Bitcoin Defends $41K Level, Chainlink Gains 5% Daily (Weekend Watch)

BTC’s troubles continue even though the asset remains above $41,000.

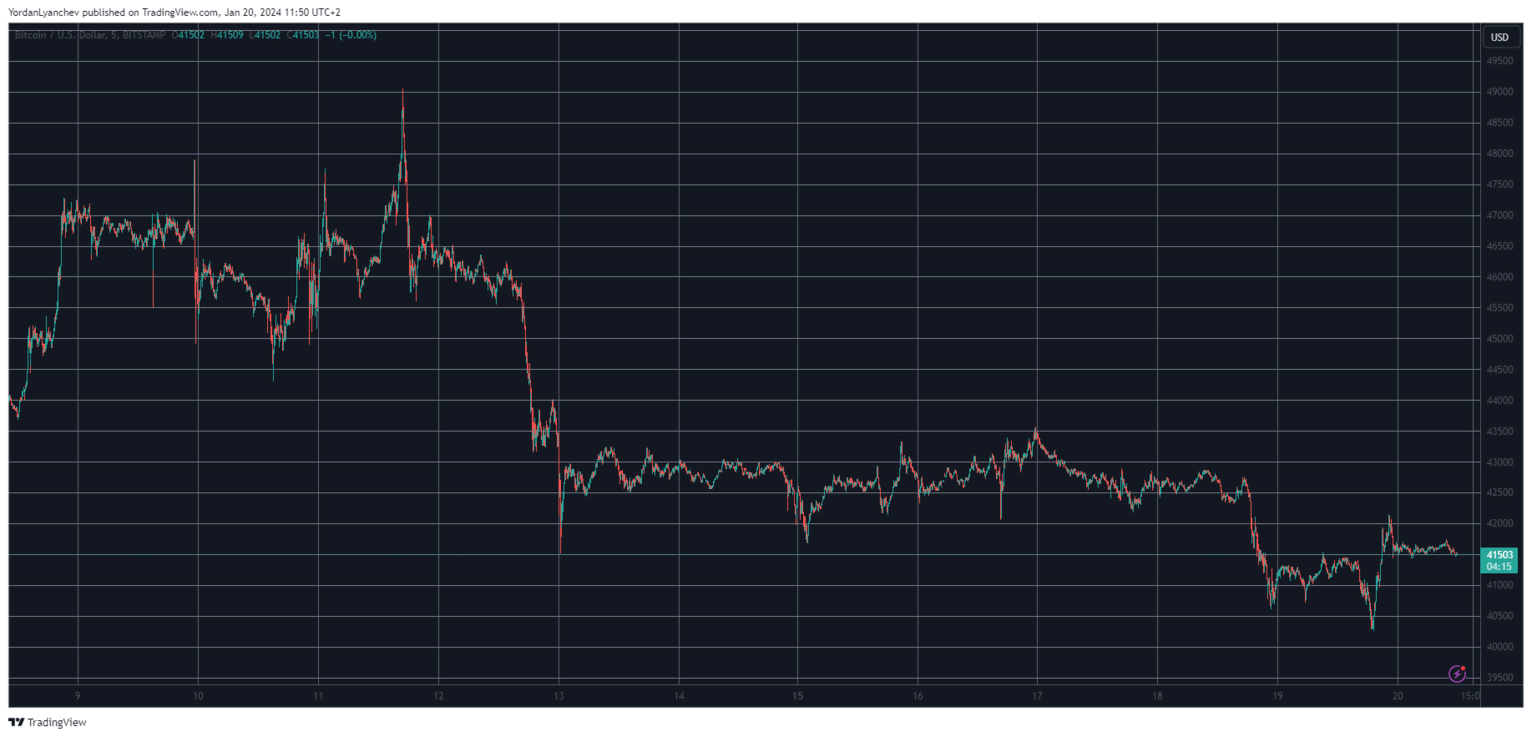

Bitcoin dumped once more yesterday to a new monthly low of under $40,500, but it reacted well and dumped above $42,000 hours later.

The altcoins continue to be quite sluggish, with little to no movements, aside from LINK, which has jumped by around 5%.

BTC’s Declines

The primary cryptocurrency had two completely different weeks. Last week, it soared past $49,000 on the day that 11 spot BTC ETFs reached the US markets and dumped by more than three grand later. The landscape worsened as Friday was coming to an end. Overall, BTC had lost over $7,000 in about 36 hours in what turned out to be a sell-the-news event .

After recovering some ground and reaching $43,000 during the weekend, the asset calmed and traded sideways for almost a week. However, another price decline occurred yesterday when Bitcoin dropped below $41,000 and then to $40,400 (on Bitstamp) for the first time in over a month.

It managed to bounce off and even soared past $42,000 briefly, but the overall negative sentiment kept the pressure on, and BTC dropped back down to $41,500, where it stands now as well.

Its market capitalization stands inches above $810 billion, and its dominance over the alts is still below 50%.

LINK Defies Market Sentiment

Chainlink is among the few notable gainers from the larger-cap alts on a daily scale. LINK has jumped by more than 5% and trades above $16. Cardano’s native token follows suit with a 3% increase that has pushed the asset to over $0.5. Uniswap and Litecoin are also well in the green, followed by Dogecoin, Tron, and Binance Coin.

In contrast, Avalanche has retraced by 4% to $32, Solana is down by 3% and is close to breaking below $90, and MATIC has shed 3% of value and is down to $0.76.

Further losses come from the likes of ARB, LDO, OP, INJ, and NEAR. The total crypto market cap has declined by about $10 billion overnight but still stands inches above $1.6 trillion on CMC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Glassnode: Bitcoin weakly fluctuates, is major volatility coming?

If signs of seller exhaustion begin to appear, it is still possible in the short term for bitcoin to move towards the $95,000 level and the short-term holder cost basis.

Axe Compute (NASDAQ: AGPU) completes corporate restructuring (formerly POAI), enterprise-level decentralized GPU computing power Aethir officially enters the mainstream market

Predictive Oncology officially announced today that it has changed its name to Axe Compute and will trade on Nasdaq under the ticker symbol AGPU. This rebranding marks Axe Compute's transition into an enterprise-level operator, officially commercializing Aethir's decentralized GPU network to provide robust, enterprise-grade computing power services for AI companies worldwide.

Bitcoin new year bear flag sparks $76K BTC price target next

Ether price rallied 260% last time this happened: Can ETH reach $5K?