United Nations identifies USDT as prominent choice for fraud in SEA: FT

Quick Take A United Nations report published Monday suggested that USDT has become a prominent payment method for money laundering and scams in Southeast Asia, according to the Financial Times.

“Online gambling platforms, especially those operating illegally, have emerged as among the most popular vehicles for cryptocurrency-based money launderers, particularly for those using Tether,” the UN report said , per the Financial Times.

The UN also reportedly suggested the world's most-popular stablecoin has been widely used in underground fraud, including romantic scams known as “ pig butchering .” This may not comes as a surprise — in November, Tether said that it assisted the U.S. Department of Justice and froze about $225 million in USDT in external, self-custodied wallets linked to an international human trafficking group in Southeast Asia responsible for a pig-butchering scam.

The report additionally noted how law enforcement agencies have disrupted multiple money laundering networks involved in the transfer of illicit Tether funds in recent years. Last August, for example, Singaporean authorities conducted an operation that led to the dismantling of one such network — resulting in the recovery of around $735 million in both cash and cryptocurrency.

Tether did not immediately respond to The Block’s request for comment.

In December, Tether CEO Paolo Ardoino said in a letter shared with U.S. legislators that it has onboarded the U.S. Secret Service and Federal Bureau of Investigation onto its platform.

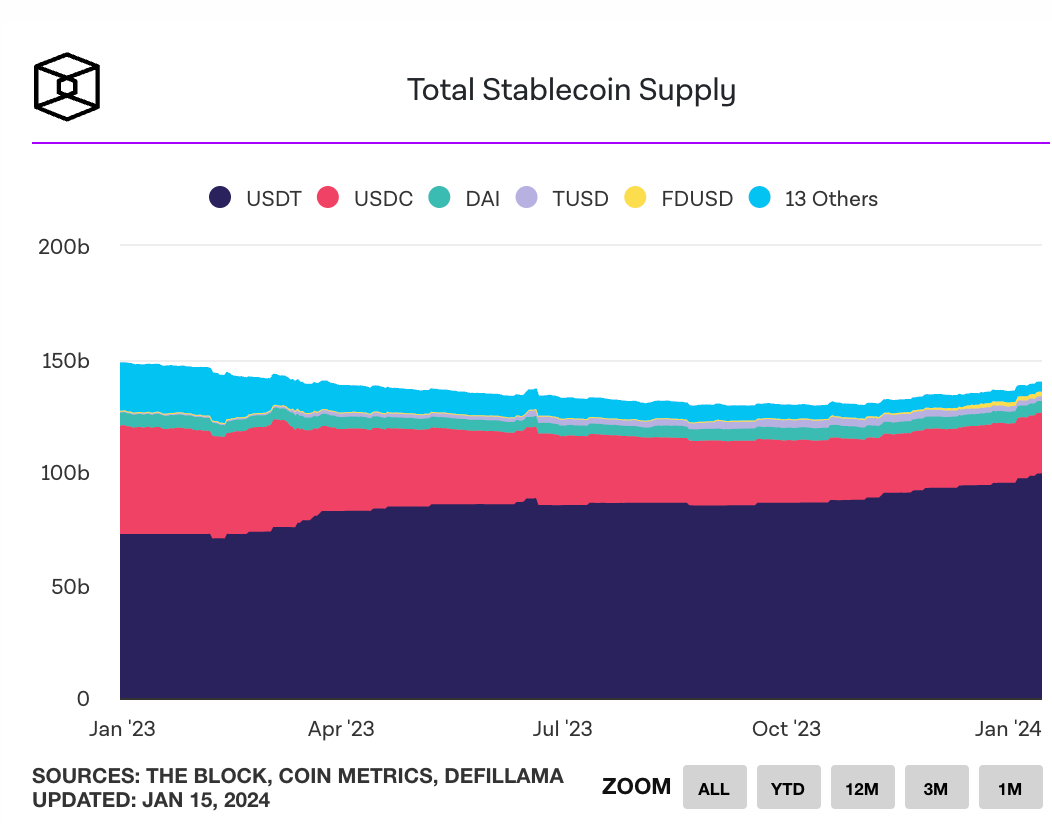

Over the course of 2023, Tether saw its share of global stablecoin supply grow from 50% to 71% , according to The Block data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

Bitcoin price eyes $112K liquidity grab as US government shutdown nears end

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.