Bitcoin has surpassed silver in terms of assets under management (AUM) and has become the second largest commodity ETF category in the United States

On January 18th, according to CryptoSlate, the size of Bitcoin ETFs has rapidly expanded. Including recently listed spot Bitcoin ETFs, the total value currently reaches $27.9 billion, approximately 647,651 BTC. Among them, Grayscale holds around 600,000 BTC. According to data from etfdb.com, the "Broad Diversified" asset category includes 22 ETFs with an AUM of $12.826 billion. Silver ranks third with five ETFs and an AUM of $11.546 billion. Although BTC is currently not included in its ETF list, if added in the future and calculated by AUM, Bitcoin would rank second and become the second-largest commodity in the United States.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: A certain wallet withdrew 823,368 UNI tokens worth approximately $4.72 million from CEX within 5 hours.

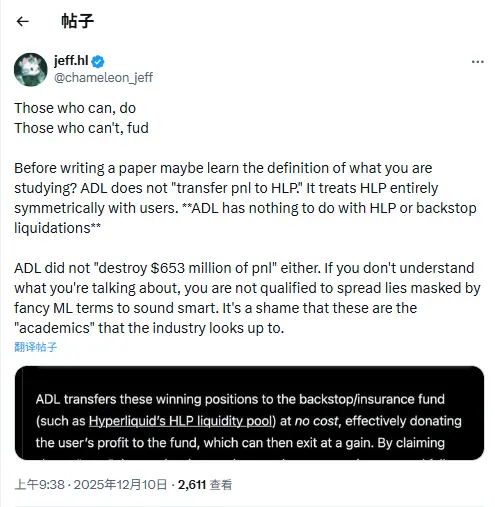

Data: Hyperliquid platform whales currently hold $4.828 billions in positions, with a long-short ratio of 0.94

Data analytics firm Inveniam announces acquisition of on-chain asset tokenization platform Swarm Markets