Bitcoin ( BTC ) threatened new local lows on April 16 as large-volume investors held off on selling.

Bitcoin whales refuse to sell while BTC price ditches $70K 'euphoria'

Bitcoin derivatives traders go from de-risking to "clear pessimism," but large-volume hodlers are in no hurry to bow to BTC price pressure.

BTC price suffers "clear pessimism"

Data from Cointelegraph markets Pro and TradingView revealed two fresh dips below $62,000 during the Asia trading session.

Nervous risk-asset markets set the tone across the board on the day, with United States stocks wobbling at the Wall Street open and Bitcoin failing to hold its rebound .

“Very crucial to remain above $62K for any chance to see a considerable bounce,” popular trader Skew wrote in part of his latest market update on X (formerly Twitter).

Placing emphasis on the upcoming weekly close, Skew described a risk-off mood across exchanges, with “consistent de-risking and now clear pessimism” now characterizing perpetual swaps markets.

He added that bulls could react during Europe trading hours, but this was absent at the time of writing as sideways moves took over.

Earlier, Cointelegraph reported on various downside targets for BTC price action, these extending to $59,000 for April 16 and below $40,000 in the long term.

Eyeing whale liquidity levels, monitoring platform Whalemap identified $52,000 and $48,000 as other key levels.

“We've had euphoria at 70k. We had smart money take profit into it. We formed a consolidation range. Now, we are at it's lows,” the Whalemap team wrote in accompanying comments.

“If you believe Bitcoin will hold — now is the time to keep believing. Otherwise, we've got a bit of a shake out ahead of us.”

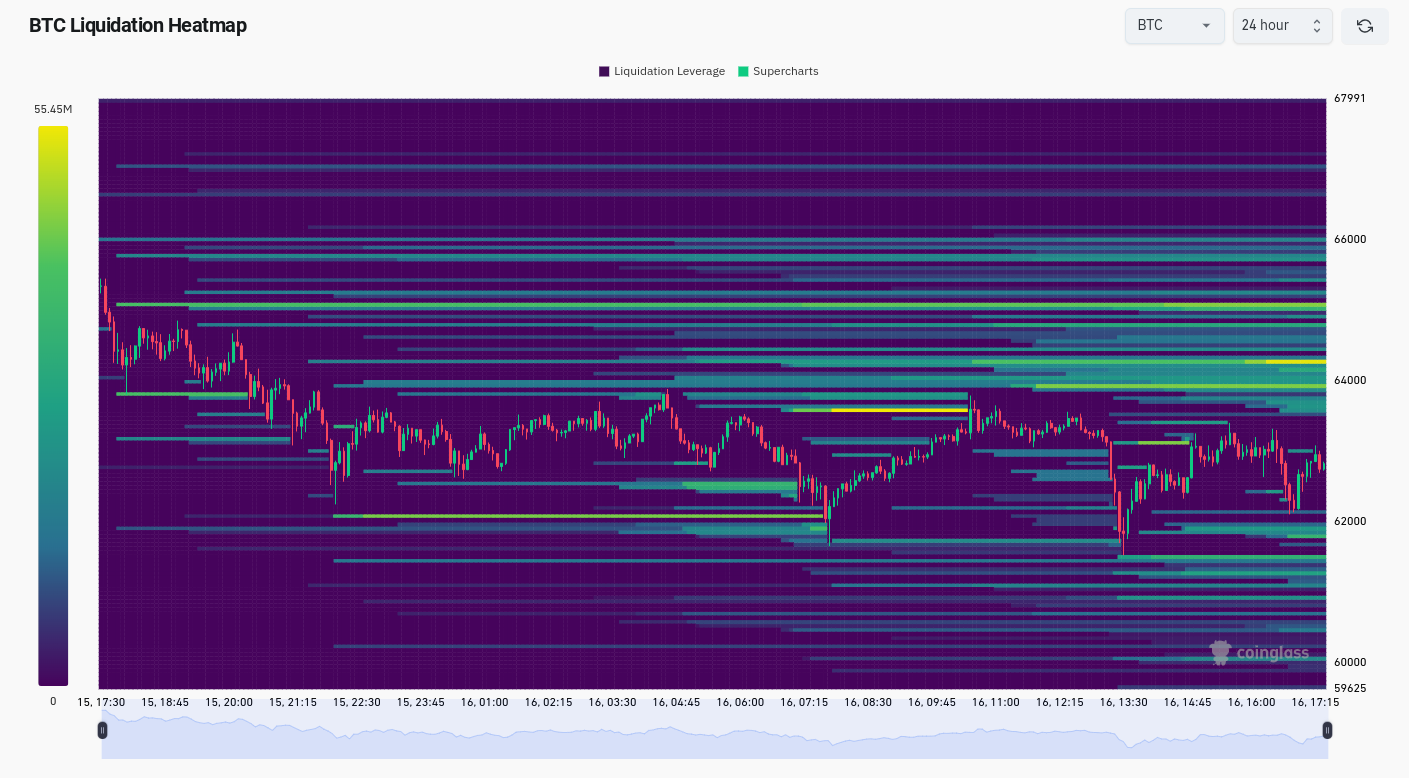

Data from monitoring resource CoinGlass showed the largest band of sell-side liquidity sitting at just above $64,000.

Bitcoin avoid selling post all-time high

At the same time, whales appeared uninterested in selling into falling markets.

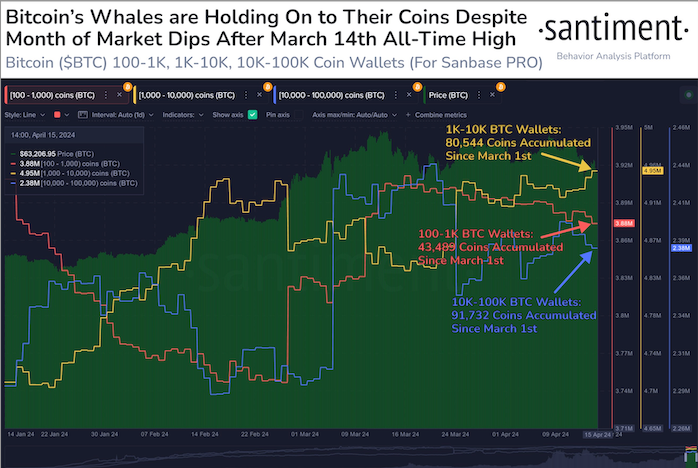

Examining accumulation by the largest BTC wallet cohorts, research firm Santiment revealed ongoing increases in exposure from March onward.

“Bitcoin key stakeholders aren't budging on their holdings, despite the concerning volatility that brought the top market cap cryptocurrency's market value as low as $61.5K over the weekend,” part of X commentary stated .

Since March 1, wallets holding between 100 BTC and 1,000 BTC have accumulated nearly 44,000 coins. Larger wallet classes added more than double that tally — despite Bitcoin’s latest all-time high coming on March 14.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."