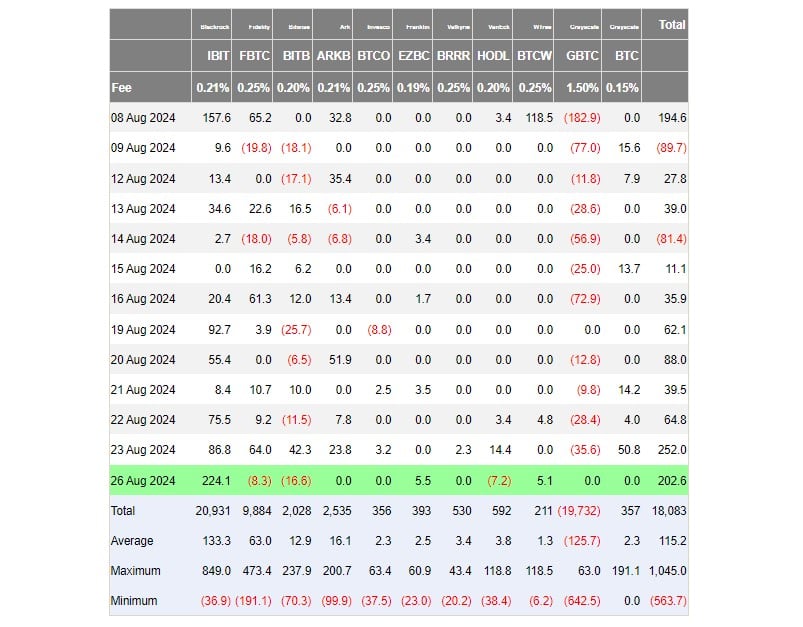

- BlackRock's iShares Bitcoin Trust led US Bitcoin ETF inflows with $224 million on August 26.

- The iShares Bitcoin Trust now controls over 350,000 BTC.

US exchange-traded funds (ETFs) investing directly in Bitcoin (BTC) posted eight straight days of net subscriptions, drawing in about $202 million on Monday, data from Farside Investors shows. BlackRock’s iShares Bitcoin Trust (IBIT) outperformed its peers with around $224 million.

Franklin Templeton’s Bitcoin ETF (EZBC) and WisdomTree’s Bitcoin fund (BTCW) also posted net inflows at Monday’s close, each capturing around $5 million.

Source: Farside Investors

Source: Farside Investors

In contrast, competing funds managed by Fidelity, Bitwise, and VanEck reported negative flows. The rest saw zero investments.

Seven months after their landmark debut , the first spot Bitcoin ETFs in the US have seen a stabilization in both inflows and outflows compared to the initial trading period.

The Grayscale Bitcoin Trust (GBTC), which had historically been linked to massive outflows, has seen a decrease in redemptions over the past two weeks, according to Farside’s data.

IBIT has solidified its dominance in the Bitcoin ETF market with its consistently strong performance. The fund’s Bitcoin stash has exceeded 350,000 BTC, according to the latest update .

BlackRock’s confidence in Bitcoin ETFs is growing with investor appetite. The leading asset manager recently reported that its Strategic Global Bond Fund added 4,000 shares of IBIT, bringing its total holdings to 16,000 shares as of June 30.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s back above $94K: Is the BTC bull run back on?

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.

Hassett: The Fed has ample room to cut interest rates significantly.