Iran's threat of retaliation against Israel has led to a sell-off in risk assets, making it difficult for BTC to break through the established range in the short term

According to Wu Shuo, QCP Capital pointed out that due to Iran’s threat of retaliation against Israel, all risk assets were sold off overnight, and the market was caught off guard. Perpetual funds have fallen into negative territory, over -40%, their highest level this year. Negative perpetual funds have also crushed the forward curve, with the front end currently below 10%. Although the BTC halving is still about a week away, it may be difficult for BTC to break out of this established range (64k-73k) in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Visa and Mastercard to reach settlement with US merchants to lower credit card payment fees

MIT brothers' $25 million Ethereum fraud trial declared a mistrial

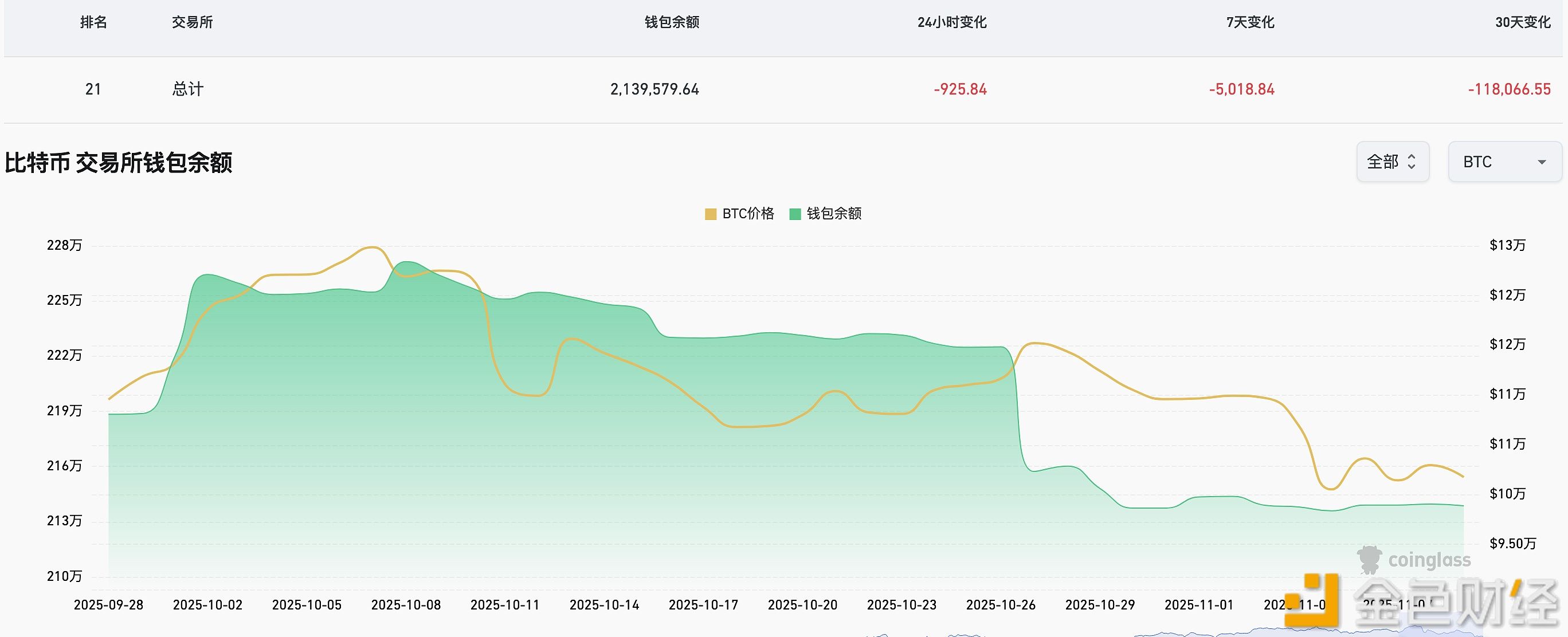

In the past week, 5,018.84 BTC have flowed out of CEX platforms.

RootData: VANA to unlock tokens worth approximately $4.57 million in one week