Web3 infrastructure firm Xion secures $25 million in funding

The web3 infrastructure firm Xion raised $25 million in funding. Animoca Brands, Laser Digital, Multicoin, Arrington Capital, Draper Dragon, Sfermion, GoldenTree and others participated in the round.

Animoca Brands, Laser Digital, Multicoin, Arrington Capital, Draper Dragon, Sfermion, GoldenTree and others participated in the round, according to a company statement . Fortune reported the round as a Series A.

Xion uses "generalized abstraction," or web3 infrastructure which removes common complexities in crypto, to build a user-friendly blockchain ecosystem that doesn't require wallet accounts, signatures or additional technical sign-ups. The firm employs the stablecoin USDC for its primary transactions.

"With Xion, people can interact seamlessly with decentralized applications right on their phone. No seed phrases to remember or private keys to store," said Burnt Banksy, a Xion network core contributor, in a release. “We’re in the process of launching mainnet and are bringing together the right partners to set the groundwork."

Xion launched its testnet in December 2023 after raising $11 million from Circle Ventures, Animoca Brands, Multicoin, HashKey, Valor and others, The Block previously reported.

USDC comprises 30.6% of the total Ethereum stablecoin supply as of March 31, according to The Block's Data Dashboard.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

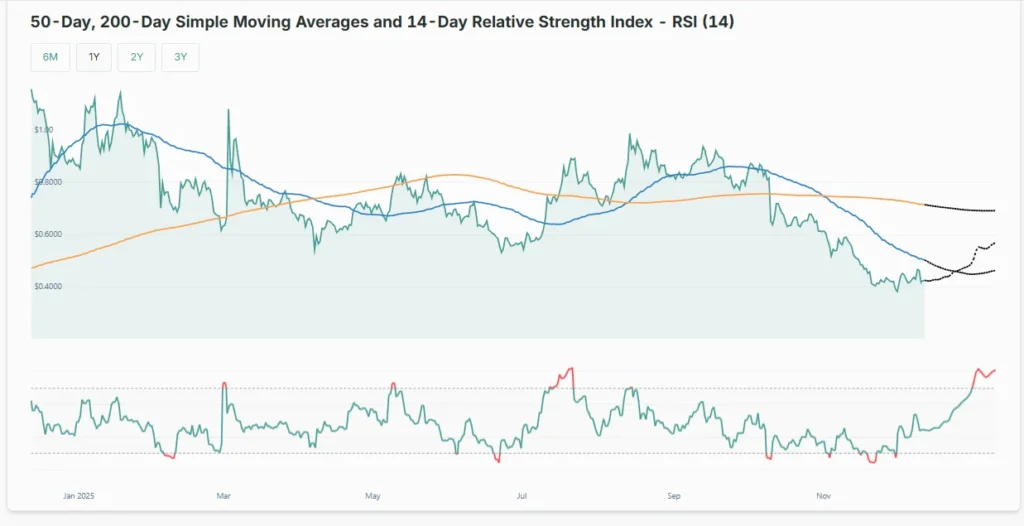

SOL Coin Faces Challenges in Late 2025 with Market Volatility

Cardano (ADA) Price Prediction 2026, 2027 – 2030

Michael Saylor Signals Further Bitcoin Purchases as BTC Slides Below $88,000

Bitcoin Flight: Investors Withdraw More Than 196,000 BTC From Crypto Exchanges