Greeks.live researcher: Recently, there are fewer market hotspots, the market is relatively quiet

Data shows that on June 14, 20,000 BTC options expired with a put/call ratio of 0.49 and the maximum pain point at $68,500 USD, with a nominal value of $1.35 billion USD. In addition, 200,000 ETH options expired with a put/call ratio of 0.36 and the maximum pain point at $3,600 USD; its nominal value was $710 million USD. Adam from Greeks.live stated that this week is significant in macroeconomics as economic data has been favorable for risk investment markets; U.S stocks have shown noticeable growth but the crypto market did not perform well - mainstream coins fell overall and altcoins even more so. The market has been relatively quiet recently due to fewer hot topics. Currently, both major short-term IVs for BTC are below 50% and those for ETH are below 60%, having fallen to lower levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

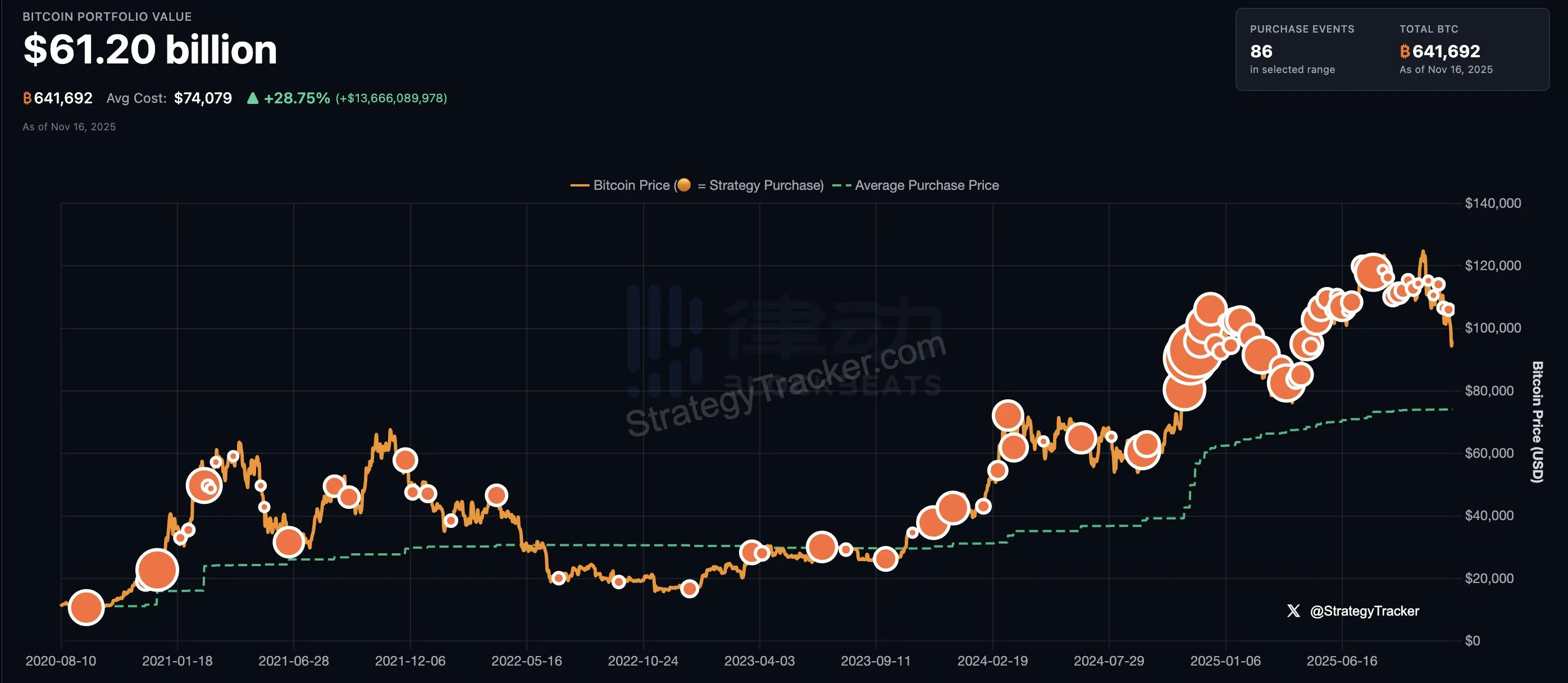

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

SOL treasury companies and ETF total holdings exceed 24.2 million SOL, equivalent to approximately $3.44 billions