Injective (INJ) Rockets To Fresh ATH With 2,700% Surge – Find Out More

Driven by heightened futures trading volumes and leverage, the price of Injective (INJ) has soared to unprecedented levels of around $38.49, marking a remarkable 2,700% surge year-to-date.

Notably, within a single day, the native token of the decentralized finance (DeFi) platform Injective, exhibited resilience and potential, demonstrating a noteworthy increase of 24% in its value.

In the context of the cryptocurrency market’s ever-changing dynamics, INJ has emerged as a standout performer, positioning itself as one of the top gainers amidst the series of surges and corrections experienced by leading tokens.

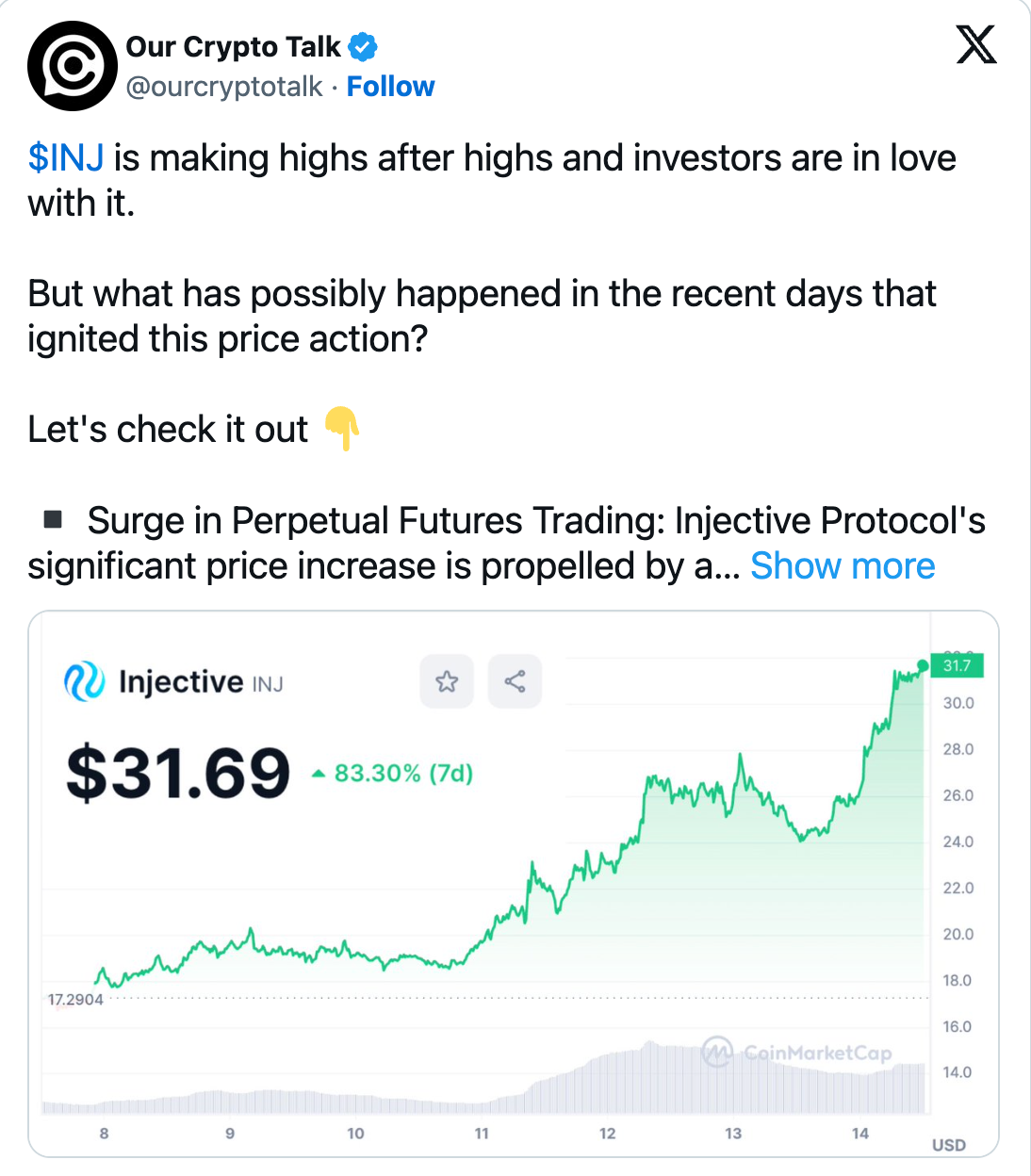

Analysts have identified a number of major factors that have contributed to this startling rally, including the surge in trading volumes for INJ perpetual futures contracts, which exceeded $25.5 billion in a single day, the incentives offered by centralized exchanges to create volatility, and the acceleration of short-term traders who are seeking leverage.

The weekly timeframe’s technical analysis reveals that the price of INJ has risen sharply since the year’s beginning. As of this writing, the altcoin has experienced a strong seven-day gain of 45%.

The price increase for INJs reached a new peak of $34.60 last week, representing an increase of 2,700% in 2023.

Based on a mix of technical indicators and fundamental factors, cryptocurrency traders and analysts on X are optimistic about the direction of the INJ price trend going forward.

Experts are more confident due to Injective’s decentralized finance (DeFi) platform’s increasing popularity and strong performance in spite of market turbulence.

Meanwhile, here’s what the analysts are saying about INJ’s price performance this week:

Our Crypto Talk is optimistic for basic reasons. The account stated that leverage-driven accumulation, exchange incentives for volatility, and the boom in perpetual futures trading were the three key drivers of the continuous rising trend.

Victorious, another cryptocurrency analyst, is upbeat because of a short-term Wyckoff Accumulation pattern.

In financial markets, the Wyckoff Accumulation pattern is a technical analysis idea that is very useful when trading equities or cryptocurrencies.

It denotes a stage of buying or accumulation by institutional or smart money investors. A sequence of price consolidations, in which the asset’s price fluctuates within a predetermined range, define the pattern.

As a result of its strong and adaptable performance, Injective Protocol has been widely used in the bitcoin market. Proof of this is its latest collaborations with some of the crypto market’s biggest players.

Carbon Browser made a big announcement on X on December 7, 2023, confirming the incorporation of Injective Protocol into their platform.

Big names in the industry including Mark Cuban, Binance, and Pantera have backed Injective Protocol, which is the quickest Layer 1 blockchain for finance.

This strategic integration signifies a pivotal progression in the promotion of a financial ecosystem that is both more inclusive and efficient.

The remarkable trajectory of Injective is proof of the cryptocurrency market’s dynamism as well as the opportunities that arise from savvy alliances and technical breakthroughs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.