TradFi Executive: Cryptocurrency derivatives will play a key role in the future of Bitcoin

TradFi executives stated that BTC and ETH derivatives will play a key role in integrating cryptocurrency into traditional finance (TradFi) and pushing it to historical highs. TradingView General Manager Pierce Crosby pointed out that derivatives have always been an important part of cryptocurrency trading, but high fees and slippage have adversely affected traders.

Giovanni Vicisoso, the global head of cryptocurrency products at CME Group, believes that spot Bitcoin ETFs will attract investors who are unwilling to use centralized exchanges and help with Bitcoin price discovery. Jim Iuorio, Managing Director of TJM Institutional Services, said that the Federal Reserve may have to cut interest rates and ease policies, which is beneficial for stocks and Bitcoin.

Crosby also mentioned that large institutional investors are changing the notion that cryptocurrencies are just tech stock subsidiaries. Although the market can sometimes be affected by internal black swan events, he believes the crypto market will eventually recover.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sources: Bank of Japan to pledge further rate hikes at next week's policy meeting, insiders say

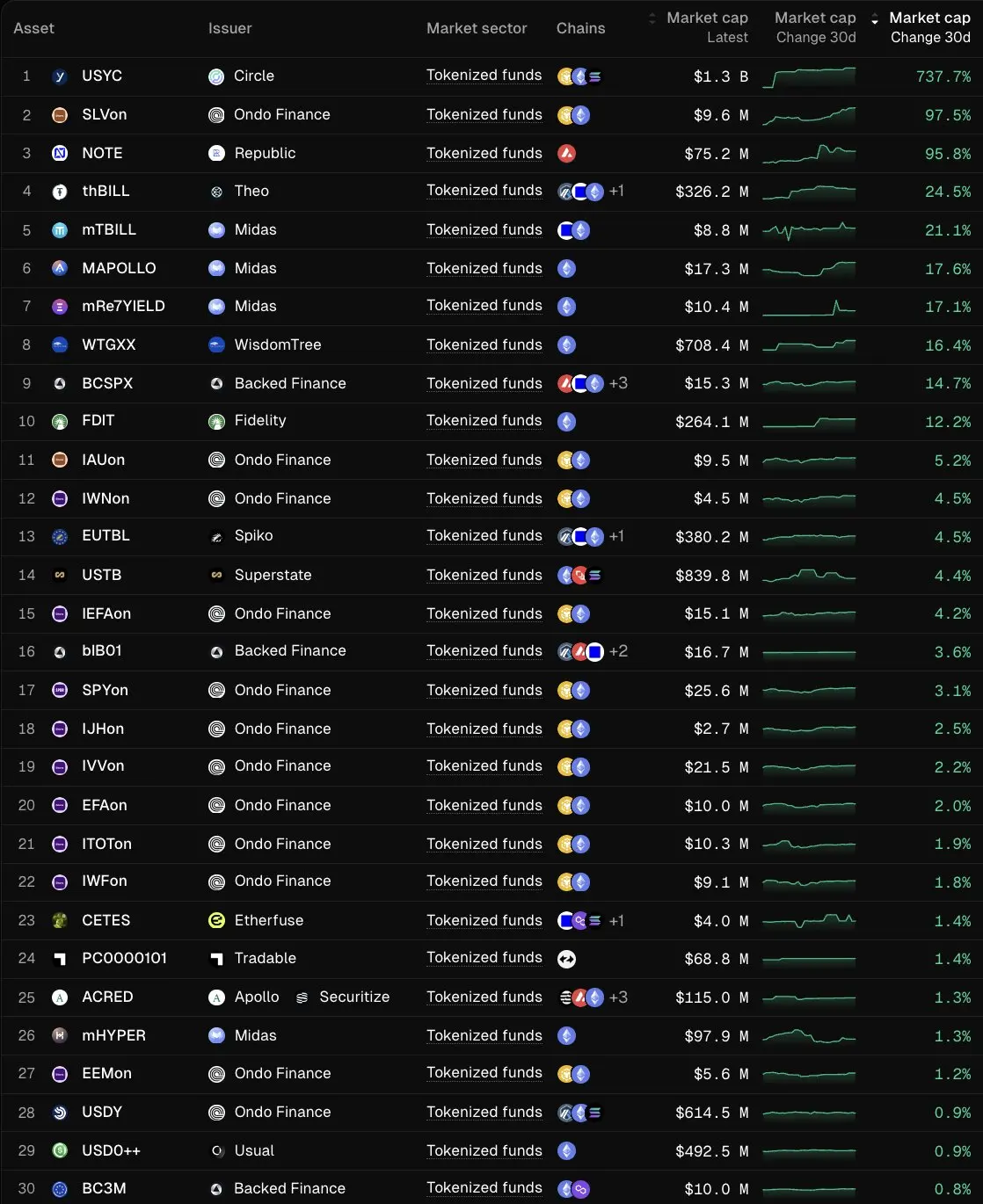

Circle CEO: Tokenized Fund USYC Sees 737.7% Market Cap Growth in the Past 30 Days

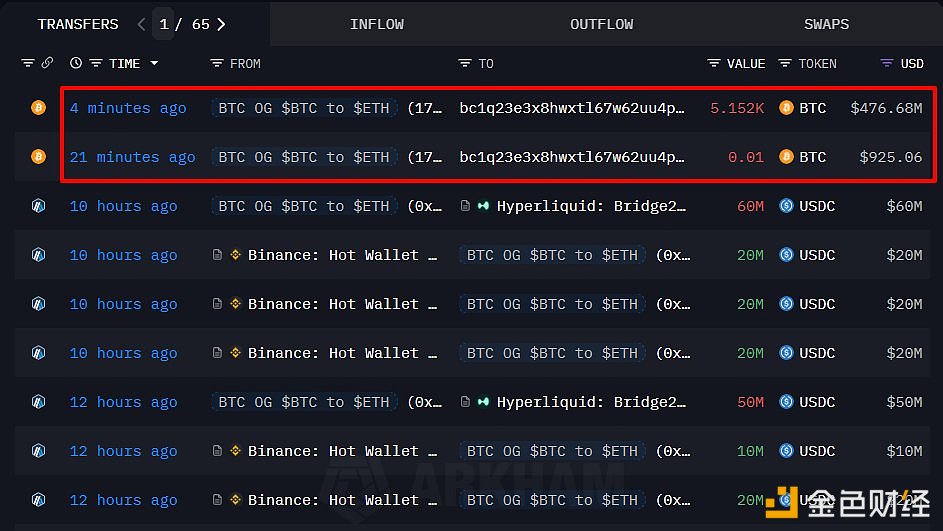

Data: Hyperliquid open interest reaches $7.73 billions, marking seven consecutive days of growth