Deribit Asia Pacific Business Head: The U.S. FOMC interest rate meeting next Thursday morning is very crucial for the crypto market

Deribit's Asia-Pacific business head, Lin, stated on platform X that the early morning of next Thursday is the U.S. FOMC interest rate meeting, and the subsequent press conference will be crucial. A single statement could increase expectations for a rate cut and cause BTC to surge. However, it's highly likely that by next Tuesday or Wednesday many institutions will sell assets to hedge risks (causing BTC to pull back), fearing dovish remarks from the Federal Reserve would lead to a drop in BTC. I think the clearest opportunity might actually be if there is a drop; I suggest building positions in spot goods or selling put options.

In addition, Lin pointed out that today's largest block option for ETH was purchased by a trader who paid $2.226 million for bullish options at $5000 by year-end, totaling 4000 ETHs. This strongly bullish move suggests this trader expects prices to break through $5880 (the breakeven point) by year-end. Today’s largest block trade of BTC options: A trader bought call options with strike price of $74000 due at end-June while simultaneously selling call options with strike price of $80000 , involving 1112.5 BTCs and costing him/her $1.809 million USD . If prices exceed $75600 when these contracts expire at end-June then he/she makes profit.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: F drops over 13% in 24 hours, FET rises over 9%

Trade tensions resurface as Bitcoin retreats from one-week high

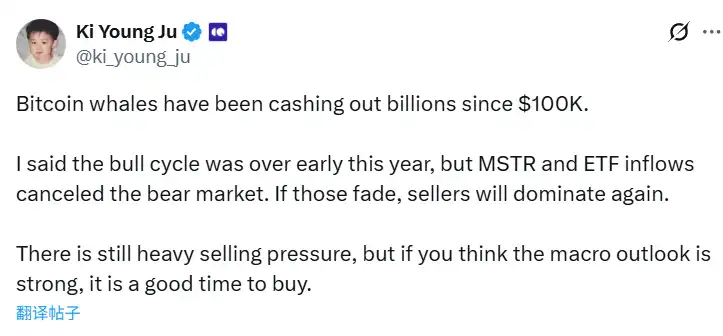

CryptoQuant CEO: Treasury companies and ETF inflows have ended the bear market