- Ethereum hits lowest RSI since Aug ’23 collapse, signaling oversold conditions.

- Altcoins reach historic RSI lows, indicating widespread market capitulation.

- Crypto market faces significant strain as RSI levels drop to new lows.

Ethereum’s price has tumbled, reaching its lowest Relative Strength Index (RSI) level since August 2023 and signaling a potential market bottom. This extreme oversold condition, mirrored across numerous altcoins, suggests widespread capitulation among investors and raises questions about the cryptocurrency market’s immediate future.

Crypto analyst Michaël van de Poppe highlighted this critical development, noting the unprecedented RSI levels. For Ethereum, the RSI level is now at its weakest point in almost a year, suggesting that the cryptocurrency is deeply oversold. Altcoins, too, have not been spared, with many reaching their lowest RSI readings in history. This pattern reflects a broader market downturn and raises questions about the near-term future of the cryptocurrency market.

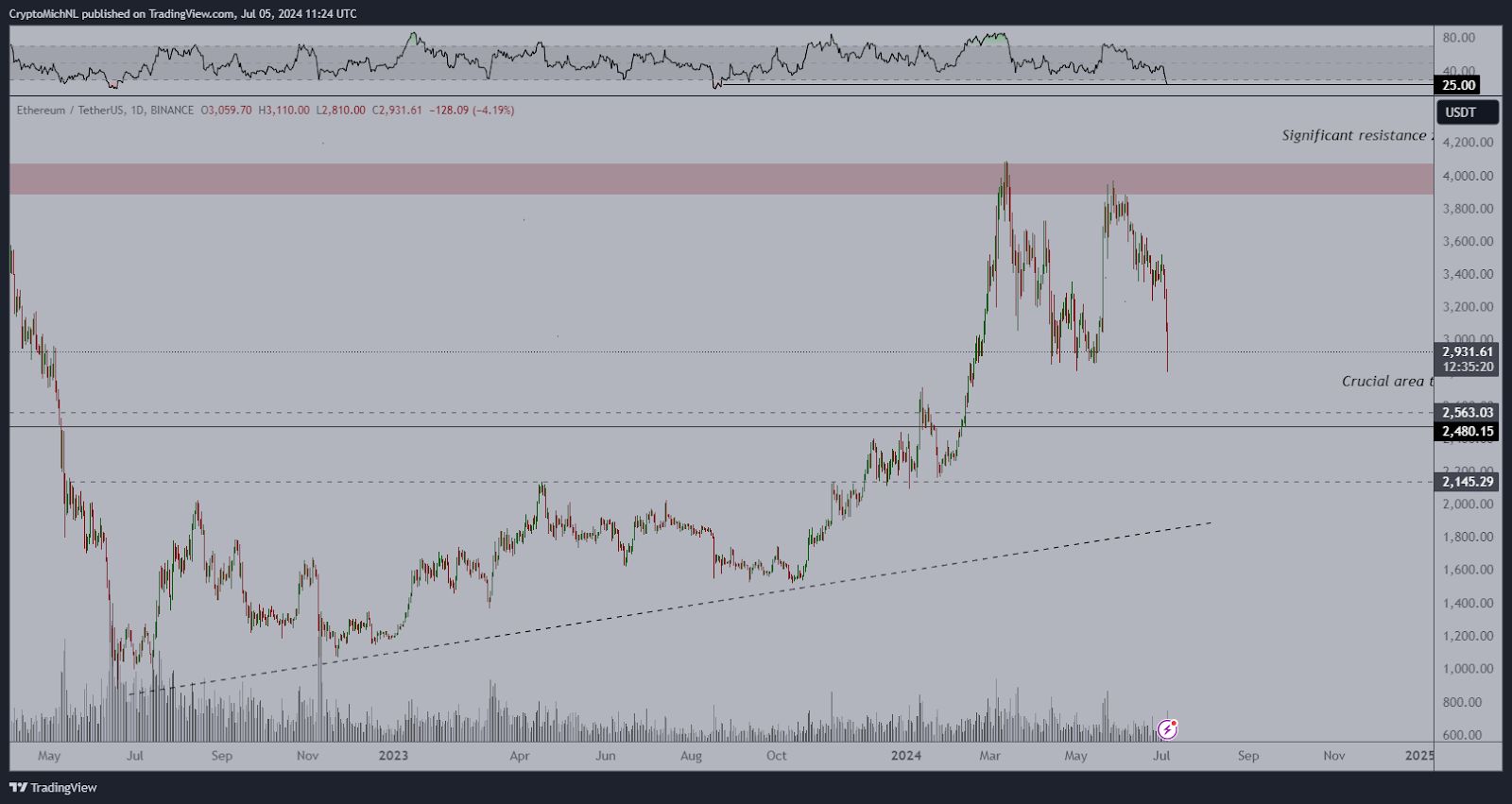

Ethereum’s RSI plunge to its lowest since August 2023 marks a significant point in its trading history. The RSI, a key momentum indicator, measures the speed and change of price movements, with values below 30 typically indicating an oversold condition. Ethereum’s current RSI at 25 suggests extreme bearish sentiment, which could precede a potential rebound if historical patterns hold.

The drop in RSI aligns with Ethereum’s price decline, which has brought it close to critical support levels around $2,480. Traders and analysts are closely monitoring these levels for signs of a reversal or further decline. The high trading volumes accompanying this drop indicate significant market participation, often seen during periods of capitulation. This phase typically signifies the final stage of a bearish trend, where selling pressure peaks, potentially paving the way for a market bottom and subsequent recovery.

Altcoins, the collective term for cryptocurrencies other than Bitcoin, are also experiencing historic lows in their RSI readings. Many of these digital assets have never seen such oversold conditions, signaling widespread capitulation across the crypto market. This trend mirrors the strain on Ethereum and highlights the broader challenges facing the cryptocurrency ecosystem.

The current market conditions have prompted investors to reassess their positions, with some seeing potential buying opportunities amid the oversold conditions. However, caution remains essential as the market navigates these turbulent times. The altcoin market’s performance often mirrors or exacerbates Ethereum’s movements, given Ethereum’s significant influence as the second-largest cryptocurrency by market capitalization.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.